Aug 15, 2024 05:54 PM IST

Home loans can potentially get costlier since SBI’s three-year tenor MCLR is now 9.10%, from 9% earlier and overnight MCLR is now 8.20%, from 8.10 previously.

State Bank of India (SBI), India’s largest state-run bank, has recently increased interest rates on loans by 10 basis points, effective from Thursday, August 15, 2024.

SBI’s Marginal Cost of Funds Based Lending Rate (MCLR) for a three-year tenor is now 9.10%, compared to 9% earlier. Overnight MCLR is now 8.20%, compared to 8.10 previously. The bank had raised its MCLR previously by up to 30 basis points in some tenors since June 2024.

Also Read: Starbucks reveals salary of new CEO Brian Niccol. Biggest perk: He can work remotely

What is the impact of the increased interest rates on SBI home loans?

All types of loans, including home loans can potentially get costlier since the MCLR has now been hiked.

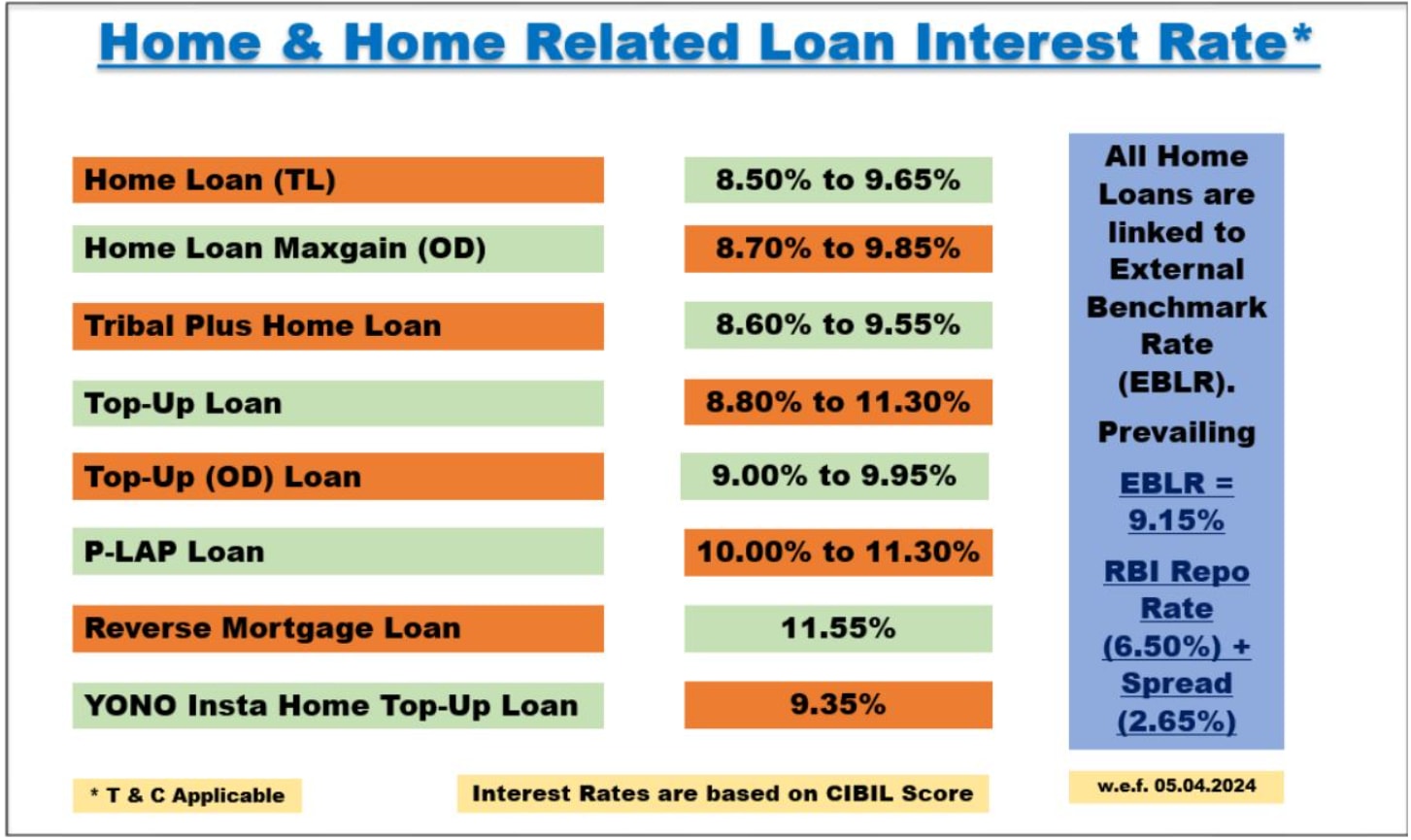

The current interest rates for SBI home loans are as follows:

Also Read: Warren Buffett’s Berkshire now has a record $277 billion cash pile after selling spree

Why did banks hike their MCLR and how is it related to home loans?

The Reserve of India (RBI) had flagged concerns due to banks and NBFCs not following prudential norms when it comes to top-up home loans. This was combined with the fact that there was a high growth in personal loans, especially in home equity or top-up loans in the housing segment.

As a result, other PSU banks including Bank of Baroda, Canara Bank, and UCO Bank had hiked their MCLR. SBI has joined the bandwagon now.

Also Read: Ola Electric launches the Roadster Series e-motorcycles, prices start at ₹74,999