MUMBAI:

Gen Z

and

millennials

are driving high growth in

digital loans

. The Gen Z cohort comprises youngsters in the 18-25 age group, many of whom entered adulthood during the pandemic. Millennials fall between the age group 26-38.

According to a report by

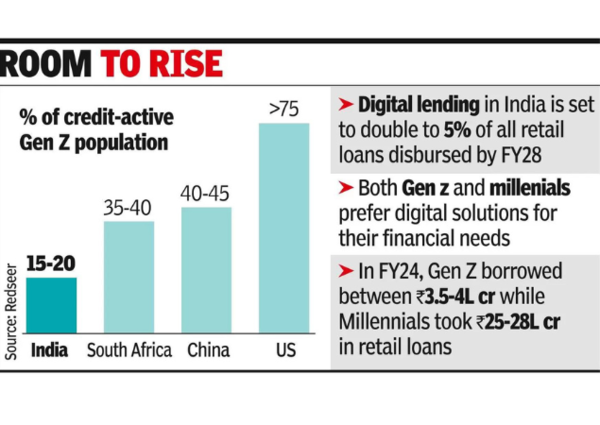

Redseer Strategy Consultants

, digital lending in India is on the rise and set to constitute 5% of all retail loans disbursed by FY28.

It has grown from 1.8% of total retail loans disbursed in FY22 to approximately 2.5% in FY24. The doubling of share from 2.5% to 5% by FY28 would follow a compounded annual growth rate of 40% in digital loans.

Digital loans refer to

financial credit

that is applied for, processed, approved, and disbursed entirely through

online platforms

or mobile apps without the need for physical paperwork or in-person interactions. In FY24 alone, Gen Z borrowed between Rs 3.5-4 lakh crore while millennials took Rs 25-28 lakh crore of the total Rs 62 lakh crore disbursed in retail loans. Both groups prefer digital solutions for their financial needs due to the convenience and speed of new-age platforms.

Room to rise

The two groups, however, exhibit distinct borrowing habits. For Gen Z, personal loans constitute about 40% of their borrowing, often used for experiential expenses like travel and tech upgrades. In contrast, personal loans make up only 21% of millennials’ borrowing, indicating a lesser reliance on this category.

“Gen Z and millennials are at the forefront of the transformative change across various sectors, including the retail lending market. In India, retail credit presents substantial growth potential, driven by these younger generations. They are not just consumers of financial services, they are actively shaping and redefining the market’s direction,” Jasbir S Juneja, partner at Redseer Strategy Consultants, said.

According to the report, the difference in manner of spending reflects the distinct life stages and financial needs of the two age cohorts.

In India, the proportion of credit-active Gen Z individuals currently stands at 15-20%, indicating significant growth potential.