Unified Pension Scheme: The government’s newly announced pension scheme, unveiled on Saturday, has the potential to significantly affect the

National Pension System

(

NPS

) if a majority of central

government employees

opt for the

Unified Pension Scheme

(UPS), as is anticipated.

However, according to an ET report, this impact may be mitigated if the NPS is designated to manage the

individual pension fund

, which is one of the two funds proposed under the UPS.

The individual fund will comprise the employee contribution, amounting to 10% of basic pay and dearness allowance, along with a matching contribution from the government.

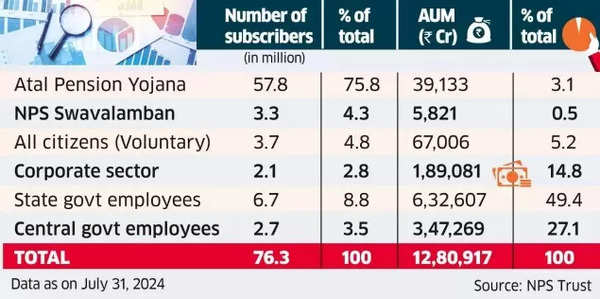

Pension Scheme Subscribers

An additional government contribution of 8.5% of basic and DA for all employees will be maintained in a separate fund.

Presently, the NPS has 2.65 million

central government

subscribers, representing 27.1% of the scheme’s total corpus of Rs 12.8 lakh crore. The fate of this corpus remains uncertain as central government employees transition to the UPS, the financial daily’s report said.

The implementation of the new scheme is set to commence from April 1, 2025. If state governments also introduce UPS-like schemes and provide NPS subscribers with the choice to switch, the impact would be even more significant.

Also Read | Unified Pension Scheme vs OPS vs NPS: How is UPS different from National Pension Scheme, Old Pension Scheme?

The NPS currently has 6.7 million subscribers from states, accounting for 49.4% of the total scheme corpus. Collectively, state and central government employees make up more than three-quarters of the scheme’s corpus, according to the most recent data. The corporate sector subscribers amount to 2.1 million, with a total corpus of Rs 1.89 lakh crore, constituting 14.8% of the total.

The scheme offers tax benefits on contributions, and upon maturity, 60% of the corpus can be withdrawn tax-free, while the remaining balance must be used to purchase an annuity.