Co-written with Gaurav Mehndiratta

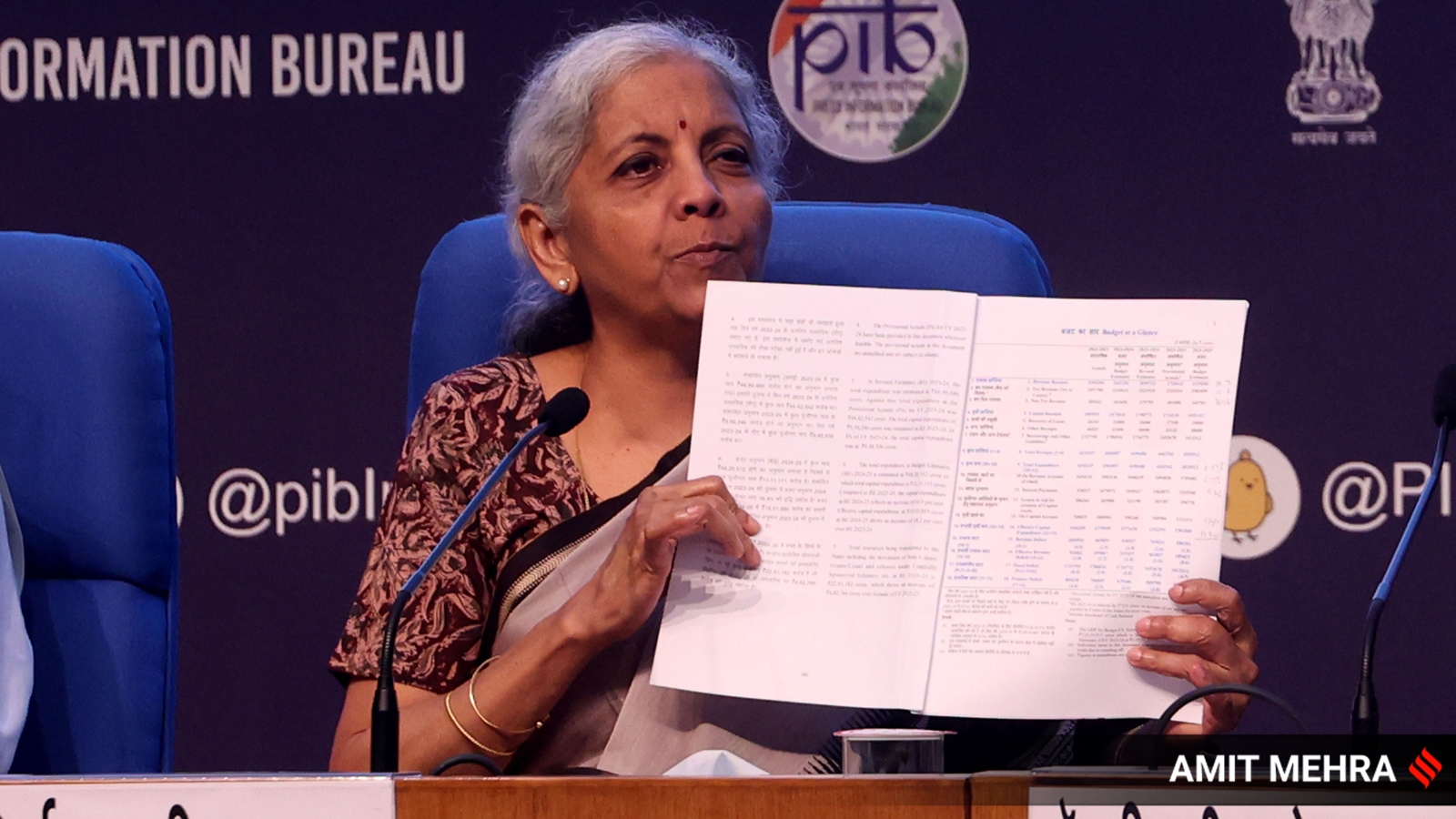

At a time when countries are tackling disruptive forces ranging from inflation to climate change, India appears to be standing out as a bastion of stability and growth with the Economic Survey pegging GDP growth to remain between 6.5 per cent to 7 per cent. In this backdrop, the longest-serving Finance Minister of India presented her seventh consecutive Budget to the Indian Parliament setting a new benchmark in Indian politics and finance.

