MUMBAI: Across-the-board buying lifted the sensex by 1,331 points to close above the 80k mark on Friday as

global cues

, especially strong

US markets

in the last two days, supported

investor sentiment

on Dalal Street. Adani group stocks that were under pressure since Hindenburg Research’s Aug 10 report too rallied.

The sensex opened the day’s session on a strong note, up more than 600 points, witnessed some selling pressure at higher levels and then reversed the trend to

rally

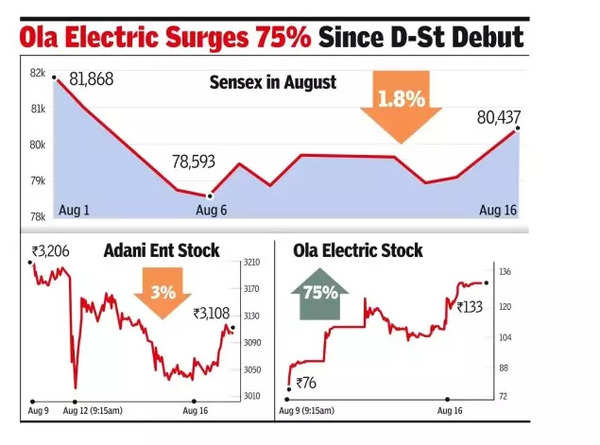

smartly to close at 80,437 points, up 1.7% on the day.

On the NSE, Nifty too followed a similar trend and closed 397 points or 1.7% at 24,541 points.

The local

market

had to catch up with gains in the US market and hence the day’s rally, market players said. The main reason for the rally in the US market was the retail inflation data that showed a downward path last month to below 3% level which raised the chances of a cut in interest rates by its central bank in the world’s largest economy next month. The stability of the Japanese yen and a few other global factors also aided the rally. The day’s strong gains also more than made up for the aggregate losses of the previous three sessions.

According to Vinod Nair of Geojit Financial Services, the stability of the yen has been instrumental in driving a global market recovery. “Besides that, strong US retail sales and a decline in weekly jobless claims have helped alleviate fears of a US recession. Further, the market sentiment has improved due to a decrease in US (retail) inflation.”

Some of the domestic factors also helped the rally while there are some weak signals too. “Domestically, Indian retail inflation rate has fallen below the estimate, signalling optimism. However, challenges such as a drop in wholesale inflation, weak IIP (Index of Industrial Production), and lukewarm (first quarter) corporate earnings suggest that market gains may be limited, which is reflected by foreign funds maintaining a net seller position,” Nair said in a note.

In Friday’s session, domestic funds, who have mostly been buying stocks in a falling market, were net buyers at Rs 2,606 crore. Interestingly, foreign funds too were net buyers on Friday, at Rs 767 crore, BSE data showed. The day’s rally also added about Rs 7.2 lakh crore to investors’ wealth with BSE’s market capitalisation now at Rs 464 lakh crore.

Among the 11 Adani group stocks, Adani Power was up 3.5%, Adani Wilmar 3.1% and flagship Adani Enterprises was up 2.3%.

Outside of the blue-chips and large companies, recently listed Ola Electric Mobility, which announced a slew of new plans on Thursday, rallied the maximum possible 20% during the day’s session to close at Rs 133 on BSE. The company now has a market capitalisation of Rs 58,558 crore, an all-time high level.