MUMBAI/NEW DELHI: The FMCG industry does not see a full revival in urban demand to set in until at least mid-next year. This is even when companies are betting on premiumisation to derive growth from the bigger cities, where consumers are seeking high-quality products and convenience to partly make up for the sluggishness that has weighed on overall consumption.

Premiumisation will help improve value growth in 2025, Mohit Malhotra, CEO at Dabur India, told TOI. “Premiumisation has helped in many categories as consumers seek to upgrade their lifestyles and prioritise new experiences. This will continue while a few categories may possibly see some trading down due to inflation,” Tarun Arora, CEO at Zydus Wellness, which makes products like Complan and Glucon-D, said. In 2025, growth will be led by premium and value-up and experiential offerings, according to industry executives.

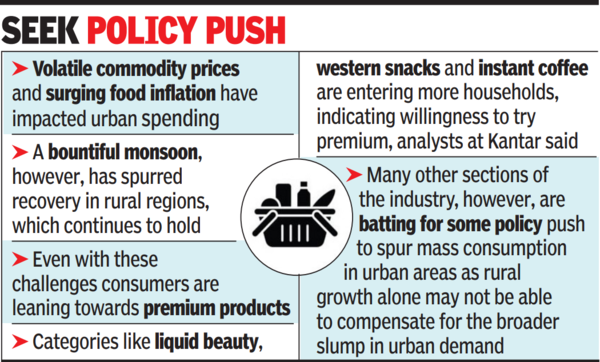

Categories like liquid beauty (including body wash, face wash), western snacks and instant coffee are entering more households, indicating shoppers’ willingness to try premium categories, analysts at marketing data and analytics firm Kantar said. The fast moving consumer goods sector recorded a growth of 4.3% as of Oct 2024, lower than the 6.4% growth it saw in the year-ago quarter and 4.5% seen in the previous (July) quarter, recent data by Kantar showed.

High inflation has shrunk household budgets of the urban middle class, eroding their ability to spend. A bountiful monsoon, however, has spurred recovery in rural regions, which continues to hold. Volatile commodity prices and surging food inflation have particularly impacted urban discretionary spending. Consumption levels in the quarter ending Sept this year dipped to their lowest point in the past two years, said Suresh Narayanan, chairman and MD at Nestle India. “While the challenges of rising debt and lower disposable incomes in urban areas persist, we expect a steady recovery starting mid-2025. Consumers are still leaning towards high-quality and health conscious products, especially in the cities. The increased demand for quick commerce is reshaping how we engage with consumers,” Mayank Shah, vice-president at Parle Products, said.

For Marico, the digital-first and premium brands within its portfolio are showing resilience and growth, MD & CEO Saugata Gupta said. He expects urban consumption to revive in a couple of quarters. For Nestle, in fact, e-commerce delivered high double-digit growth, which was the highest in the last seven quarters contributing to 8.3% of domestic sales in Q2 of 2024-25.

Some sections of the industry are, however, batting for some policy push to spur mass consumption in urban areas as rural growth alone may not be able to compensate for the broader slump in urban demand, the revival of which is still at least a good six months away. The ability of rural to fully offset the urban slowdown will hinge on overall inflation and in particular food inflation, settling down along with broader economic conditions being more conducive. “Without relief from inflation or some demand impetus from govt, achieving significant improvement in mass consumption might be an uphill task,” Arora said. The upcoming budget should consider “proactive measures” to stimulate consumption in the larger economy, said Aasif Malbari, CFO at Godrej Consumer Products.