THE TIMES OF INDIA | Jun 05, 2024, 10:13:21 IST

Stock Market Live Updates: BSE Sensex and Nifty50 opened in green in trade on June 5. BSE Sensex and Nifty50 suffered from the shockwaves sent on Dalal Street by the less than expected Lok Sabha results mandate for the Narendra Modi-led NDA on Tuesday. Both the Indian equity benchmark indices closed over 5% in red, seeing their worst day in four years. Investors saw a staggering Rs 31 lakh crore wealth erosion in just six-and-a-half hours. Foreign portfolio investors (FPIs), who have been cautious on Indian stocks since the commencement of the Lok Sabha polls in April, are expected to maintain their stance, neither investing with renewed enthusiasm nor withdrawing funds in large quantities. FPIs believe that the lower-than-expected Lok Sabha seats for the BJP could restrict their decision-making capacity in the near future.

Since April this year, FPIs have been net sellers of stocks in India, withdrawing nearly Rs 37,700 crore, including Tuesday’s net selling figure of Rs 12,436 crore, as per data from the BSE and CDSL. Market dealers suggest that any significant change in the investment patterns of foreign funds in India could have a substantial impact on the stock market.

Contrary to exit poll predictions of a resounding election mandate for BJP, the actual results left the governing party 31 seats short of the majority mark, making it reliant on allies such as TDP and JD(U). Consequently, investors now anticipate that the new government may face challenges in implementing bold policy decisions to sustain the country’s strong economic growth trajectory.

Stock Market Today Live Updates: Pace of reforms to not slow down?

Morgan Stanley’s Riddham Desai has shared his insights on the recent election verdict and its potential impact on the Indian equity markets. According to Desai, the firm’s medium to long-term views remain unchanged despite the outcome of the elections.

He expects both realized and implied volatility to decrease in the coming days, suggesting a more stable market environment. However, Desai points out that the equity markets have not yet priced in the possibility of “unresolvable disagreements within the NDA coalition,” which could potentially lead to some uncertainty.

Despite this, Desai believes that the pace of reforms is unlikely to slow down following the election results. He also expresses confidence that the government will continue to prioritize macro stability as the foundation of its economic policy, rather than sacrificing it for short-term gains.

Stock Market Today Live Updates: ‘Markets will take time to recover’

According to Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, the unexpected election outcomes will require some time for the market to digest. Although stability is expected to be restored in the near future, fluctuations will persist until there is transparency regarding the cabinet and crucial portfolios. In the short term, a significant market recovery is improbable, but sector-specific preferences may shift. Industries such as FMCG, healthcare, and IT will gain increasing favor, while momentum plays will decelerate, he said.

The sharp market correction has one advantage: it has slightly reduced the excessive valuations, which will encourage institutional buying once the cabinet’s formation and composition are clarified.

Investors can begin accumulating high-quality largecaps in sectors such as IT, financials, autos, and capital goods, he says.

Stock Market Today Live Updates: Sensex, Nifty pare initial gains

Stock market today: After rising over 650 points, Indian markets pared initial gains on Wednesday. At 9:49 AM, BSE Sensex was trading at 72,142.00, up 63 points or 0.087%. Nifty50 was at 21,906.35, down 22 points or 0.100%.

Sectors (PSUs and nonPSUs) that previously enjoyed inflated valuations due to expectations of strong reform-driven growth may experience some downward pressure on valuations

Vinit Sambre, Head Equities, DSP Mutual Fund

Stock Market Today Live Updates: What’s the road ahead for investors?

Mahesh Nandurkar from Jefferies shares his insights on the potential outcome of the elections and its impact on various sectors. He maintains that the most likely scenario is a coalition government with Narendra Modi at the helm.

Despite the uncertainty surrounding the elections, Nandurkar remains optimistic about the housing-led capital expenditure cycle. He believes that any extreme market reactions to the election results could present a lucrative buying opportunity for investors, according to an ET report.

According to Nandurkar, large-cap stocks that have underperformed in the recent past offer the most attractive risk-reward ratio. He particularly favors private banks, consumer staples, and automotive original equipment manufacturers (OEMs). However, he has reduced his overweight stance on real estate, industrials, and public sector undertakings (PSUs).

