Gold vs Nifty

returns: Gold has surpassed the performance of the

Nifty

index in the initial six months of 2024, generating returns of 13.37% in comparison to the 10.5% yield of the 50-stock index. The MCX gold contract has increased by approximately Rs 8,400 per 10 grams when measured in rupee terms, while the Sensex has risen by 2,279 points as of June 30, 2024.

The July gold futures reached an all-time high of Rs 74,777 and are currently trading near Rs 71,800, according to an ET report.

The gains in gold prices have been attributed to various factors, including tensions in the Middle East, increased demand from China, and expectations of interest rate cuts by the US Federal Reserve.

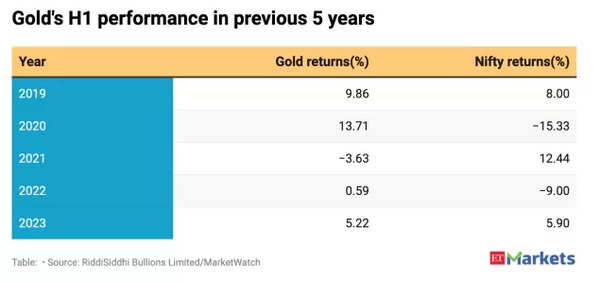

A comparison of the performance of gold and the Nifty index during the first half of the year over the past five years (2019-2023) shows that gold has had positive returns on four occasions, with the highest returns of 13.71% in 2020 and the lowest of 0.59% in 2022. However, in 2021, gold experienced negative returns of 3.63%.

The Nifty index, on the other hand, has delivered positive returns in three out of the five years, specifically in the first half of 2019, 2021, and 2023. In 2022, the Nifty saw its highest returns of over 12% within the 5-year period. However, in 2020, the Nifty experienced a 15% decline due to the Covid-19 lockdowns in March, and in the first half of 2022, it lost 9%.

Gold H1 Performance In Last 5 Years

Aamar Deo Singh, Senior Vice President-Equity, Commodity & Currency at Angel One, told ET that the first half of the year was an exciting and volatile period for the Nifty, yet rewarding for patient and disciplined investors who seized opportunities.

The market was influenced by various factors, including the Lok Sabha election results falling short of expectations, mixed global cues, positive domestic macroeconomic indicators, escalating tensions in the Middle East, and diminishing hopes of multiple rate cuts by the US Federal Bank in 2024.

“Major heavyweights such as Reliance Industrie (RIL), Axis Bank, ICICI Bank, Bharti Airtel, M&M, Maruti Suzuki & SBI, added to the rally while at the same time, across sectors, the momentum was witnessed. The participation by domestic market participants including the mutual funds and the retail, has been nothing short of spectacular, with their positive impact being largely felt despite the gyrations of the FPIs, with the Indian stock market adding almost $1 trillion in market cap over the past 6 months,” Deo said.

Also Read | RBI’s overseas gold reserves drop to 6-year low! Share of gold held at home goes up to 53%

Ajit Mishra, Senior Vice President-Research at Religare Broking, described the Nifty’s performance as exceptionally strong and surpassing expectations. He believes that the stage is set for a positive trajectory in the second half of the year. Mishra attributed this growth to the overall economic resilience and investor confidence in the Indian markets, driven by favorable economic indicators, robust corporate earnings expectations, and supportive global market conditions.

Prithviraj Kothari, Managing Director of RiddiSiddhi Bullions Limited (RSBL) and IBJA National Chief, commented on the recent performance of gold, stating that the precious metal is currently consolidating around Rs 71,000-72,000 after a significant rally of 18% between February and April, during which it gained Rs 12,000 per 10 grams and reached record highs.

Kothari believes that the current price stability of gold can be attributed to a lack of sufficient triggers, indicating that all positive factors have already been accounted for. He also points out that some negative triggers have emerged, such as the Federal Reserve’s stance shifting from dovish to hawkish. The anticipated interest rate cuts have been postponed from March to June and now to September, with their implementation dependent on the inflation situation.

Also Read | Why did RBI bring 100 tonnes of gold reserves back to India? RBI governor Shaktikanta Das explains

The Federal Reserve’s stance on interest rates has shifted dramatically since the beginning of the year. Instead of the anticipated six rate cuts, experts are now looking at a single 25 bps rate cut, with some members of the FOMC even suggesting the possibility of another rate hike if inflation persists or stagnates for an extended period. Furthermore, the Dollar Index (DXY), which moves inversely to gold prices, is hovering above 105 against a basket of six major currencies.

Kothari predicts that gold will reach Rs 70,000 in the next 1-2 months due to weak fundamentals and technical factors. However, he maintains a positive medium to long-term outlook, with the precious metal potentially reaching new record highs in the last quarter of 2024.

“The strategy is to buy on the dips around Rs 70,000 for the target of Rs 75,000 and Rs 77,000 by the end of the year.”, RiddiSiddhi Bullions analyst said.