The

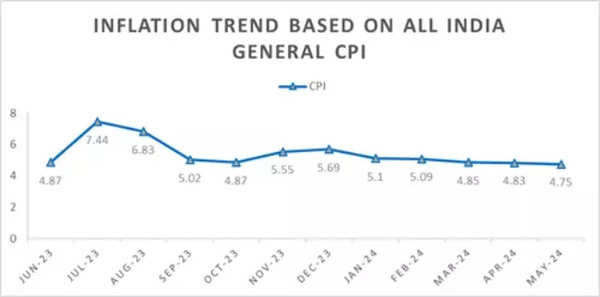

Consumer Price Index

(CPI) inflation for the month of May 2024 eased to 4.75% as against 4.83% in April 2024. The rural and urban inflation rates are 5.28% and 4.15%, respectively. The Consumer Food Price Index (CFPI) inflation came in at 8.69%, down marginally from 8.70% in April 2024.

Notably, the all India inflation based on the

General CPI

for May 2024 is the lowest since May 2023, according to Ministry of Statistics & Programme Implementation release.

Furthermore, the inflation rate has remained below 6% since September 2023.

At the sub-group level, ‘Spices’ has experienced a significant decrease in year-on-year inflation compared to the previous month, April 2024. Additionally, the inflation rates for ‘Clothing & Footwear’, ‘Housing’, and ‘Miscellaneous’ groups have also declined since last month, the release said.

CPI Inflation Trend

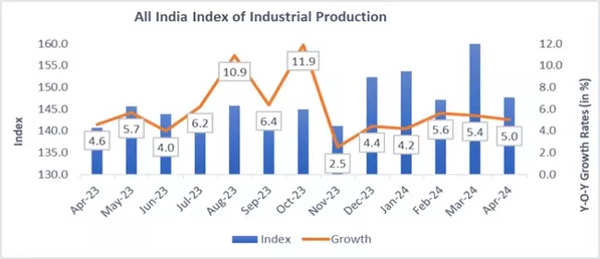

The Ministry of Statistics & Programme Implementation data also shows that the

Index of Industrial Production

(IIP) grew at 5% in the first month of the current financial year. This marks a slight increase from the IIP growth rate of 4.6 percent recorded in April 2023.

Breaking down the performance of individual sectors, the Mining sector demonstrated a robust growth of 6.7 percent in April 2024 when compared to April 2023. The Manufacturing sector, on the other hand, experienced a more modest growth rate of 3.9 percent during the same period. Lastly, the Electricity sector showcased an impressive growth rate of 10.2 percent in April 2024 over the corresponding month in the previous year.

All India IIP Production

Last week, RBI governor Shaktikanta Das said that the ihe inflation-growth balance is moving favourably. “Growth is holding firm. Inflation continues to moderate, mainly driven by the core component which reached its lowest level in the current series in April 2024. The deflation in fuel prices is ongoing. Food inflation, however, remains elevated,” he said in the central bank’s monetary policy statement.

“While the MPC took note of the disinflation achieved so far without hurting growth, it remains vigilant to any upside risks to inflation, particularly from food inflation, which could possibly derail the path of disinflation. Hence, monetary policy must continue to remain disinflationary and be resolute in its commitment to aligning inflation to the target of 4.0 per cent on a durable basis,” he said when talking about why the MPC decided to keep the repo rate unchanged.