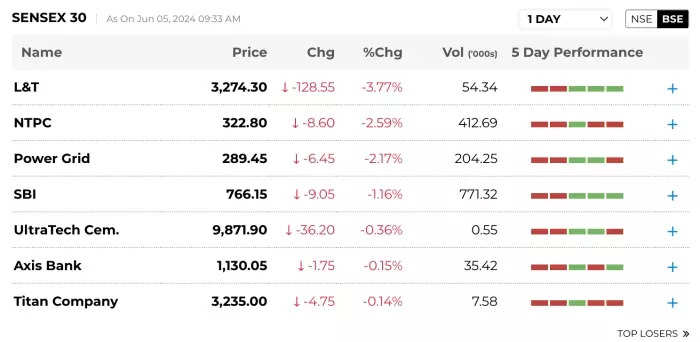

Stock Market Today Live Updates: Top Losers on BSE Sensex 30

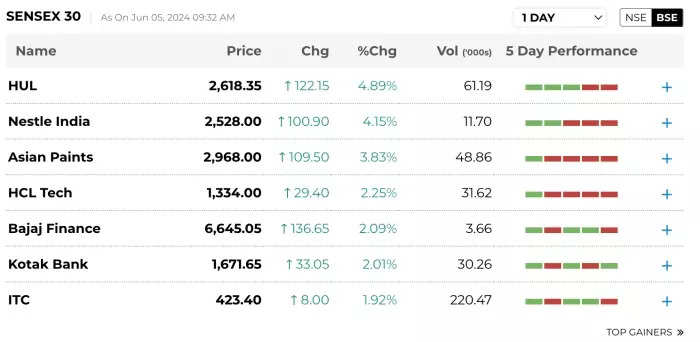

Stock Market Today Live Updates: Top Gainers on BSE Sensex 30

PSU stocks were cheaper in the 2019-2020 period and but now valuation have run up significantly in the entire PSU pack, barring few

Christy Mathai, Fund Manager at Quantum Mutual Fund

Stock Market Today Live Updates: BSE Sensex stocks at 9:22 AM

Stock Market Today Live Updates: Markets open in green

Stock market live: Indian equity benchmark indices saw a positive start to trading on Wednesday after the market mayhem on Tuesday when Lok Sabha results showed Modi-led NDA securing lesser than predicted seats. At 9:17 AM, BSE Sensex was trading at 72,723.13, up 644 points or 0.89%. Nifty50 was at 22,070.90, up 186 points or 0.85%.

Stock Market Today Live Updates: BSE Sensex, Nifty50 rise in pre-open

Stock Market Today Live: BSE Sensex has rise almost 950 points to 73,027.88, up 1.32% in pre-open. Nifty50 has risen 1.11% to 22,128.35.

Stock Market Today Live Updates: Check out the stocks in news today

Stock market crash: The domestic markets experienced a significant intraday decline yesterday, the largest in over four years, as the election results indicated the NDA’s return to power but with a reduced majority. Today’s trading session will focus on various companies, including Tata Motors, Wipro, RIL, SJVN, NTPC, and Canara Bank, due to recent developments.

SJVN anticipates its 900 MW Arun-3 hydro-electric project in Nepal, currently under construction, to commence power generation from the following year, as approximately 75% of the work has been completed.

PSU stocks will remain in the spotlight today following a significant sell-off on Monday, which was triggered by the NDA securing a lower-than-expected majority in the Lok Sabha elections.

Tata Motors‘ board has given the green light to establish a wholly-owned subsidiary, proposed to be named TML Commercial Vehicles Ltd (TMLCVL), to manage its commercial vehicles business.

RIL, a major constituent of the Nifty50 index, will be closely watched today after the company’s investors lost around Rs 1.27 lakh crore on Tuesday.

Wipro has partnered with Zscaler to introduce “Wipro Cyber X-Ray,” an AI-assisted decision support platform.

Infosys has announced a collaboration with Nihon Chouzai (TSE) to expand healthcare access in Japan by enhancing online medication guidance services.

NTPC is reportedly planning to venture into the nuclear power sector by establishing a 10 GW capacity with an investment of Rs 1.5 lakh crore over a 10-year period.

Canara Bank has reportedly initiated the process of seeking regulatory approval to convert its software services subsidiary into a non-banking finance company.

We are of the view that the current market texture is extremely volatile and uncertain; hence, it is advisable that traders should remain cautious for next few trading sessions

Shrikant Chouhan, Head of Equity Research, Kotak Securities

Stock Market Today Live Updates: What should investors do?

