MUMBAI: Loans against gold jewellery by banks have grown by 50.4% in the first seven months of the current financial year. The sharp increase comes even as credit in every other personal loan segment grew in single digits.

Data on sectoral deployment of

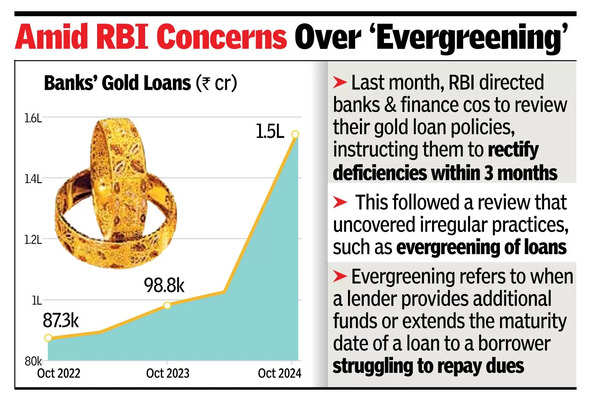

bank credit

released by RBI on Friday showed

gold loans

outstanding as of Oct 18, 2024, at Rs 1,54,282 crore. At the end of March 2024, total gold loans outstanding stood at Rs 1,02,562 crore. The year-on-year growth was 56%, compared to 13% in October 2023.

Bankers said the spike in gold loans in the first seven months could be attributed to several factors, including a shift from NBFCs and a preference for secured loans over unsecured ones. Bank loans to NBFCs have shrunk by 0.7% to Rs 1.5 lakh crore during the first seven months of the year.

Bankers also noted that the rise in gold loans could be due to the increase in its prices, which provides borrowers an opportunity to repay old loans and secure higher new loans. Some analysts view the growing demand for gold loans as a sign of financial distress.

Last month, RBI directed banks and finance companies to review their gold loan policies and procedures, instructing them to rectify any deficiencies within three months. This followed a review that uncovered irregular practices, such as hiding bad loans through evergreening.

In the personal loan segment, the year-to-date growth in home loans was 5.6%. The home loan books of banks rose to Rs 28.7 lakh crore. Year-on-year growth in home loans was 12.1%, compared to 36.6% in October 2023.

The next highest growth was in credit card outstanding, which rose by 9.2% in seven months to Rs 2.81 lakh crore. The increase in outstanding credit was in line with the rise in online transactions during the period. However, growth in other personal loans, including unsecured loans, was sluggish at 3.3%.

Overall, bank credit grew by 4.9% to Rs 172.4 lakh crore, with credit to industry increasing by 3.3%