TOI Business Desk

/ TIMESOFINDIA.COM / Updated: 17 Jun 2024, 09:57:09 PM

AA

Text Size

- Small

- Medium

- Large

1/9

FD Calculator: How Much Will Rs 10,000 Invested in Fixed Deposits Grow To?

Fixed Deposit Calculator: Bank fixed deposits or FDs are a popular investment avenue for conservative or risk averse investors. If you are looking to invest in a bank FD, then financial experts advise that the current high interest rate scenario may be the right time to put your money in fixed deposits before the RBI starts the rate cut cycle. But, which are the best bank FDs in the market right now? Which bank fixed deposits offer the highest rate? And, how much will you earn if you invest in an FD? We take a look at the top 5 bank FDs for 1 year, 2 years, 3 years and 5 years tenure and also tell you how much Rs 10,000 invested in a fixed deposit would grow into. The best bank FDs list and calculations in the tables are sourced from ET Intelligence Group: (AI image)

2/9

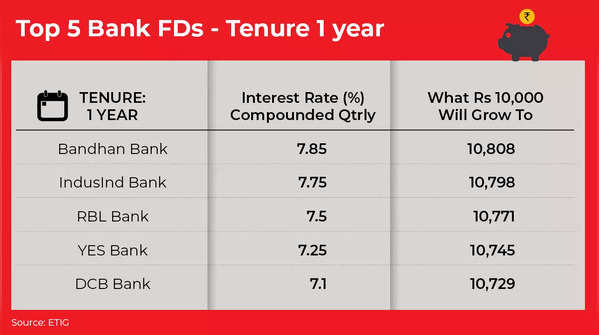

Top 5 Bank FDs With 1 Year Tenure

Top 5 Bank FDs: As per the list compiled by ETIG, Bandhan Bank offers the best fixed deposit for a 1 year tenure, with an interest rate of 7.85% compounded quarterly. A Rs 10,000 investment in the FD would grow to Rs 10,808/- Other fixed deposits in the list include FDs from IndusInd Bank, RBL Bank, YES Bank and DCB Bank.

3/9

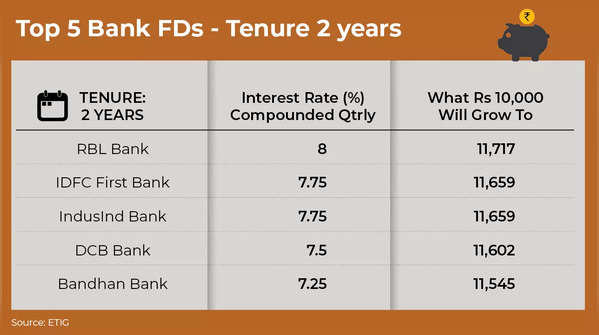

Top 5 Bank FDs With 2 Years Tenure

Top 5 Bank FDs: RBL Bank offers the best interest rate of 8% compounded quarterly for fixed deposits with a 2 year tenure. A Rs 10,000 investment would grow to Rs 11,717/- Other FDs included in the list are from IDFC First Bank, IndusInd Bank, DCB Bank and Bandhan Bank.

4/9

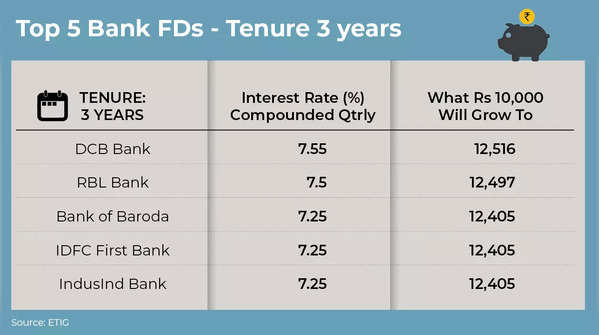

Top 5 Bank FDs With 3 Years Tenure

Top 5 Bank FDs: With a 7.55% interest rate compounded quarterly, DCB Bank tops the list of best fixed deposits with 3 years tenure. If you invest Rs 10,000 in the FD, it would grow to Rs 12,516/- Other FDs in this list include fixed deposits from RBL Bank, Bank of Baroda, IDFC First Bank, and IndusInd Bank.

5/9

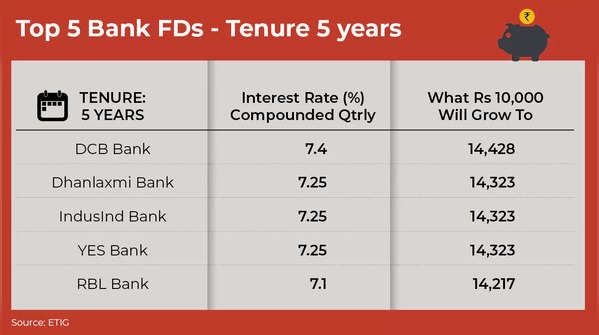

Top 5 Bank FDs With 5 Years Tenure

Top 5 Bank FDs: DCB Bank bags the top rank in fixed deposits with 5 year tenure with an interest rate of 7.40% compounded quarterly. Rs 10,000 invested in the DCB Bank FD would grow to Rs 14,428/- Other banks in this list include Dhanlaxmi Bank, IndusInd Bank, YES Bank and RBL Bank.

6/9

Right Time To Invest in FDs?

Fixed Deposit Investment: According to Adhil Shetty, CEO, Bankbazaar.com, interest rates on FDs are expected to rise, with banks offering competitive rates to attract more depositors. He is of the view that this is the best time to monitor rates as banks may offer higher interest rates on FDs to attract more deposits, as they try to balance their own lending and deposit rates. This makes it a favourable time for depositors to lock in higher returns on their deposits, Shetty told TOI. (AI image)

7/9

Do 5-Year FDs Make More Sense?

Fixed Deposit Investment: According to Nirav Karkera, Head of Research at Fisdom, investors can take advantage of the current high interest rates by investing in long-term fixed deposits for periods of five years or more. “This allows investors to benefit from these rates even if they decline later,” he told ET. (AI image)

8/9

Fixed Deposit Laddering

Fixed Deposit Laddering: Nirav Karkera also suggests a strategy called laddering, which involves splitting the investment into several fixed deposits with varying maturity periods, such as one, two, and three years. This approach ensures that a portion of the investment matures at regular intervals, providing both liquidity and the chance to reinvest at the prevailing rates. (AI image)

9/9

FDs: Minimize Risks

FD investment strategy: This method helps to minimize reinvestment risk while maintaining a balance between liquidity and returns. Karkera further advises, “Additionally, investing in short-term fixed deposits (one year or less) offers the flexibility to reassess the market situation and reinvest at potentially higher rates of different instruments as the interest rate trend becomes clearer.” (AI image)

FOLLOW US ON SOCIAL MEDIA