MUMBAI: After a muted start,

Ola Electric

Mobility

shares

surged to hit the maximum possible 20% upper circuit limit at Rs 91 on their first day of trading. The Rs 6,146-crore

IPO

for Ola Electric was the biggest in India in the last two years.

The strong closing that translated to a

market

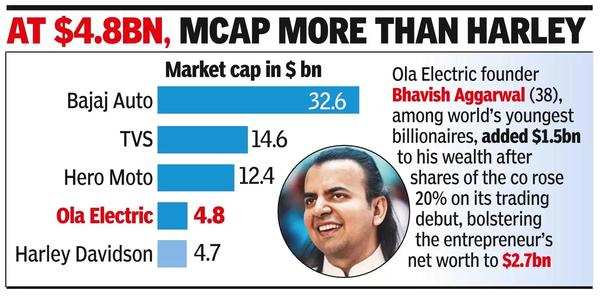

capitalisation of a little over Rs 40,200 crore (nearly $4.8 billion) for the top Indian electric two-wheeler company left market players surprised.

During the bidding process that was open from Aug 2 to 6, the stocks were offered at Rs 72-76 per share.

According to dealers and market analysts, the non-institutional part in Ola Electric’s IPO (the portion reversed for high networth

investors

) didn’t see high subscription as was expected during the bidding period. Compared to smaller IPOs that get subscriptions from HNIs in double-digits, the Ola Electric issue was subscribed 2.4 times. For HNIs who look for

listing

gains, this low subscription figure increased the cost of application in the offer.

As the stock was listed on Friday morning, lots of HNIs rushed in to sell which initially depressed the price. After the initial bout of selling, long-term investors stepped in that in turn lifted the

stock price

to hit the upper circuit level and close at the same price, market players said.

“The performance of Ola aftert the listing has caught people by surprise. A 20% gain on listing has beaten all expectations and puts the stock on radar for the immediate future,” Arun Kejriwal, director, KRIS, an investment advisory services firm.