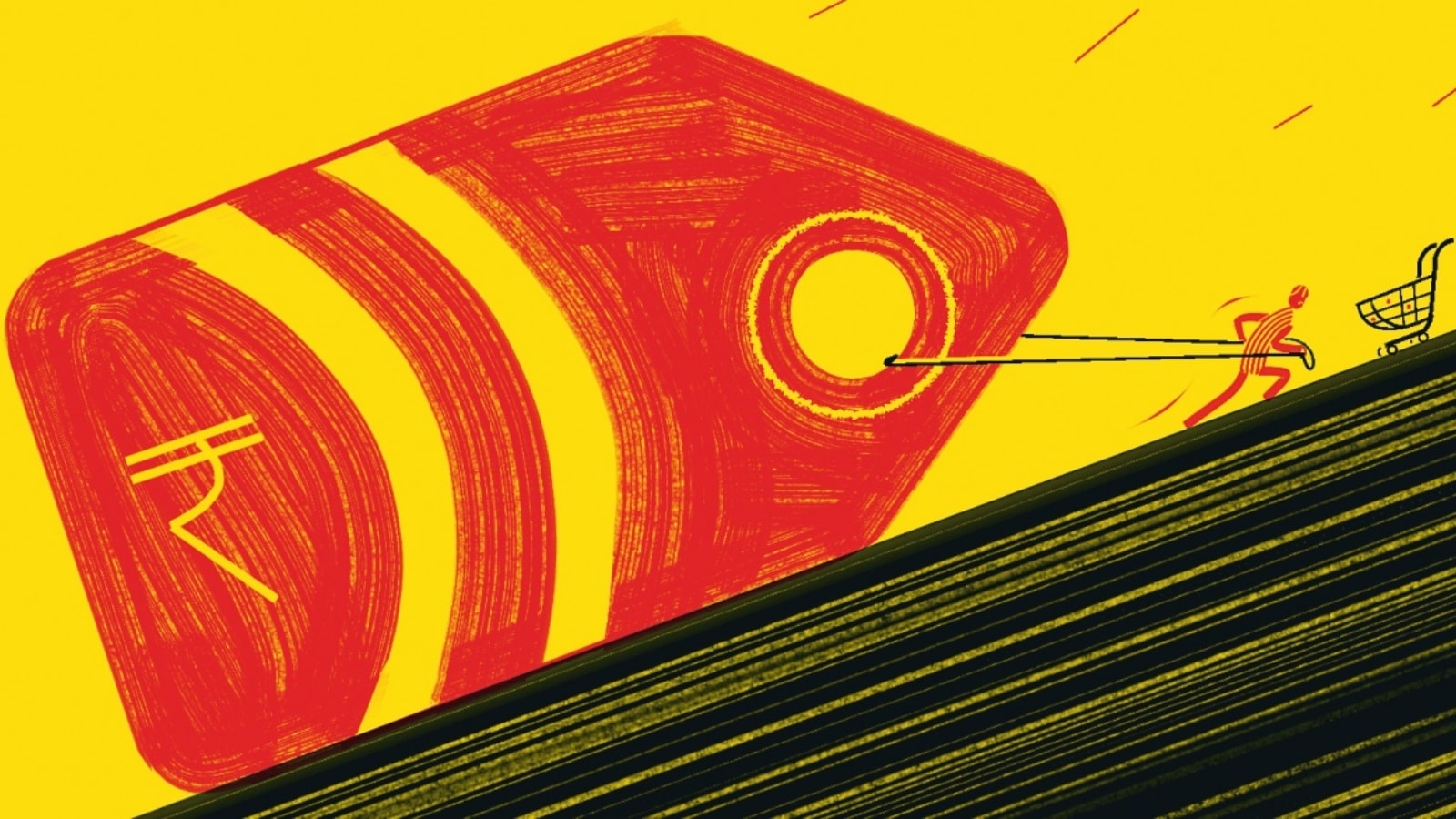

The monetary policy committee of the RBI has embarked on a rate-cutting cycle in its February 2025 review. The growth-inflation trends and outlook mix had provided a window to cut rates. The committee presciently used this opportunity to do the same even as the global arena is fraught with uncertainty, which has manifested most visibly in the depreciation in the rupee versus the US dollar. However, while India’s rate cut cycle has kicked off, it is highly likely to be shallow.