Fostering stability

With India’s tax-to-GDP ratio expected to hit a record high of almost 12 per cent of GDP in 2024-25, the need of the hour was to keep the economy on a steady course. At the same time, certain areas of the Indian economy needed to be propped up, such as the Indian startup ecosystem that has been reeling with a prolonged funding winter. With large investors sitting on dry powder, the timing of the Finance Minister’s announcement to abolish the angel tax was spot on. Similarly, another vexed issue of the 2 per cent non-creditable equalisation levy applicable on foreign companies doing business digitally in India has been consigned to the history books — a move that marks India’s first step towards adopting global minimum tax reforms. By reducing the corporate tax rate from 40 per cent to 35 per cent for foreign companies operating in India through branches or project offices, the FM has demonstrated a semblance of symmetry in tax reforms.

The Economic Survey has estimated that 78.5 lakh jobs need to be created in the non-farm sector by 2030. While data from May 2024 published by the Employees’ Provident Fund Organisation (EPFO) shows that formal job creation has reached a 10-month high, “employment and skilling” continue to be a priority item for this government. Towards this end, the announcement of employment linked incentives in the form of EPFO-linked schemes that would use the India Stack would encourage job creation even as the risk of artificial intelligence displacing certain jobs remains a concern.

Enabling simplicity

After the successful clean-up of Rs 99,765 crores of disputed taxes in the first tax dispute settlement scheme, the FM’s announcement of Vivad Se Vishwas Scheme 2024 comes at a time when as many as 5.44 lakh income-tax appeals are pending at the level of Commissioner (Appeals) and more than 63,000 appeals at various Income Tax Appellate Tribunals, High Courts and the Supreme Court. More importantly, it seems that the government has recognised that the root cause of tax disputes may lie in the statute itself, which is why a comprehensive review of the Income Tax Act, 1961 within six months is a promising step towards reducing litigation.

Significant strides have also been made towards curtailing GST litigations, with an amnesty scheme being announced for waiver of interest and penalty. This amnesty is available for all matters where full tax has been discharged by the taxpayer, in cases of demand notices issued for non-fraud related matters in the first three years of GST, that is, till FY 2020. This is a welcome measure and will help in clearing pendency to an extent. In fact, monetary limits for filing appeals related to erstwhile laws, that is service tax and excise, would also be increased — this will also help in cutting down long-drawn disputes. Separately, related to litigation management, a common look-back period of three-and-a-half years has now been put in place in GST for all matters, including those involving fraud/suppression-related allegations and demands. Thus, effectively “extended period of limitation” as a concept has been done away with, bringing some respite. The announcement to review the customs duty rate structure would also help reduce disputes and ease trade.

Although simplification of taxes has been a perennial demand of investors, the reaction towards capital gains tax proposals has been mixed. While on one hand, the government has brought simplicity by prescribing a uniform long-term capital gains tax rate of 12.5 per cent on almost all asset classes, barring unlisted debentures, the removal of indexation has invited criticism from certain quarters for being akin to an inheritance tax on property transactions.

Looking ahead

While presenting the Interim Budget in February, the FM highlighted that over the past 10 years, direct tax collections have tripled, with return-filers increasing 2.4 times. The government seems to have accepted that driving tax collections and inculcating a compliance culture needs a stable and simplified tax regime. While some Budget announcements may have created an initial stir in the stock markets, this government’s larger message is one of policy certainty and commitment towards the reform agenda to make the vision of “Viksit Bharat in 2047” a reality.

Dimri is Head of Tax, KPMG in India and Mehndiratta is Partner and Head, Corporate and International Tax, KPMG in India. Views are personal