NEW DELHI: The exodus of

Foreign Portfolio Investors

(FPIs) from the

Indian equity markets

continues unabated, as they have withdrawn Rs 64,156 crore ($7.44 billion) so far this month, driven by the depreciation of the rupee, a rise in

US bond yields

, and expectations of a tepid earnings season.

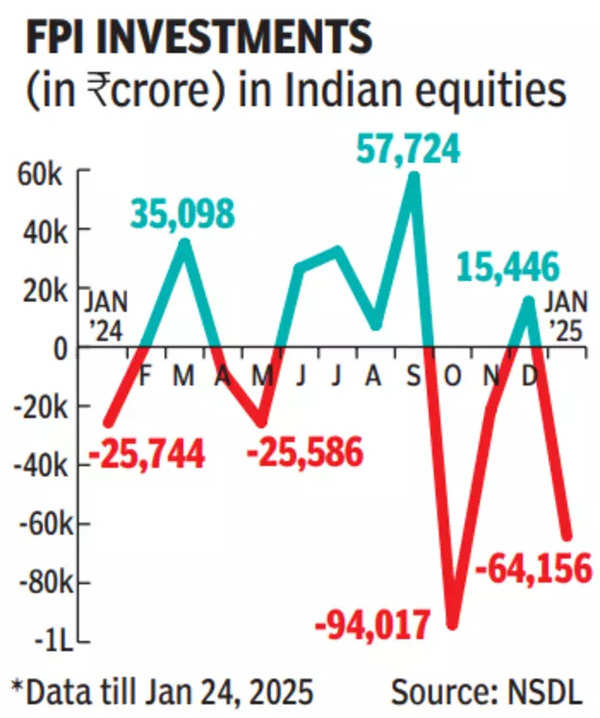

This comes after an investment of Rs 15,446 crore in Dec, according to data from depositories. The shift in sentiment reflects a mix of global and domestic headwinds. “The continued depreciation of the Indian rupee is exerting significant pressure on foreign investors, leading them to pull money out of the Indian equity markets,” said Himanshu Srivastava, Associate Director – manager research, Morningstar Investment Advisers India.

Additionally, the high valuation of Indian equities -despite recent corrections, the expectation of a subdued earnings season, and macroeconomic challenges-are making investors cautious, he added. Moreover, the unpredictable nature of Trump’s policies has prompted investors to tread cautiously, steering clear of riskier investment avenues, he noted.

According to the data, FPIs sold shares worth Rs 64,156 crore in Indian equities this month (up to Jan 24). Notably, FPIs have been net sellers on all days this month except Jan 2. “The sustained strengthening of the dollar and the rise in US bond yields have been the principal factors driving FPI selling. As long as the dollar index remains above 108 and the 10-year US bond yield stays above 4.5%, the selling is likely to continue,” said V.K. Vijayakumar, chief investment strategist, Geojit Financial Services.