Stock Market Today Live Updates: What’s happening in global markets?

On Tuesday, U.S. stocks experienced a modest increase following the publication of weaker-than-expected labor market data. This information strengthened the notion that the Federal Reserve may soon lower interest rates. The data released on Tuesday showed that U.S. job openings in April fell to the lowest level in more than three years, suggesting a softening of labor market conditions. This development is consistent with the anticipated Fed rate cut in the near term. As a result, U.S. Treasury yields declined after the report’s release.

In early Asian trading on Wednesday, oil prices continued to slide slightly from the previous session after an industry report indicated increases in U.S. crude and fuel stockpiles. This news further exacerbated concerns regarding demand growth. Brent crude futures fell 14 cents, or 0.2%, to $77.38 a barrel by 0005 GMT. U.S. West Texas Intermediate crude futures fell 18 cents, or 0.3%, to $73.07 a barrel.

Stock Market Today Live Updates: What GIFT Nifty signals

Gift Nifty (formerly SGX Nifty) indicates a positive opening

Nifty futures on the Gift Nifty rose by 103 points, or 0.47%, to trade at 22,050

The markets are pricing the risk associated with this scenario, and the potential impact of a shift toward socialist policies by the government, thus leading to a sell-off,

Yashovardhan Khemka, Senior Manager, Research & Analytics at Abans Holdings

We would like to see the incoming govt continue to create a favourable environment for four growth factors: increased foreign direct investments into the country, private capex, continuation of govt capex and better infrastructure, both social and physical

Anand Shah, CIO for PMS & AIF Investments, ICICI Prudential AMC

Stock Market Today Live Updates: Budget to be keenly watched

Investment professionals hold the view that capital expenditure, undertaken by both the government and private enterprises, plays a crucial role in driving economic growth. They emphasize the importance of private sector investment, which has been significantly lacking in recent years, and stress that it should either supplement or complement the government’s capital expenditure efforts.

Given India’s favorable macroeconomic fundamentals, fund managers believe that any positive developments on the global stage could provide additional support to the domestic economy. These potential tailwinds include improving macroeconomic conditions in China and interest rate reductions in the United States.

The upcoming Budget for the fiscal year 2024-2025 is expected to be a key determinant of the future trajectory of the Indian economy and financial markets. Market participants will closely monitor the budget announcements and their potential impact on various sectors and overall economic growth prospects.

Stock Market Today Live Updates: Development agenda to continue?

Stock market crash: According to Vinit Sambre, head (equities), DSP Mutual Fund, “There is a bit of uncertainty as investors are concerned about the slowdown of reforms that had been initiated under the (outgoing) BJP-led govt. This has triggered a correction in the markets as investors reassess the outlook under the new political landscape. We would like to believe that the development agenda that spurred the performance of equity is likely to persist, irrespective of the party in power.”

The election result is likely to lead to a more balanced market. Risk-reward in large-caps and underperforming sectors like banking and consumer appear more favourable. There is likely to be greater scrutiny and valuation discipline in the performing sectors like capital goods, power, defence and manufacturing

Rahul Singh, CIO (equities) at Tata MF

Stock Market Today Live Updates: Raging bull market to be reined in?

Stock market live updates: Fund managers in India are hopeful that the new government will maintain the current momentum of economic reforms and policies that support the industry. They anticipate that the BJP-led alliance, despite having a reduced mandate, will persist with the initiatives and projects initiated by the previous government. This sentiment prevails even amidst the apprehension that gripped investors following the announcement of the Lok Sabha election results on Tuesday.

Furthermore, financial experts believe that the election outcome, which is seen as a setback for the ruling alliance but a significant boost for the opposition, has the potential to temper the surging bull market in India and bring valuations to a more reasonable level. Most believe that even though the BJP-led alliance now has a depleted mandate, it would continue the works and projects launched under the outgoing govt.

Stock Market Today Live Updates: Adani stocks take a severe beating

Stock market crash: The stock prices of all 11 Adani Group companies plummeted on Tuesday, resulting in a staggering loss of Rs 3.6 lakh crore for investors. The crash was attributed to the reduced mandate for the BJP-led NDA coalition. Since Prime Minister Modi took office in May 2014, opposition parties have claimed that the Adani Group has gained the most. Investors speculate that a weakened NDA mandate could cause the group to lose its competitive edge. Additionally, the group would face increased scrutiny from a more powerful opposition.

