- News

- Business News

- India Business News

- LTA Calculator: What Are The Leave Travel Allowance Rules? Check LTA Calculation Example, Eligibility, Expenses Covered, Tax Exemption – Top 10 Points

TOI Business Desk

/ TIMESOFINDIA.COM / Updated: 24 May 2024, 10:26:49 PM

AA

Text Size

- Small

- Medium

- Large

1/11

LTA Calculator: What Are The Leave Travel Allowance Rules?

LTA Calculation: Leave Travel Allowance (LTA) or Leave Travel Concession (LTC) is a common tax exemption available to salaried employees in the government and private sector. LTA is a part of the cost-to-company or CTC for salaried taxpayers. So what is LTA or LTC? Who can claim LTA and how is LTA calculated in your salary? What all travel expenses are covered under LTA and what are not? Which documents do you need for LTA and how often can you claim it? We take a look at an LTA calculation example for your better understanding and answer the top 10 frequently asked questions (FAQs) on LTA or LTC: (AI image)

2/11

What is Leave Travel Allowance or LTA?

Leave Travel Allowance or LTA which is often included in your salary package, covering the expenses of your travel during vacations. The exemption also extends to travel-related costs for family members who accompany the employee. To claim LTA, employees must usually provide documentary evidence of their travel expenses to their employers within specified deadlines. (AI image)

3/11

Who Can Claim LTA?

LTA Eligibility: Any employee whose employer includes LTA as part of their compensation package can claim a deduction for LTA. However, to claim LTA, you must travel and submit the original proof of your journey to your employer. This exemption cannot be claimed if you did not travel during your leave. (AI image)

4/11

How Much LTA Can You Claim?

LTA Claim Rules: The maximum amount that can be claimed as LTA is limited to the actual travel expenses incurred and the LTA amount provided by the employer. According to an ET report, Rule 2B of the Income-tax Rules, 1962 (Rules) states that only travel expenses (air/rail/road) for the shortest route between the origin/base location and the destination will be exempt from tax. (AI image)

5/11

How Is LTA Calculated In Salary?

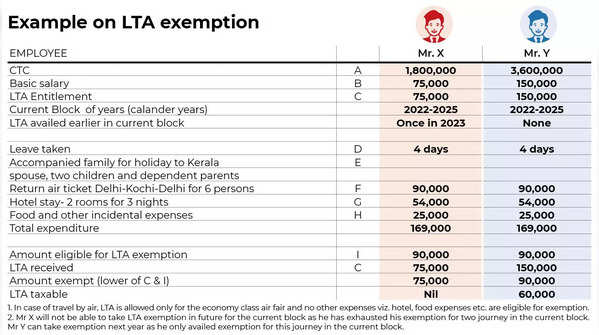

LTA Calculator: In this example provided by Tanu Gupta, Partner at Mainstay Tax Advisors LLP, it can be seen that your LTA exemption depends on factors such as the LTA entitlement and the actual expenditure incurred. Expenses for hotel accommodation and food are not covered under LTA. Mr. X with an LTA entitlement of Rs 75,000 and expenditure of Rs 90,000 is able to claim his full LTA exemption of Rs 75,000. Mr Y, with an LTA entitlement of Rs 1.5 lakh and actual expenditure of Rs 90,000, gets to claim only Rs 90,000. However, since Mr Y has only availed his LTA once in a block of 4 years, he will be able to avail the exemption next year.

6/11

LTA Claim: Documents You Need To Submit

LTA Documents: According to Rule 26C of the Rules, employees are required to furnish proof of expenses in Form 12BB to determine the tax exemption and taxable income. In practice, the following documents can be submitted to the employer to claim LTA exemption: Original bills of journey, train ticket, in case train or air facility is not available then original bills issued by a car rental company, boarding passes in case of air travel, bank/credit card/debit card/ wallet statements from which the payments were made. (AI image)

7/11

What Does LTA Not Cover?

Leave Travel Allowance only covers domestic travel and excludes international travel. Expenses such as hotel stays, meals, and airport transfers (e.g., travel from the airport to the hotel and vice versa) cannot be claimed under LTA. Additionally, travel expenses within the city are not eligible for LTC exemption. (AI image)

8/11

LTA: Things to Keep in Mind

Individuals can claim LTA exemptions for up to two journeys within a block of four calendar years. The current block period is January 1, 2022, to December 31, 2025. LTA is available for the shortest route from the place of origin to the destination. Additionally, there are specific rules regarding travel routes and ticket classes for exemption. (AI image)

9/11

LTA Claim Rules

LTA Claim Rules: Economy airfare of the national carrier for the shortest route or the amount spent, whichever is less can be claimed. If the destination is connected by rail but the journey is performed by any mode of transport other than air then AC 1st class rail fare for the shortest route or amount spent can be claimed. For other modes either the 1st class or deluxe class fare for public transport. (AI image)

10/11

LTA New Tax Regime Versus Old Tax Regime

Leave Travel Allowance Tax Exemption: LTA exemption is not available under the new concessional income tax regime. To claim LTA exemption, employees need to opt for the old income tax regime. It’s important to remember that the new income tax regime is currently the default tax regime in effect. (AI image)

FOLLOW US ON SOCIAL MEDIA