NPS operates through a two-tier structure. The Tier-I Account functions as the principal retirement savings vehicle. (AI image)

The National Pension System or the NPS is gaining recognition as a popular retirement-focused investment option. Financial experts highlight that NPS combines essential features of an ideal

retirement savings

product, offering extended investment opportunities with cost-effective management and conservative risk levels.

NPS operates through a two-tier structure. The Tier-I Account functions as the principal retirement savings vehicle, receiving regular deposits from subscribers and/or their employers, invested according to the participant’s chosen scheme/fund manager.

Opening this account requires a minimum deposit of Rs 500, alongside a yearly contribution requirement of Rs 1,000.

NPS Tier II Account is a supplementary withdrawable account accessible to only active Tier I account holders. Account holders can make withdrawals whenever required. To start this account, one needs to contribute a minimum of Rs 250, and there are no yearly minimum contribution requirements.

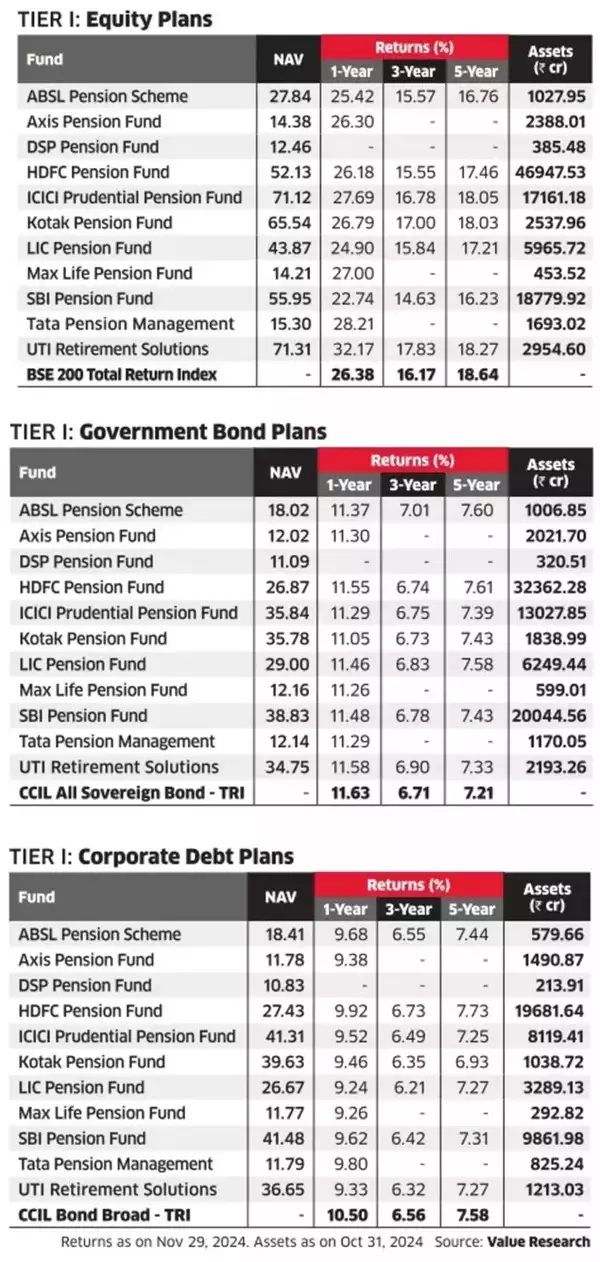

NPS Fund Managers: Performance for Tier-1 Equity, Government Bond, Corporate Debt Plans Compared

The NPS framework offers four distinct asset classes: Asset Class E covers Equity and associated instruments; Asset Class C encompasses Corporate debt and related instruments; Asset Class G includes Government Bonds and associated instruments; whilst Asset Class A comprises Alternative Investment Funds including CMBS, MBS, REITs, AIFs, Invlts, and similar investments.

NPS participants can choose from 11

pension fund managers

and have the flexibility to change their fund manager once every year.

NPS Fund Managers: Performance for Tier-1 Equity, Government Bond, Corporate Debt Plans Compared

NPS is a voluntary contribution programme linked to market performance, specifically created to support retirement savings. Financial specialists recognise it as a valuable tool for building retirement wealth. The Central Government established this initiative to ensure citizens have adequate pension income for their post-retirement years.

Account registration for the voluntary NPS programme is available through the online eNPS platform. Individuals can have an NPS account until they reach 70 years, with the flexibility to continue contributing until age 75.

Also Read | Top Fixed Deposit Rates: These bank FDs will earn you up to 9% return for 3-year deposits – check list

The scheme’s fund management fees are notably economical compared to mutual funds and insurance products. For example, investing Rs 5,000 via SIP in a mutual fund charging 2% annually would accumulate to approximately Rs 19 lakh in management fees over 25 years. In contrast, identical investment in NPS would only incur Rs 1 lakh over the same period, considering NPS’s maximum fund management charge of 0.09%. These figures are derived from calculations assuming a 9% compounded annual return, according to an ET analysis. The reduced charges result in enhanced returns for investors.