MUMBAI: Even as analysts are forecasting the

monetary policy committee

meeting this week to vote for another pause with a

rate cut

pushed to December,

banks

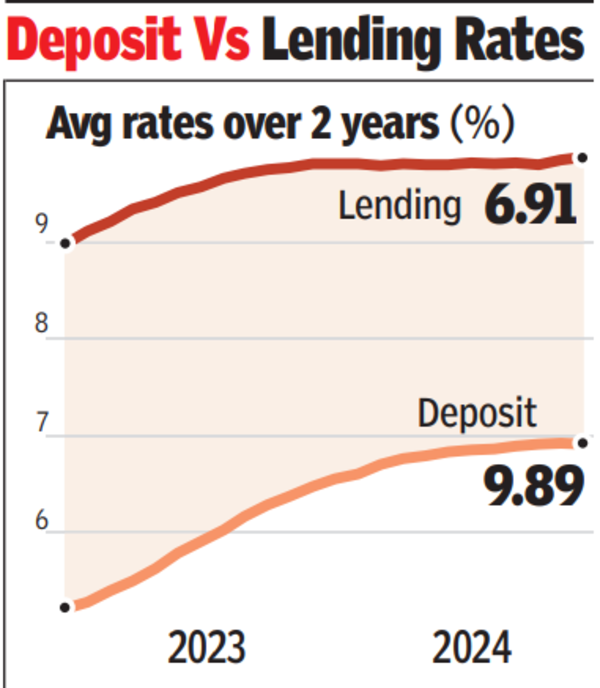

have been selectively raising deposits and lending rates.

According to

SBI

chairman Dinesh Khara, markets can no longer look up to the

US Federal Reserve

for the direction of

interest rates

. “There is a lot of decoupling that is happening.

It is not that US Fed reduces rates and everybody else starts falling. We have seen the Bank of England reduce first followed by Australia. Japan has increased. All the central banks are not in sync,” Khara said.

According to Bank of India chairman Rajneesh Karnatak, the fight for resources is like to continue for a few quarters. “We are passing on the increase in cost of deposits to borrower in the form of higher MCLR rates and we may increase the spread over the repo rate as well,” he said.

What is skewing the interest rate market is that while depositors are punishing banks for not offering enough on savings accounts, large corporates are still deciding their borrowing rates.

“Corporate still holding the pricing power – the weighted average lending rate on fresh rupee loan decreased by 11 basis points (100bps = 1 percentage point) from Jan to June 2024 even though the weighted average domestic term deposit rate increased by 3bps.. A classic case of asymmetric transmission,” said an SBI research report. This means small businesses are bearing the brunt of the rate hikes.

According to Bank of Baroda chief economist Madan Sabnavis, the earliest rate cut can happen in Dec 2024. “RBI’s MPC is likely to hold repo rate steady. The stance of the monetary policy is also expected to be retained at withdrawal of accommodation. Incidentally, the stance of the monetary policy was last changed in June. This is because RBI is unlikely to be comfortable with the elevated levels of food inflation in the recent months,” said Sabnavis.

According to Barclays regional economist Shreya Sodhani, the rate cut is likely to get pushed to 2025. “We continue to expect the window for a rate cut to open only in Dec 2024, but see the risks that the first cut will be delayed into 2025. Recent communication by RBI has turned increasingly cautious over elevated food inflation, which continues to prevent durable disinflation in the headline rate,” said Sodhani.