Two types–

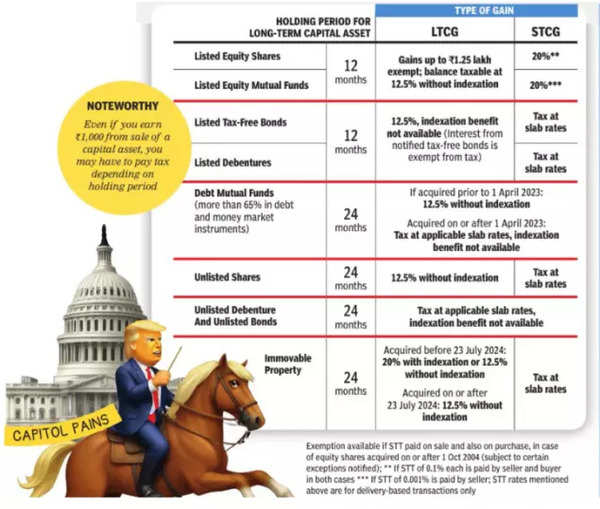

Long term capital gains

(LTCG),

Short term capital gains

(STCG)

But first what is indexation?

Indexation in

capital gains tax

adjusts the purchase price of an asset for inflation, reducing taxable gains and lowering the tax burden.

Set-off provisions for capital losses

- Loss on a long-term capital asset can only be set off against gains from another long-term capital asset in the same year. A long-term capital loss cannot be set off against short-term capital gains.

- Loss from transferring a short-term capital asset can be set off against gains from any other capital asset in the same year.

- Any remaining capital losses can be carried forward for the next eight years and utilised in the same way as described above.

- However, to be able to carry forward any losses, make sure to file your income tax return on or before the due date.

As per the 2025 Budget proposals, any income earned from redemption of Unit Linked Insurance Plans (ULIPs) which is not exempt under Section 10(10D) will be considered as income from capital gains and taxation of such ULIPs will be similar to equity oriented mutual funds.