MUMBAI: The board of markets regulator

Sebi

on Tuesday tightened rules for

mutual funds

to stop instances of

front-running

and

price manipulation

. Sebi will come out with broad guidelines for this, while

Amfi

, the

fund industry

trade body, would frame the detailed guidelines, a release from the

regulator

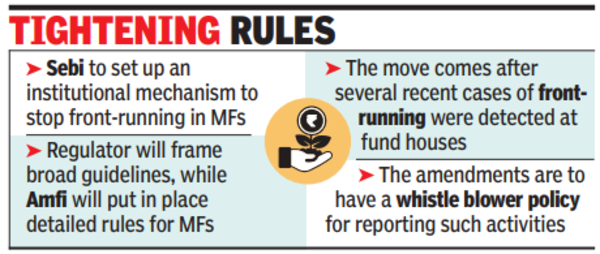

said. The move was necessitated in the backdrop of several cases of front-running in fund houses.

The regulator will put in place a “structured institutional mechanism” to curb front-running and fraudulent transactions in mutual funds, the release said.

“The mechanism shall consist of enhanced surveillance systems, internal control procedures and escalation processes to identify, monitor and address specific types of misconduct including front-running,

insider trading

, misuse of sensitive information etc.”

The Sebi board also approved amendments to MF regulations to “enhance responsibility and accountability of management of (fund houses) for such an institutional mechanism and foster transparency by requiring (MFs) to have a whistle blower mechanism.”

The regulator will “specify the broad framework of the institutional mechanism” and Amfi, in consultation with Sebi, shall specify detailed standards for such an institutional mechanism, the release said.

The Sebi board also reduced the face value of debt securities and non-convertible redeemable preference shares to Rs 10,000 from Rs 1 lakh. This could potentially attract more retail investors to participate in the

bond market

.

The regulator’s board also relaxed some of the norms governing non-resident Indians (NRIs), overseas citizens of India (OCI) and resident Indians (RIs) to invest through the IFSCs.