MUMBAI:

Investors

on Dalal Street will have the option to select from at least 16

IPOs

to invest in the coming week, making it one of the busiest weeks for

primary offers

in recent years. Together, these 16 IPOs are aiming to raise nearly Rs 9,000 crore from the market, data on Chittorgarh, a web portal on public offers, showed.

Of the 16 IPOs, three are already open and will close next week.

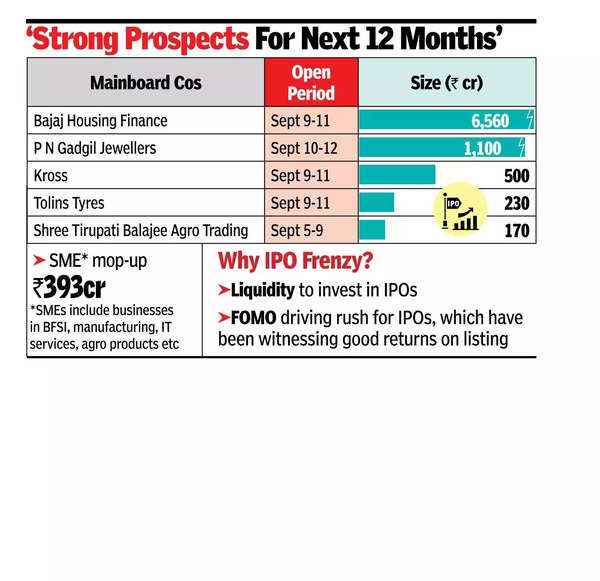

Twelve will open and close during the week. Another IPO will open on Friday and close the following week. Of the total, five are mainboard IPOs while eleven are SME offers.

The biggest among these 16 public offers, in terms of the amount of money to be raised, is by

Bajaj Housing Finance

. The IPO is set to open on Sept 9 and close on Sept 11, and aims to raise Rs 6,560 crore, a release from the company said. This will be followed by the Rs 1,100-crore IPO by

P N Gadgil Jewellers

that will open on Sept 10 and close on Sept 12. Both companies are headquartered in Pune.

16 D-Street IPOs eye Rs 9,000cr this week

According to a note from

Pantomath Capital Advisors

, a mid-market investment bank, the domestic primary market has demonstrated robust momentum this week and the outlook remains strong for the next 12 months. “The persistent zest for IPOs and healthy subscription numbers highlight the increasing investor confidence” in Indian IPOs. According to an analysis by Pantomath, in Aug, 10 companies raised about Rs 17,047 crore, “making it the busiest period for public offerings since May 2022”.

Merchant bankers believe that a few factors are driving the current IPO frenzy. Investors’ substantial liquidity to invest in IPOs is one. Additionally, regulatory and other changes to the IPO market have made it tough for bad companies run by unscrupulous promoters to tap investors for funds. Another reason is the FOMO (the fear of missing out) factor that’s driving this rush for IPOs, which have been witnessing good returns on listing.

A recent Sebi report showed that banks and retail investors were most likely to invest and quickly book profits in those stocks which listed at a gain. Mutual funds, on the other hand, remained investors for the long term.