MUMBAI: RBI has said there has been a temporary slackening of the economy during the second quarter due to unseasonal heavy rains in August and September and ‘pitru paksha’ – a 16-day period in the Hindu calendar where new activities are not undertaken. However, a robust domestic engine supported by festival season consumption and

private investment

is expected to fuel an uptick in the economy.

This ‘idiosyncratic’ slowdown is reflected in GST collections, automobile sales, bank credit growth, merchandise exports and the purchasing managers index. “The slowing of speed is also reflected in our nowcast of real GDP growth,” RBI’s state of the economy report said.

RBI expects

India’s economy

to “shrug off” this temporary slowdown as festival demand picks up pace and consumer confidence improves. Rural demand is expected to get a boost from the improved agricultural outlook, and private investment should pick up steam in response to rising business optimism, RBI said.

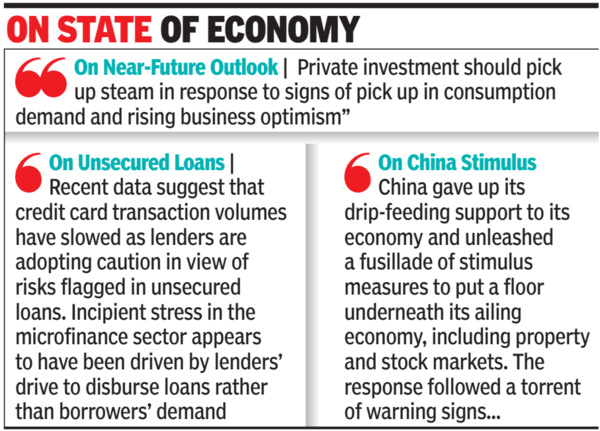

“Private investment should pick up steam in response to signs of pick up in consumption demand and rising business optimism,” the report said.

It also took note of the stress in credit cards and unsecured loans. “Recent data suggest that credit card transaction volumes have slowed as lenders are adopting caution in view of risks flagged in unsecured loans. Incipient stress in the microfinance sector appears to have been driven by lenders’ drive to disburse loans rather than borrowers’ demand,” the report said.

According to RBI, the outcome of the China stimulus package is uncertain. “China gave up its drip-feeding support to its economy and unleashed a fusillade of stimulus measures to put a floor underneath its ailing economy, including property and stock markets. The response followed a torrent of warning signs: shrinking tax revenue; falling prices of homes and industrial goods; slowing retail sales; depressed consumer confidence; and weak industrial output and investment,” the report, whose authors include RBI deputy governor Michael Patra, said.

RBI also noted that India’s external sector is “showing resilience” despite rising geopolitical tensions. The country’s foreign exchange reserves have reached a historical high and net FDI inflows have “more than doubled” from a year ago. The report highlighted RBI’s commitment to active and adaptable liquidity management.