When will your loan EMIs come down? If that’s the question on your mind, then the

RBI

’s Monetary Policy Committee (MPC) meeting on June 7, may disappoint you! The Reserve Bank of India (RBI) has long been grappling with food inflation, but the recent election results have introduced a new challenge for the central bank in terms of potential rate cuts.

The possibility of a populist spending-led fiscal landscape has emerged as a concern.

RBI’s MPC meets once in two months to decide on the course of key rates, including

repo rate

and CRR, with an aim to keep inflation closer to the 4% target while balancing economic growth. Repo rate is the rate at which the RBI lends to banks. A cut in repo rate makes lending cheaper for banks, hence translating into reduced loan rates and hence lower EMIs.

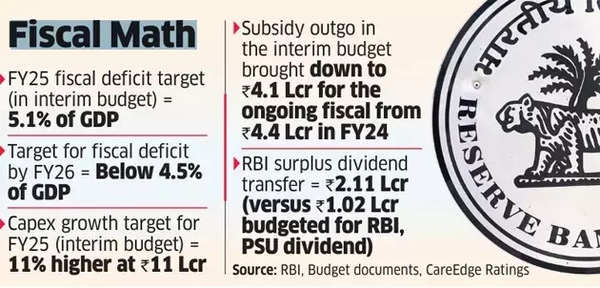

Prior to the election results, bond markets were abuzz with speculation that the Centre, having received a record-high surplus dividend from the RBI, might significantly reduce the fiscal deficit. However, the actual results present a different scenario.

Fiscal math

Tanvee Gupta Jain, an economist at UBS Securities, told ET, “While political stability should help ensure continuity in policy agenda, we see risk of populist bias in the third term targeted towards lower income strata and change in economic policy dynamics with tougher reforms getting pushed further out.” She added, “In the upcoming budget (in July), our base case is for the government to stick to a medium-term fiscal consolidation roadmap but with a populist bias.”

The RBI’s upcoming policy statement on June 7 was not expected to include a

rate cut

, but the prospect of the Centre making significant progress towards fiscal consolidation and reducing borrowing would have provided the central bank with reassurance regarding aggregate demand conditions in the economy.

The reaction in India’s overnight indexed swap market on Tuesday suggests that the chances of rate cuts in 2024 are slim, as traders consider the potentially inflationary impact of increased public spending.

Madhavi Arora, lead economist at Emkay Global Financial Services, pointed out, “The BJP will be dependent on regional allies like Telugu Desam and Janata Dal (Secular) and make policy adjustments accordingly. Second, there will be greater demand to stimulate consumption in the economy from both the BJP and allies.”

However, the government has a significant fiscal cushion due to the RBI’s transfer of Rs 2.11 lakh crore as surplus to the government, which is more than double the amount budgeted as dividend from the central bank and PSU institutions. This allows the government to spend more to boost consumption in the economy, if needed, without severely disrupting the fiscal balance.

Madan Sabnavis, chief economist at Bank of Baroda, said, “The government already has Rs 1 lakh crore of additional income which can be used in different ways. I don’t think there is a major conundrum for the government.” He added, “Let’s assume that there were no constraints at all, the government could have probably targeted a 4.9% fiscal deficit this year instead of 5.1%, but I don’t think there is a rush to do it right now because we are following the prudential path of gradually going back to 4.5%.”