TOI Business Desk

/ TIMESOFINDIA.COM / Updated: 12 Jun 2024, 09:41:52 PM

AA

Text Size

- Small

- Medium

- Large

1/10

SIP Calculator: How To Be Become A Crorepati

SIP Calculator: Who wants to be a millionaire? Many of us! How to become a crorepati – that’s the important question. Systematic Investment Plans or SIPs offer a great opportunity for individuals to invest in mutual funds and the stock market, even if they lack market knowledge or the time to actively monitor it. Regular investment in SIPs can help you realise your dreams of becoming a crorepati, even with a modest monthly contribution. SIPs allow investors to allocate their money into a mutual fund at predetermined intervals, such as monthly or quarterly. This approach enables the building of wealth through consistent investments, regardless of the amount invested, by leveraging the power of compounding. We take a look at some SIP calculation examples to explain this better: (AI image)

2/10

Rs 1 Crore Goal

When aiming to accumulate a substantial sum, such as Rs 1 crore, opting for an equity mutual fund SIP is a wise choice, say experts. By investing a fixed amount regularly, typically on a monthly basis, investors can save a significant amount over the long term. This is made possible by the combined effects of compounding and rupee-cost averaging, which work in favour of the investor even if the initial investment amount is modest. (AI image)

3/10

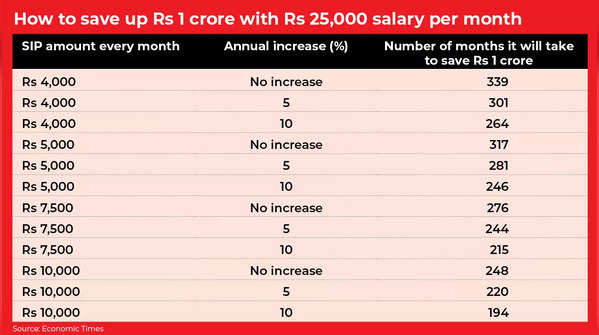

Steps To Reaching Crorepati Goal

To reach your goal of saving Rs 1 crore, the amount you need to invest monthly depends on the time you have and the expected returns. Assuming an annual return of 12% from an equity mutual fund scheme, investing Rs 4,000 per month from a Rs 25,000 salary consistently will enable you to accumulate Rs 1 crore in slightly over 28 years, or 339 months, according to an ET report. By investing Rs 10,000 per month, or 40% of your monthly salary, you can accumulate Rs 1 crore in just over 20 years, or 248 months. (AI image)

4/10

Step-Up SIP Explained

Step-up SIP: Financial advisors suggest using the SIP top-up feature to simplify the process of increasing your investments as your income grows. Mutual fund companies now offer top-up SIPs, allowing investors to automatically and systematically boost their SIP investments in accordance with anticipated income growth. Through the top-up option, investors can increase their existing SIP in a mutual fund scheme by a fixed amount or percentage at regular intervals, typically on a half-yearly or yearly basis. (AI image)

5/10

How To Save Rs 1 Crore With Rs 25,000 Salary

SIP Crorepati Route: Consider a scenario where you begin your SIP journey with a monthly investment of Rs 10,000. If you commit to increasing this amount by 5% annually, you can accumulate a substantial sum of Rs 1 crore in approximately 18.3 years, or 220 months. However, if you opt for a more aggressive approach and raise your SIP contribution by 10% each year, you can reach the Rs 1 crore milestone in just over 16 years, or 194 months.

6/10

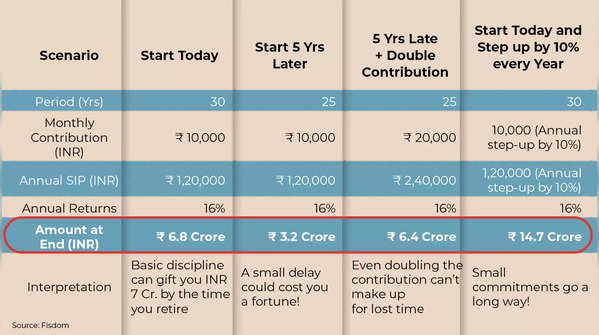

SIP Calculator

SIP Calculator Explained: In the table provided by Nirav Karkera, Head of Research at Fisdom, the benefits of timely SIP investments are obvious. Assuming a 16% return on investment, if you start today and invest Rs 10,000 every month then after 30 years, you would have accumulated a corpus of Rs 6.8 crore! That’s the power of compounding! The table also shows you the importance of timely investment, because even if you start 5 years later, then even with double the SIP contribution, you cannot make up for lost time.

7/10

Step-Up SIP Calculator: Power of Compounding

SIP Calculator Power of Step-Up SIP: The most important takeaway, however, is the importance of a top-up SIP. If you step-up your SIP contribution by 10% every year, then at the assumed 16% rate of return, you can end up with a corpus of almost Rs 15 crore!

8/10

SIP Challenges

SIP challenges: The top-up SIP mechanism presumes an annual income increase for investors. However, it is crucial to recognize that while beneficial, difficulties may emerge in situations of high inflation or unexpected financial challenges like job loss or decreased family income, making it challenging to sustain the SIP top-up consistently. (AI image)

9/10

Inflation-Indexed SIP Returns

Investors choose SIP top-ups to factor in inflation and income growth, such as pay raises, in line with their financial objectives, including funding their children’s education, marriage, home purchase, or retirement. This automated feature streamlines the process after a salary increase, removing the requirement to initiate a new SIP annually. (AI image)

10/10

SIP Investments: Patience Is Key

SIPs are generally good bets for long-term investments due to the principle of compounding. When investing in a mutual fund SIP, be prepared to commit for the long term. Have the patience to maintain your investment for years. By consistently investing without pausing, canceling, or withdrawing during downturns, you are more likely to achieve your financial goals. (AI Image)

FOLLOW US ON SOCIAL MEDIA