MUMBAI: Across-the-board selling pulled down the sensex and Nifty by nearly 1% each on Friday as dismal quarterly corporate earning numbers and strong selling by

foreign funds

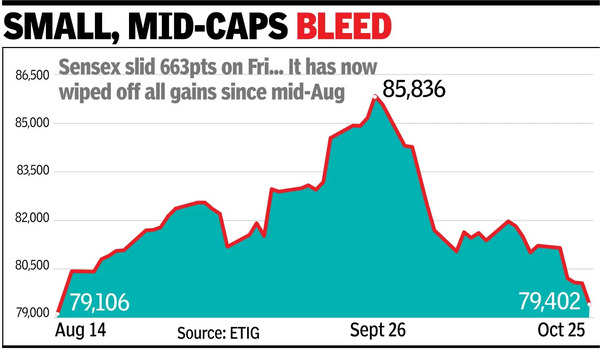

weighed on investor sentiment. At close, the sensex was down 663 points or 0.8% at 79,402 while Nifty ended 219 points or 0.9% lower at 24,181 points. Both indices are now at levels not seen in over two and a half months.

Selling, however, was more intense outside the blue chips pack. BSE’s small-cap index lost 2.4% while the mid-cap index was down 1.4%. The day’s selloff left investors poorer by a little over Rs 7 lakh crore, with BSE’s

market capitalisation

now at Rs 444.5 lakh crore, official data showed. The sensex has plunged 6,434 points from its Sept 26 life-high of 85,836.

According to Shrikant Chouhan, head of equity research at Kotak Securities, markets corrected sharply this week as foreign funds continued to sell in the domestic market. “Market sentiment was also weighed down by weaker-than-expected (quarterly) earnings numbers and weak commentary (from the companies).” He added that going forward, geopolitical developments will likely keep the equity markets and prices of certain commodities volatile. “In the coming weeks, key events include the US elections and the US FOMC (Federal Open Market Committee) meet.”

Technically, a decisive break below 24,000 points for Nifty could worsen the outlook for the market, Ajit Mishra, SVP (research) at Religare Broking, said. “In the event of a rebound, 24,500 will now serve as a strong resistance level.”

Selling by foreign funds — at a new monthly record of net outflow of nearly Rs 90,000 crore — is the main reason for the market’s slide, brokers and dealers said. So far in Oct, foreign portfolio investors were net sellers in stocks on each of the 18 trading sessions, data from NSDL showed.

Although domestic funds have been big buyers with a net inflow at nearly Rs 1.1 lakh crore, still they could not neutralise the strong stock liquidation by foreign funds, they said. However, domestic funds have provided some cushion to the impact of selling by FPIs.

DIIs have been strong buyers absorbing the selling and mitigating the fall, Vinod Nair, head of research at Geojit Financial Services, said. “Due to the (current) selling, the domestic market is expected to reach (an) oversold territory. We can expect a tactical bounceback in the near-term.”

In Friday’s market, of the 30 sensex stocks, 21 closed lower while nine closed with gains. Among the gainers was ITC, with a 2.2% rise, which announced a strong set of quarterly numbers on Thursday. On the other side, IndusInd Bank crashed 18.6% on the back of dismal quarterly numbers and rising non-performing assets.