MUMBAI/CHENNAI: After a brief period of lull,

investors

seem to have actively started scouting for deals and cutting cheques for Indian startups.

Of late, both global and domestic

venture capital

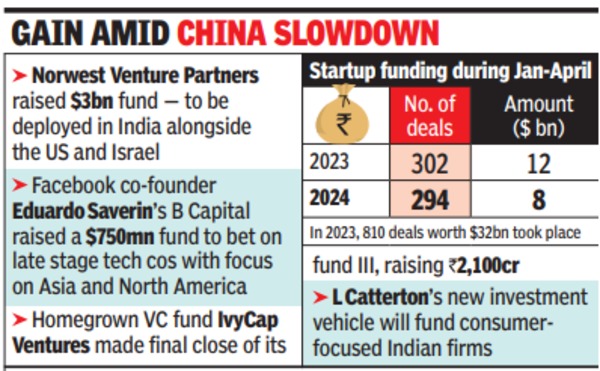

(VC) and private equity (PE) investors including the likes of US-based Norwest Venture Partners have raised new funds. A sizeable amount of this capital is earmarked for India and there is pressure on investors to deploy.

LVMH-backed

PE fund

L Catterton, for instance, is launching a new

investment

vehicle which will fund consumer-focused Indian firms.

In fact, an estimated $25 billion of India-focused capital is sitting unallocated, according to industry executives. Moreover, with China facing a slowdown, India has become more palatable for investors within the broader Asia market.

“The China slowdown has benefited India and it will continue to do so for some more time,” Vikram Gupta, founder and managing partner at homegrown VC fund IvyCap Ventures, which has backed startups like Purplle and Dhruva Space, told TOI. On Tuesday, the company made the final close of its fund III, raising Rs 2,100 crore.

About Rs 1,250 crore from the Rs 2,100 crore fund will be used to make 25 new series A investments and a portion of the fund’s corpus will also go towards follow-on investments in existing companies. IvyCap Ventures is looking to bet on consumer focused firms deploying AI, machine learning and other new emerging technologies to build products. “Series A is our sweet spot. Besidesconsumer tech, we are also closing two health tech deals as we speak. We also see opportunities in fintech, space tech, climate and clean tech spaces,” Gupta said, adding that deals including late stage ones will pick up in the second half of the year.

PE-VC

funding

sure still lags — data sourced from market research firm Venture Intelligence showed that investments in the January-April period stood at $8.1 billion, lower than $12.3 billion during the year-ago period. However, with enough capital, new fund launches by investors and ecosystem stability setting in, second half is expected to see significant deal momentum. Last week, Norwest Venture Partners closed a $3 billion fund, a portion of which will be used to make investments in India alongside US and Israel. The company which has been operational in India since 2005 and has backed unicorns like Swiggy and OfBusiness typically invests $250-$300 million in the country annually. Earlier this year, Facebook co-founder Eduardo Saverin’s B Capital also raised a large $750 million fund to bet on late stage

tech companies

with focus on Asia and North America. Indian startups Meesho, PharmEasy and Khatabook are among its portfolio firms.

“The general sense is that we will start seeing a sustained recovery on a YoY basis starting in the second half of 2024. In the VC segment, home grown firms like Blume Ventures, Fireside Ventures and Anicut Capital, are taking new bets in recent months,” said Arun Natarajan, founder at Venture Intelligence.

For L Catterton, there has never been a better time to deepen its India commitment given the country’s huge population and high GDP growth, said global co-CEO Michael Chu. The company’s Asia platform has formed a joint venture partnership with former Hindustan Unilever chief Sanjiv Mehta to drive its India strategy. Gurgaon-based institutional investor Oister Global has recently launched a Rs 440 crore fund, a significant part of which will fund tech startups. The company will not directly invest in a startup but instead rout its funding through investments in VC and PE funds.