MUMBAI: With the

BJP-led alliance

set to be sworn in on Sunday, Dalal Street investors are coming back in droves to revive the bull rally. On Friday, after a muted start of the session, investors, led by

foreign funds

, took the sensex to a new

all-time high

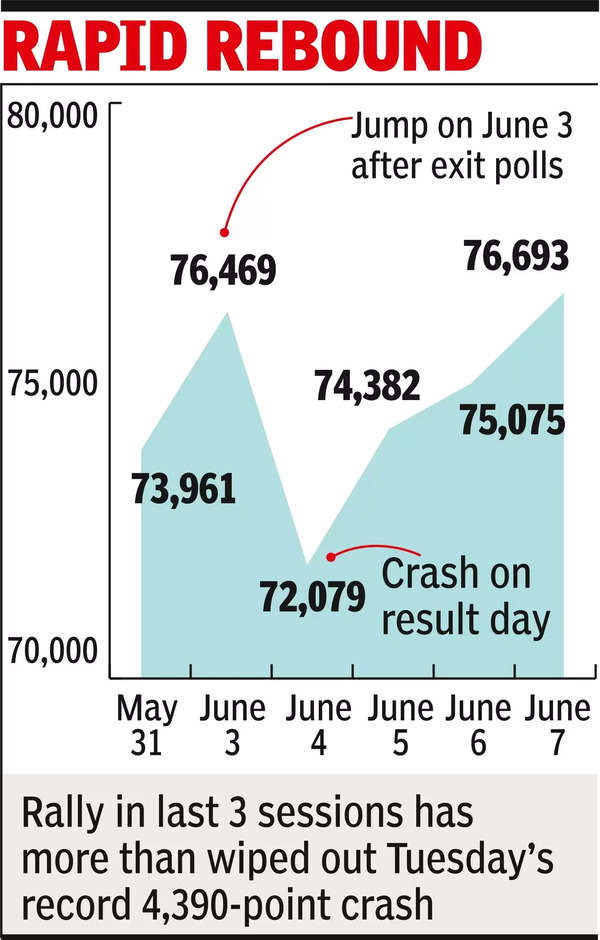

, at 76,795 points and closed a tad off that at 76,693, up 1,619 points or 2.2%.

The RBI decision to maintain a status quo on rates and an upward revision in the growth projections for the current fiscal year also helped the rally.

Good monsoon forecast added to the positive cues for investors to support the rally. Short covering during the closing hour of the session added some points to the index, market players said.

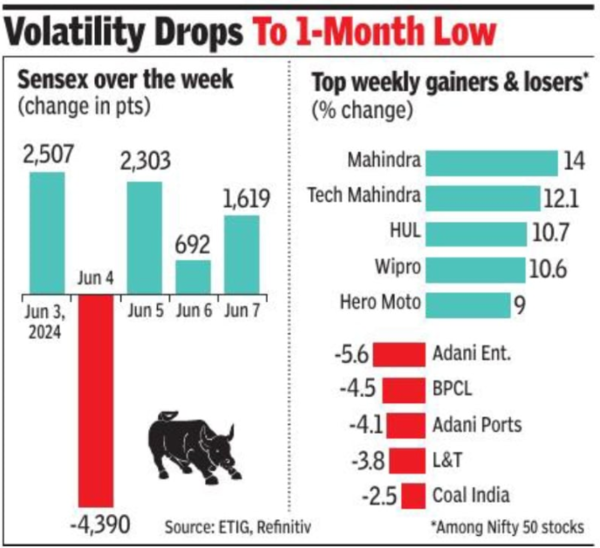

On the NSE, the nifty too recorded a new all-time high mark of 23,320 points and closed at 23,290 points, up 469 points or 2.1%. The rally in the last three sessions has more than wiped out the record 4,390 point crash on Tuesday when general election results were announced.

“Markets shrugged off weak global cues as investors cheered RBI’s higher growth forecast for FY25 in its credit policy announcement, which propelled sensex to a fresh all-time high on massive broad-based buying support,” Prashanth Tapse, Senior VP (Research), Mehta Equities said.

“Also, the arrival of monsoon rains on time and expectations of its even spread across the country raised hopes of softening inflation going ahead. With the election uncertainty now over and the NDA most likely to form the government, investors are hopeful that the action will now shift to reforms and the upcoming Budget.”

For a change, Friday’s rally was supported by foreign funds who recorded a net inflow of Rs 4,391 crore, while domestic funds were net sellers at Rs 1,290 crore, end-of-the-session data on BSE showed.

The day’s rally added Rs 7 lakh crore to investors’ wealth with BSE’s market capitalisation now at Rs 429.5 lakh crore.

The day’s session also saw volatility reducing substantially with India VIX, the measure of volatility, dropping to one-month low of 16. This was a sign of reduced anxiety among investors over the formation of the new government at the Centre, market players said.

Going forward, a host of global and local factors are expected to drive the market. After the European Central Bank announced interest rate cut for the first time in nearly five years, hopes have revived that the US Fed might follow suit in its September meeting, said Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services. “Next week focus will be on allocation of key cabinet portfolios such as finance, defence, roads, energy, commerce, and railways.”