Income Tax Notice

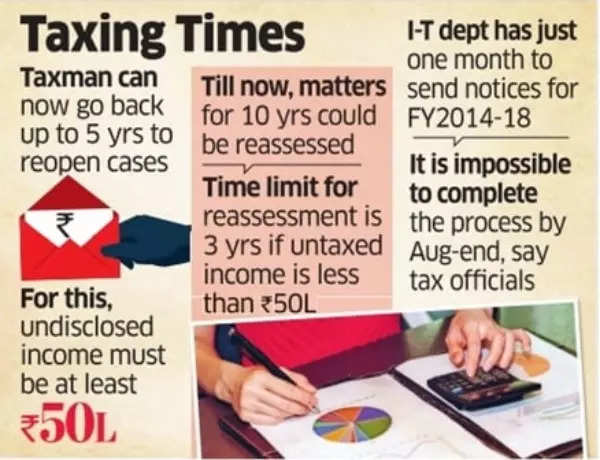

on the way? The Income Tax Department is gearing up to send out a large number of notices in the coming month, as there are concerns that many taxpayers might escape the tax net due to the impending implementation of the new reassessment law on September 1, 2024.

According to the amended regulation announced in

Budget 2024

, the tax authorities can only go back a maximum of five years to reassess a taxpayer’s records if the escaped income is at least Rs 50 lakh, and three years for an amount less than Rs 50 lakh.

Previously, they could reassess cases up to 10 years old.

According to an ET report, tax officials are now faced with the challenge of compiling and corroborating data on tax and income mismatches for the financial years 2013-14 to 2017-18 within the next few weeks, as these years will become time-barred for reassessment from September 1, 2024.

The

I-T department

relies on information from various sources, such as banks, property registrars, and search findings from the investigation wing, to build reassessment cases.

Taxing Times

A tax officers’ body has raised concerns about the feasibility of issuing notices under Section 148 (or 148A) in a large number of cases within a single month, given the overburdened nature of the jurisdictional assessing officers and the time-consuming process of obtaining sanction from the chief commissioner, who is the specified authority for such notices.

Moreover, the law provides taxpayers with the right to explain their position before reassessment orders are finalized, a process that most believe cannot be completed by the end of August.

Also Read | ITR refund status for FY 2023-24: How to check income tax refund status online – here’s a step-by-step guide for incometax.gov.in & NSDL websites

The Central Board of Direct Taxes (

CBDT

) has been urged by its officers to postpone the effective date of the proposed amendment. However, this suggestion is unlikely to be well-received by corporations and high net worth individuals.

“Capping the reassessment period at five years was a great decision as it would reduce hassles and litigation. But if the department fears there could be a genuine loss of revenue as it may not be possible to wrap up several matters by August 31, the government can think of strict parameters where time-bound cases can be selectively reopened – based on trails of steps taken in identifying escaped income,” said Mitil Chokshi, partner at CA firm Chokshi & Chokshi.

“Taxpayers may expect a rush of reassessment notices in August 2024. These notices are likely to be for the AYs 2018-19 and prior to that. It is pertinent to note that the Bombay High Court in a recent ruling in a case of Hexaware Technologies has taken a view on a proviso introduced in 2021, which can be interpreted to mean that AY 2017-18 (and prior years) got time barred on March 31, 2024. These reassessment notices (for AYs 2017-18 and prior) are likely to rake up new interpretation issues in the already muddled reassessment provisions,” said Ashish Mehta, partner at law firm Khaitan & Co.

The current situation is similar to the conflict between the Income Tax office and taxpayers in 2021. The reassessment law was amended in April 2021, allowing the tax office to reopen 10-year-old tax returns if the total undisclosed income exceeded Rs 50 lakh and reassess 4-year-old matters if the amount was less than Rs 50 lakh.

Also Read | Latest NPS rules 2024: How much tax will you save with new NPS contribution benefit under new regime after Budget 2024?

However, this change led to over 10,000 writ petitions being filed by companies, arguing that they were not given sufficient time to explain and that the notices were issued without considering the carve-out that cases which couldn’t be reopened earlier couldn’t be reassessed under the new law.

The Supreme Court invoked its extraordinary powers under Article 142 of the Constitution on May 4, 2022, to uphold all reassessment notices issued after March 31, 2021. However, the court left room for judicial proceedings based on the merits of each case, and several such matters are currently pending before the court.