Backtracking to the MPC’s previous policy meeting in December 2024, the last available CPI (Consumer Price Index) inflation print had breached 6 per cent, the upper threshold of the medium-term target range of 2-6 per cent. This had signalled that a rate cut was clearly off the table, even though GDP growth had slumped to a lower-than-expected 5.4 per cent in the second quarter of 2024-25. The February 2025 policy meeting seemed “live” for a rate cut, with inflation having receded appreciably and expected to moderate further in 2025-26. Even as the tea leaves of the high frequency indicators portend a pickup in domestic growth from the trough of the second quarter, it is likely to remain well below the level of 8.2 per cent recorded in 2023-24.

Story continues below this ad

Eventually, the MPC unanimously cut the repo rate by 25 basis points, while maintaining a neutral stance, both in line with our expectations. Interestingly, it was last in April 2019, when the MPC had reduced the policy rate to 6 per cent from 6.25 per cent, while maintaining a neutral stance. This had been, however, followed by a change in stance to accommodative and a series of rate cuts pre- and post- the onset of the pandemic to the low of 4 per cent by May 2020. In our view, this cycle is likely to be markedly different. ICRA believes that the outlook for inflation and growth can provide space for only one more rate cut of 25 basis points in the near term, although the timing of the same needs to be calibrated to the domestic and global developments.

We expect the CPI inflation to dip to 4.2 per cent in 2025-26 from 4.8 per cent in 2024-25, in line with the MPC’s estimates. This is expected to be driven by a sharp moderation in food inflation, even as core inflation is expected to rise slightly. The supply-led cooling in food inflation, benefitting from the healthy rabi sowing and ample reservoir levels, as well as the Budget’s announcements regarding schemes for perishables and pulses, is expected to provide relief to low and middle-income households. The tax cuts of Rs 1 trillion unveiled by the Union Budget are generous from a macro point of view. However, the monthly improvement in disposable income is not large enough to prove inflationary, in our assessment. This is especially so with overall fiscal policy being mildly restrictive, with the fiscal deficit set to narrow to 4.4 per cent of GDP in 2025-26 from 4.8 per cent in 2024-25.

However, the global environment is mired with inflation risks, one of which stems from tariff-related actions by the US and countermeasures by other countries. The yo-yo on tariff measures has already enhanced financial market volatility and impacted the rupee, which has depreciated over the last few months, even though it has outperformed other emerging market currencies. This raises concerns on account of pass-through to inflation and adverse growth outcomes, which have also been acknowledged by the MPC.

Story continues below this ad

While global headwinds are likely to adversely impact India’s near-term outlook, the muted outlook for exports, particularly for the goods segment, is expected to constrain India’s GDP growth over the medium term as well. This would imply that the bulk of the heavy lifting in terms of growth would need to be done by domestic consumption, and that the private capex cycle will likely remain measured and non-exuberant in the absence of strong external demand.

Another rate cut in early 2025-26 would certainly play an important role in supporting urban consumption and GDP growth in the next fiscal. This would aid in reducing the EMIs of borrower households, augmenting their discretionary consumption. Although the impact of this may not be significant, it will be spread across a wide number of households; as per the RBI data, there were as many as 194.9 million personal loan accounts, including 14.7 million home loan accounts outstanding as of end-September 2024.

Additionally, the aforesaid income tax relief to the tune of Rs 1 trillion that was provided in the budget to individual taxpayers would result in a consumption multiplier and has the potential to boost GDP growth in the coming year. This combination of rate cuts, income tax relief and lower food inflation is expected to boost urban consumption.

most read

In the budget, the government has also provided a capex thrust of Rs 1 trillion, which is a growth of 10.1 per cent. However, over the medium term, government capex is unlikely to grow at very high rates on a sustained basis, owing to fiscal constraints, notwithstanding the shift to the new fiscal anchor, namely debt/GDP from the more rigid extant fiscal deficit/GDP. Besides, fiscal consolidation will have to contend with challenges owing to the recommendations of the 8th Pay Commission and the 16th Finance Commission, which are scheduled to be released during the coming year. This assessment suggests that India’s growth potential remains around the 6.5-7 per cent mark, well below the 8 per cent alluded to in the Economic Survey.

Interestingly, the RBI governor stressed that the exchange rate policy remains focused on smoothening excessive and disruptive volatility rather than targeting any specific exchange rate level or band. This suggests policy continuity despite a change in guard at the RBI. It debunks the expectations of increased comfort of a depreciation in the US dollar/rupee pair that the market seems to have developed over the last few months.

The writer is chief economist, head — Research & Outreach, ICRA