MUMBAI: Scores of

Flipkart sellers

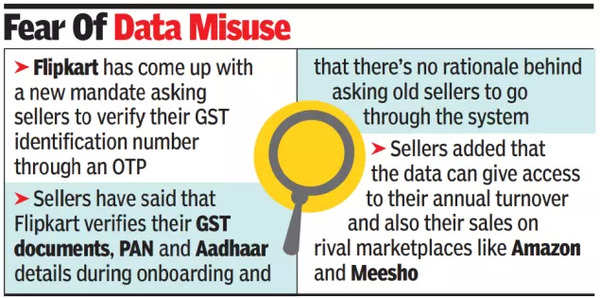

are in a muddle over a new mandate asking them to verify their goods and services tax identification number (GSTIN) through an OTP (one time password) verification process.

Sellers said that the Walmart-controlled company has not given them any reason for initiating the process and that under the garb of verifying their GST credentials, Flipkart may be trying to get access to their

confidential GST data

, they alleged.

“Once we share the OTP, Flipkart can get API (application programming interface) access to our data. The company can then have access to all previous data since GSTIN registration,” a seller, who has been on the marketplace since nine years, said.

Five sellers TOI spoke with said that the data can give access to their annual turnover and also the amount of sales they make on rival marketplaces like Amazon and Meesho. “To prevent potential location blocking, please verify your GSTINs through the OTP verification process,” screenshots of the Flipkart portal shared by sellers said.

In a statement, Flipkart said that the OTP entered by sellers on the platform is a one-time process to validate that the GST registration number belongs to a particular seller who is doing business through Flipkart and to prevent any misuse of a seller’s GST number by any unauthorised person. “This does not give us access to data submitted by them in their GST returns,” a company spokesperson said.

Sellers said that Flipkart already verifies their GST documents, PAN and Aadhaar details during the onboarding process. Seeking OTP verification from new sellers is still understandable, but there is no rationale behind directing old sellers to go through the system. “Some sellers have given OTP access to Flipkart as they don’t want their festive season sales to get impacted. This looks like an attempted data theft,” said another seller, adding that none of the other marketplaces including Flipkart Group’s Myntra follow such a process.

“If Flipkart is saying that the OTP verification is a one-time process, then maybe they will do that just to verify the registration but submission of OTP by a seller does give the company access to data that sellers have filed on the GST portal. The apprehension of sellers is not entirely misplaced,” said a tax expert.