High

food inflation

has been a challenge for policymakers. Food has a high share of 45.9% in the consumer price index and supply shocks influence the overall

retail inflation

numbers. The focus in recent months has been on the surge in tomato, onion and potato (TOP) prices. TOP accounts for 4.8% in the retail food and beverages group and 2.2% in the overall CPI but fluctuation in their prices influences overall retail inflation.

A recent RBI working paper has tried to examine the price dynamics in these commodities and offers some solutions to tame the high volatility.

Why are tomato, onion and potato prices high?

Short seasonal crop cycles, storage problems due to their perishable nature, regional concentration of production and

supply chain issues

and extreme weather have a bearing on the price situation. Rising demand and growing preference for these vegetables in specific areas have added to the price surge. Extreme weather conditions such as heat waves and floods add to the supply chain issues.

A patchy supply chain for these vegetables is also a crucial factor in how prices fluctuate. For example, studies have shown that during lean season, consumers are confronted with high prices and short supply and during a bumper season, farmers are forced to dump their produce, resort to distress sales as prices fall below the production costs. Fluctuating demand-supply scenarios also have a bearing on prices.

How has production of these crops risen?

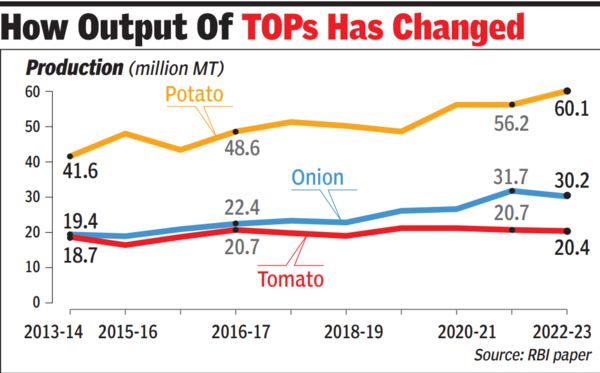

Production has grown rapidly and in 2022-23, tomato, onion and potato production was estimated at 20.4 million metric tonnes (MMT), 30.2 MMT and 60.1 MMT, according to the paper. India now is the second largest producer of tomato and potato in the world. It has also overtaken China as the largest producer of onion in the world and in 2022 contributed 28.6% of global production, the paper said, citing FAO data.

Possible policy interventions to tame price volatility in TOPs…

The RBI paper has suggested several measures such as agriculture marketing reforms, storage solutions, processing and raising productivity of tomato, onion and potato.

Under marketing reforms, the paper has suggested increasing private mandis to increase transparency for these perishable commodities and these entities will provide a wider choice to farmers to sell their crops. Competition is also expected to improve the state of Agricultural Produce Market Committee (APMC).

It has suggested re-launching potato futures, which were traded in the country’s commodity exchange but were banned in 2014. Authorities should also consider launching future trading in onions for better price discovery and managing risks. Storage should be expanded across the country as cold storages for potato are largely in UP while those for onions are mostly in Maharashtra.