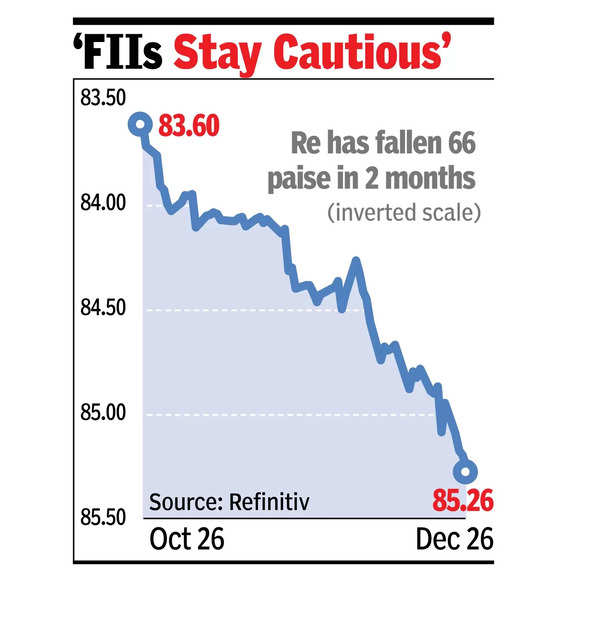

MUMBAI: The rupee continued its slide against the dollar on Thursday, closing at a record low for the third consecutive session as it ended at 85.26 – down six paise from its previous close. It hit an all-time intraday low of 85.28 as buyers for dollars outstripped sellers in weak year-end trades.

“The rupee weakened marginally as the dollar index remained elevated near the 108 level.

Foreign institutional investors

continued to stay cautious, refraining from taking long positions in Indian markets, which kept the rupee subdued. The currency faces challenges in regaining stability, sliding over hurdles while attempting to recover lost ground. In the near term, the rupee is expected to trade within a range of 85-85.45,” Jateen Trivedi, VP (research analyst) at LKP Securities, said.

The dollar has gained over the rupee in the past two months. The publication in RBI’s Bulletin of the real effective exchange rate hitting a multi-year high of 108.14 raised concerns of overvaluation. The Real Effective Exchange Rate is an index that tracks how the rupee’s value compares to other currencies by looking at how they move against the dollar. It has increased because other currencies have weakened less than the rupee.

Dealers say that the rupee could face further downward pressure as global economic uncertainties and domestic macroeconomic challenges continue to weigh on market sentiment. RBI’s interventions are expected to provide some support, but sustained dollar strength poses significant challenges for the rupee in the coming months.

The dollar has strengthened on the back of rising bond yields in the US and expectations that the Federal Reserve will introduce its interest rate cuts more slowly in 2025. On Thursday, the sensex closed nearly flat at 78,472 points, while Nifty ended slightly higher at 23,750.