India’s

capital expenditure outlay

for FY25 could see an increase of 8-10% from the Rs 11.11 lakh crore allocated in the interim budget. This is due to better-than-expected

tax revenue

and a record surplus transfer from the

RBI

.

“Both tax and non-tax revenue are expected to be better,” a senior official told ET. “Additional surplus transfer from RBI provides enough headroom to spend more.”

The interim budget for the current election year was presented by Finance Minister

Nirmala Sitharaman

in February, with the full budget expected to be announced approximately a month after the formation of the new government, following the declaration of election results on June 4.

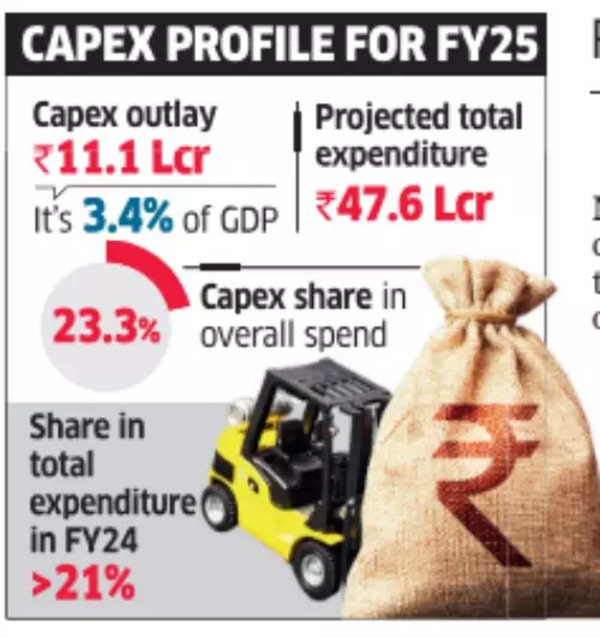

Capex profile for FY25

The Reserve Bank of India’s recent announcement of a Rs 2.1 lakh crore surplus transfer to the Centre could be partially utilized by the government to strengthen

capital expenditure

in the current year, maintaining its focus on public investment-led growth to support the gradual increase in private investment.

Also Read | FM Nirmala Sitharaman: Modi government reshaped Union Budget in 10 years; reforms to continue for Viksit Bharat

India’s capital expenditure saw significant increases of 42% in FY22 and 24% in FY23. The interim budget for FY25 reduced this growth to 11.1% from the budgeted capex in FY24, which had risen by 35.9% from the previous year, aligning with the government’s fiscal consolidation path.

The Centre aims to reduce its

fiscal deficit

from 5.8% in FY24 (RE) to 5.1% in FY25, with final figures to be released by the end of this month. “It is not possible to match large increases of past few years in capex growth but some additional support can be provided,” the official said.

Sitharaman recently cited a study by the National Institute of Public Finance and Policy (NIPFP), stating that each rupee invested in capital expenditure in India multiplies economic output by 4.8 times.

Also Read | ‘On June 4, markets will…’: PM Modi’s big prediction for Sensex on Lok Sabha election results day

Economists believe a modest increase would be appropriate, with Bank of Baroda chief economist Madan Sabnavis commenting, “A single-digit hike is fine and even fiscally viable. Capex growth of 20-25% would not make much sense, so a tapering down is both evident and required.”

He further noted that improved tax revenue and dividends from public sector enterprises might enable the government to manage any increase in subsidy bills while maintaining control over the fiscal deficit.