According to dealers, these factors contributed to the decline of Adani Group stocks in Tuesday’s crashing market. BSE data revealed that the group’s combined market capitalization dropped from Rs 19.4 lakh crore on Monday to Rs 15.8 lakh crore as stock prices of Adani Group companies plunged during the day.

The group’s flagship company, Adani Enterprises, led the decline with a 19% crash, eroding its market cap by Rs 80,416 crore. Adani Ports, which will soon join the sensex, lost nearly Rs 72,800 crore, or a fifth of its market value, bringing its current level to Rs 2.7 lakh crore. Other group companies also suffered significant losses, with Adani Green Energy losing nearly Rs 62,000 crore and Adani Power losing about Rs 58,300 crore in market value.

Stock Market Today Live Updates: What happens to IPO launches?

India has secured the second position in the global IPO market, raising $4 billion in the current year. With the NDA expected to form the next government, the IPO boom is likely to continue throughout 2024 due to anticipated policy stability. Although the amount raised by India is 45% lower than the total collected in 2023, according to LSEG data, it surpasses China ($3 billion) and Saudi Arabia ($2.1 billion). India’s IPO proceeds also exceed the combined amount raised in Turkey, Hong Kong, and South Korea. The US remains the top IPO market, having raised $14 billion so far in 2024, as per LSEG. India has climbed from the 11th position in 2019 to the third place globally in terms of IPO proceeds, following the US and China in 2023.

Between January and the present, India has witnessed 113 IPOs. Mahavir Lunawat, MD at investment bank Pantomath Capital Advisors, said, “Amidst general elections, the primary market remained vibrant with the solid response to certain IPOs like Awfis Space Solutions. Confidence can be gauged by these offerings that have been launched amidst elections… Looking ahead, the market is set to witness a flurry of IPOs, from new-age business as well as from conventional business segments.”

Several prominent companies, including Hyundai Motor India, Tata Capital, Ola Electric Mobility, Swiggy, and NSDL, are planning to launch their IPOs in the near future.

Stock Market Today Live Updates: ‘Investors to focus on government formation’

According to UBS, “After a weak political outcome, we believe investors will focus on govt formation and the choice of prime ministerial candidate considering the BJP does not have a simple majority of its own.” The other focus areas would be “policy choices to support growth vis-a-vis ensuring macro stability, and the reform narrative”.

UBS analysts said they would watch out for upcoming union budget announcements, implementation of labour laws and the next set of reforms in land and capital.

“This was not an election outcome the market valuations were set up for. Indian valuations have been expensive for pretty ordinary corporate earnings growth/outlook. One of the arguments behind India’s rich valuations has been the political stability/policy certainty afforded by a strong govt. Some of those assumptions could now come under question,” the report by UBS said.

Stock Market Today Live Updates: What will be the market reaction – immediate and long-term?

Stock market live updates: According to Pradeep Gupta, Co-founder & Vice-chairman, Anand Rathi Group, the Indian stock markets experienced significant volatility in response to the 2024 Lok Sabha election results with broader indices, Nifty 50 closing the day at -5.93%, with the lowest of the day touching -8.19%. Here are the key reactions and insights based on recent market movements and expert analyses by Anand Rathi.

•Immediate Market Reaction:

The markets saw heightened volatility due to the uncertainty surrounding the election outcomes mainly due to the gap between the exit polls and the actual results declared today. The pre-election rally witnessed yesterday, driven by expectations of a BJP victory, had already been factored into market prices. Till the question of the continuity of the current government was at an unsure position, the markets continued with heightened volatility in the short term period.

•Long-Term Outlook:

Historical data suggests that despite initial volatility, markets tend to recover and even thrive in the longer term. For instance, even after the 2014 and 2019 elections, the Indian stock market saw significant gains in the months following the election results. Investors are advised to focus on long-term strategies, such as maintaining a diversified portfolio and avoiding panic selling. Strong fundamentals and resilience against political changes are crucial for navigating market volatility.

•Sectoral Impact:

Sectors like infrastructure, defence, and capital goods are expected to benefit from policy continuity and government focus on development projects.

Large-cap stocks are preferred for their stability and resilience against economic fluctuations. In summary, while the immediate market reaction to the election results has been volatile, the overall long-term outlook remains positive, particularly if policy continuity is maintained. Investors are encouraged to stay informed, focus on fundamentals, and be prepared for short-term fluctuations.