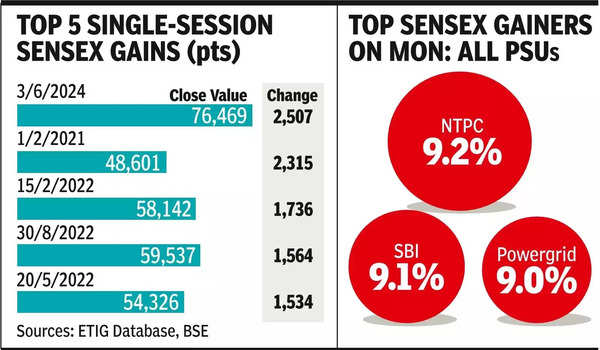

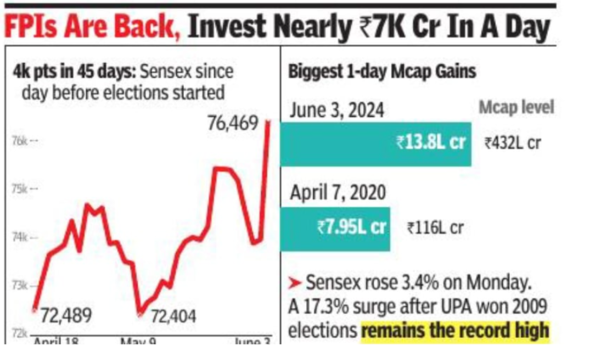

MUMBAI: Dalal Street bulls were on a rampage on Monday. Backed by exit poll estimates that showed the BJP-led govt would return to office at the Centre for the third time that would ensure policy continuity, sensex gained a massive 2,507 points — it’s biggest-ever gain in a single day, to close at 76,469 points, a new all-time closing peak. Sensex’s 3.4% gain is also the biggest in a single day in over three years, BSE data showed.

The day’s rally made investors richer by Rs 13.8 lakh crore, its biggest single-session jump, with BSE’s market capitalisation now at Rs 432 lakh crore, translating to $5.2 trillion.

Investors’ wealth, too, is at a new all-time high level.

On NSE, nifty gained 733 points, again its biggest daily gain, to 23,264 points, its highest-ever close.

These records on Dalal Street were created after over a month’s nervousness during Lok Sabha polls when investors felt jittery at times from narratives that doubted the ability of the BJP-led govt to return to office with a strong majority. On Saturday, after the end of the seven-phase election, all exit polls predicted a good majority for NDA alliance.

As a result, India VIX, the measure of market volatility that had peaked at 24.8 points on Thursday, fell 22% to 19.2 in Monday’s unidirectional session.

According to Ajit Mishra, SVP – Research, Religare Broking, the markets started the new week strongly and leading indices gained over 3% primarily due to exit poll numbers that indicated

political stability

.

However, volatility could return during Tuesday’s session, Mishra cautioned. “As we await the official election results, significant volatility is expected.”

During the day’s session,

PSU stocks

led with BSE’s PSU index closing 7.7% higher. Analysts expect these stocks, like in the last two years, could gain from the govt’s policies and return superior profits.

The rally could extend after the election results are out on Tuesday. “If the actual election results (on June 4) align with what exit polls are suggesting, it is expected that India will experience a period of political stability, clear policy direction and ongoing impetus on infrastructure and capex investments,” Pranav Haridasan, MD & CEO, Axis Securities said.

“This stability is key to maintaining the current, high economic growth cycle. Moreover, there’s an expectation that private sector investments, which have been low in recent years, will increase. Keeping these factors in mind, the market is expected to remain bullish and continue its upward growth trajectory.”

During Monday’s session, foreign funds, which were net sellers of domestic stocks for nearly two months, turned a big buyer. The day’s net foreign fund buying of stocks was Rs 6,851 crore, the biggest such number in nearly two months, BSE data showed.

Of the 30 sensex stocks, 25 closed with gains. Among these stocks SBI, Reliance Industries, Powergrip Corp and some others recorded new all-time peak prices.