Jul 23, 2024 02:51 PM IST

Union Budget 2024: Nithin Kamath warns of increased market activity cooling due to tax changes

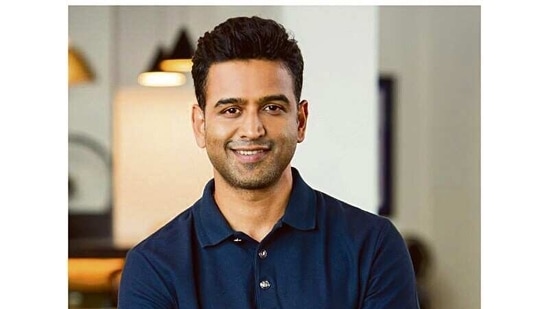

Zerodha founder and CEO Nithin Kamath said that the changes announced in the Budget 2024 by Union finance minister Nirmala Sitharaman in tax rates for the stock trading could cool down market activity.

What are the changes that Nithin Kamath referred to?

Read more: Union Budget 2024: Where does Centre spend the most money?

In the Budget, the finance minister proposed to hike the rates of Securities transaction tax (STT) on the sale of an option in securities from 0.0625 per cent to 0.1 per cent of the option premium and on the sale of a futures in securities from 0.0125 per cent to 0.02 per cent of the price at which such futures are traded from October 1.

Read more: Which country receives the most aid from India? Union Budget reveals top 10 beneficiaries

What Nithin Kamath said on the Budget?

“We collected about ₹1,500 crore of STT last year, @zerodhaonline. If the volumes don’t drop, this will increase to about ₹2,500 crores at the new rates,” Kamath said.

Read more: Stock market crash: 3 reasons why investors gave a thumbs down to Budget

He added, “The capital gains tax has been increased from 10 percent to 12.5 percent, and it will apply from today. If the idea was to cool down the activity in the markets, this might just do the trick.”