“>

It remains important to consider the potential impact of a US market downturn, considering past patterns. (AI image)

Economic Survey 2024-2025

: Is the Indian stock market headed for a meaningful correction in 2025? The Economic Survey 2025 tabled in Parliament ahead of

Budget 2025

has pointed to risks for the Indian stock market in 2025, especially in light of possible corrections in the US stock market.

The Economic Survey has flagged risks saying, “Elevated valuations and optimistic market sentiments in the US raise the likelihood of a meaningful market correction in 2025. Should such a correction occur, it could have a cascading effect on India, especially given the increased participation of young, relatively new retail investors.”

“Many of these investors that have entered the market post-pandemic have never witnessed a significant and prolonged market correction. Hence, if one were to occur, its impact on sentiment and spending may be non-trivial,” the Economic Survey says.

Poll

Do You Think the Indian Stock Market Will Face a Meaningful Correction in 2025?

US markets at a record high

Looking ahead to 2025, the US stock market displays notable characteristics: elevated stock valuations, peak corporate earnings and widespread investor optimism. Given that the United States represents 75 per cent of the MSCI World Index (as of November 2024), any downward movement in its markets could significantly impact global markets, including India, necessitating careful monitoring, the Economic Survey warns.

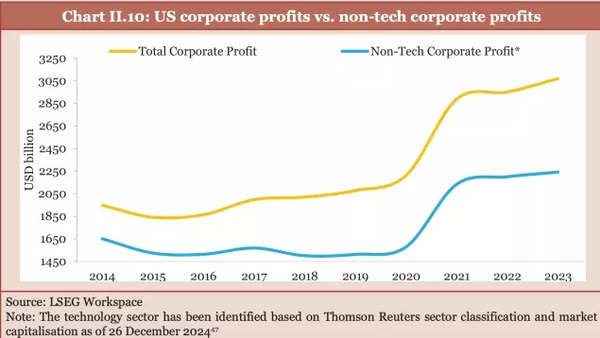

According to the Economic Survey, concerns are rising regarding the durability of US corporate profits, especially considering their concentration amongst select major technology companies and their reliance on robust government expenditure, which increased by 10 per cent year-on-year to USD 6.75 trillion45 between October 2023 and September 2024.

US Corporate Profits vs non-tech corporate profits

Additionally, investors’ appetite for structured and sophisticated financial instruments, deriving returns from alternative assets like data centres, music catalogues and solar panel revenues, has reached its highest point since the Global Financial Crisis (GFC).

Indian Stock Markets: The Growth in Numbers

Since the pandemic’s beginning, Indian equity markets have maintained consistent performance, influenced by various domestic factors beyond global trends. A significant development has been the substantial increase in retail involvement during the past five years, which includes both investor numbers and market activities.

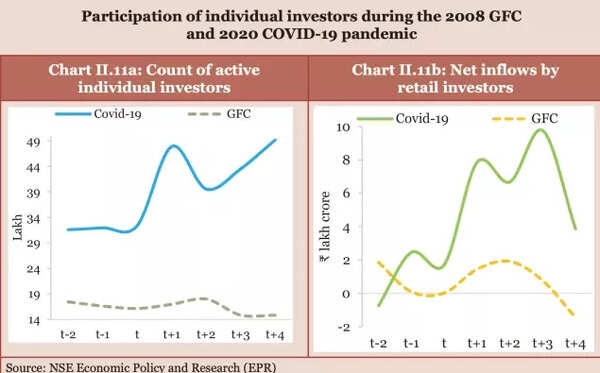

Participation of individual investors during the 2008 GFC and 2020 COVID-19 pandemic

- At the National Stock Exchange (NSE), unique investors exceeded 10 crore in August 2024, showing a threefold increase over four years, reaching 10.9 crore by December 26, 2024. Client codes at NSE, representing investor accounts, expanded from approximately six crore in late 2019 to nearly 21 crore by December 2024.

- Trading activity statistics show that monthly active traders in NSE’s cash segment grew from about 32 lakh in January 2020 to approximately 1.4 crore by November 2024. Individual investment patterns demonstrate increased market engagement.

- Following an 11-year period of minimal activity, individual investors became net purchasers in 2020, with growing involvement thereafter.

- During 2020-24, individuals invested ₹4.4 lakh crore net in NSE’s cash segment, with 2024 (January-November 2024) recording peak net inflows of ₹1.5 lakh crore.

- Combined with substantial mutual fund participation, this compensated for fluctuating FPI outflows. Individual investors’ direct and mutual fund-based ownership reached 17.6 per cent (September 2024) in NSE-listed firms, matching FPI levels, compared to a 7.1 percentage point difference in FY21.

- The increased individual participation, alongside strong equity performance surpassing other investments, has generated substantial household wealth recently. NSE calculations indicate household wealth in Indian equities increased by over ₹40 lakh crore during 2020-2024 (as of September 2024).

India de-linked to US markets? What history tells us

- The increasing retail investor participation corresponds with a noticeable reduction in the 5-year rolling beta between the Nifty 50 and the S&P 500 over the past four years, indicating that Indian markets are becoming less influenced by US market fluctuations.

- This independence is apparent in how Indian markets now handle FPI outflows more effectively. A notable example occurred in October 2024, when despite FPI withdrawals of USD 11 billion, the Nifty 50 index dropped by only 6.2 per cent, sustained by robust support from domestic institutional and retail investors.

- This contrasts significantly with March 2020, when FPI outflows of USD 8 billion led to a sharp 23 per cent market decline during the pandemic.

However, whilst the Indian market’s stability, bolstered by increased retail participation, shows promise, it remains important to consider the potential impact of a US market downturn, considering past patterns.

- Analysis shows that Indian equity markets have historically been responsive to US market movements. The Nifty 50’s correlation with the S&P 500 is significant, with data from 2000 to 2024 showing that during 22 occasions of the S&P 500 declining over 10 percent, the Nifty 50 decreased in all but one instance, with an average decline of 10.7 per cent. Conversely, in 51 instances of Nifty 50 corrections exceeding 10 per cent, the S&P 500 showed positive returns 13 times, averaging a -5.5 percent return.

- This demonstrates an unbalanced relationship between these markets, with US market movements having a stronger influence on Indian equities than vice versa.

- Additional analysis indicates that S&P 500 returns Granger-cause Nifty 50 returns, suggesting US market changes precede Indian market movements, particularly during market disruptions, whilst the opposite isn’t true. This confirms Indian markets’ susceptibility to US market trends, warranting vigilance during potential US market downturns.