MUMBAI: Strong demand for India’s sovereign bonds and good coordination between govt and RBI ensured that for the first time in nearly 20 years, there was neither

devolvement

nor any cancellation of

bond auctions

during FY24. According to bond market players, this could play as a positive kicker for Indian

gilts

once they are included in

bond indices

by

JP Morgan

and

Bloomberg

, starting next month.

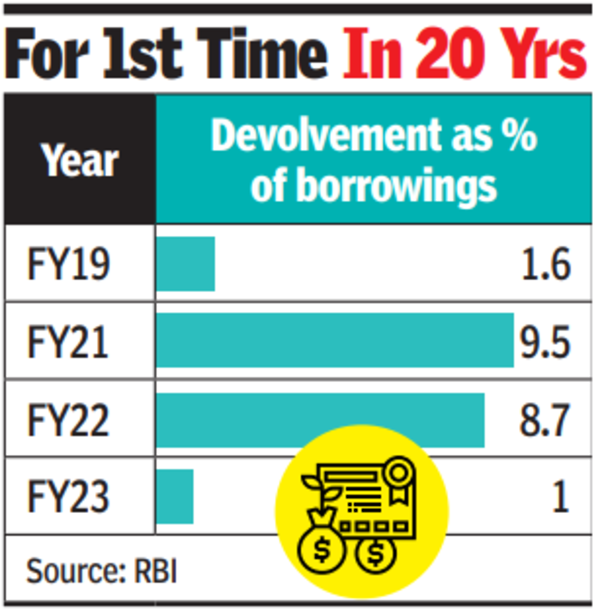

The devolvement of an auction happens when, due to lack of interest from buyers of gilts, primary dealers (authorised brokers in govt securities market) are obligated to buy the unsold part of the auction from RBI. The last time this happened was in FY06, RBI said in its recent monetary policy document.

In FY24, the absence of devolvement or cancellations came against the backdrop of heightened geopolitical tensions in Europe and West Asia that have led to a spike in crude prices globally. Abnormal volatility in fixed income markets around the world as falling but elevated

inflation

prompted global central banks to maintain monetary policy restraint have also been a feature.

In contrast to volatile global markets, domestic financial markets exhibited orderly movements due to sound

macro management

by govt and RBI, bond market players said. Quality fiscal management and proactive management of food supply in the economy not only supported growth through investment demand but also helped in containing inflation, along with a relatively stable currency, they added.

RBI’s proactive liquidity management, lower-than-expected domestic consumer inflation and the proposed inclusion of Indian govt bonds in JP Morgan and Bloomberg global indices elevated the demand for G-Secs. This has helped the benchmark yield on 10-year papers within a relatively narrow range of 6.95% to 7.35%. In comparison, the yield on US 10-year govt papers fluctuated between 3.3% to 5%.

In FY24, the yield on Indian 10-year paper also exhibited a softening bias. Also, there was no devolvement or cancellation of auctions despite record high gross borrowing of around Rs 15.4 lakh crore, RBI data showed. In comparison, in FY23, about Rs 10,000 crore worth of sovereign bonds had devolved while it was nearly Rs 1 lakh crore in FY22 and Rs 1.3 lakh crore in FY21, data from RBI showed.

Bond market players expect govt and the central bank to continue to maintain the high quality of coordination during the current fiscal. This is expected to boost growth and come in as a positive factor for foreign and domestic fixed income investors.

“Govt’s intention towards credible and sustainable fiscal management with continued thrust on infrastructure and RBI’s vigilance on domestic price stability while ensuring proactive liquidity and exchange rate management are likely to provide strong foundation for sustainable growth over medium term,” said Ram Kamal Samanta, senior VP (investment), Star Union Dai-ichi Life Insurance.