This is a representational image (Pic credit: Reuters)

MUMBAI: Government is divesting up to 2.5% in Hindustan Zinc through the offer for sale (OFS) route at a floor price of Rs 505 per share to mobilise about Rs 5,330 crore. The OFS will open on Nov 6 for institutional investors and HNIs while for the retail ones, it’ll open the next day. For all investors the offer will close on Nov 7, government disclosed to the exchanges.

The floor price for the OFS at Rs 505 is about 10% discount to its Tuesday close at Rs 560. The base offer is for nearly 5.3 crore Hindustan Zinc shares, translating to 1.25% of the company’s equity capital. government also has the right to offer an additional 5.3 crore shares in case of oversubscription, the offer document said. 10% of the offer is reserved for retail investors while another 25% is reserved for mutual funds and insurance companies.

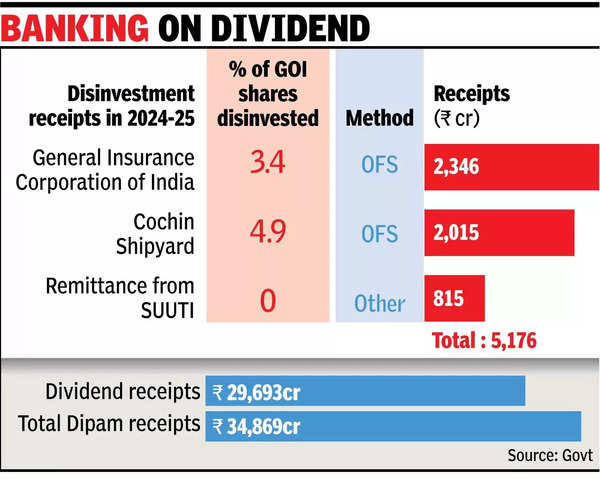

Currently government holds nearly 30% in the company that produces zinc and silver. Billionaire investor Anil Agarwal’s Vedanta holds 63.4% in the company and is listed as the promoter. The balance 6.6% is held by the general public that includes a 2.8% stake held by LIC. The current stake sale by government is part of its divestment programme with the current fiscal’s target to mobilise through this channel set at Rs 50,000 crore, Budget documents showed.