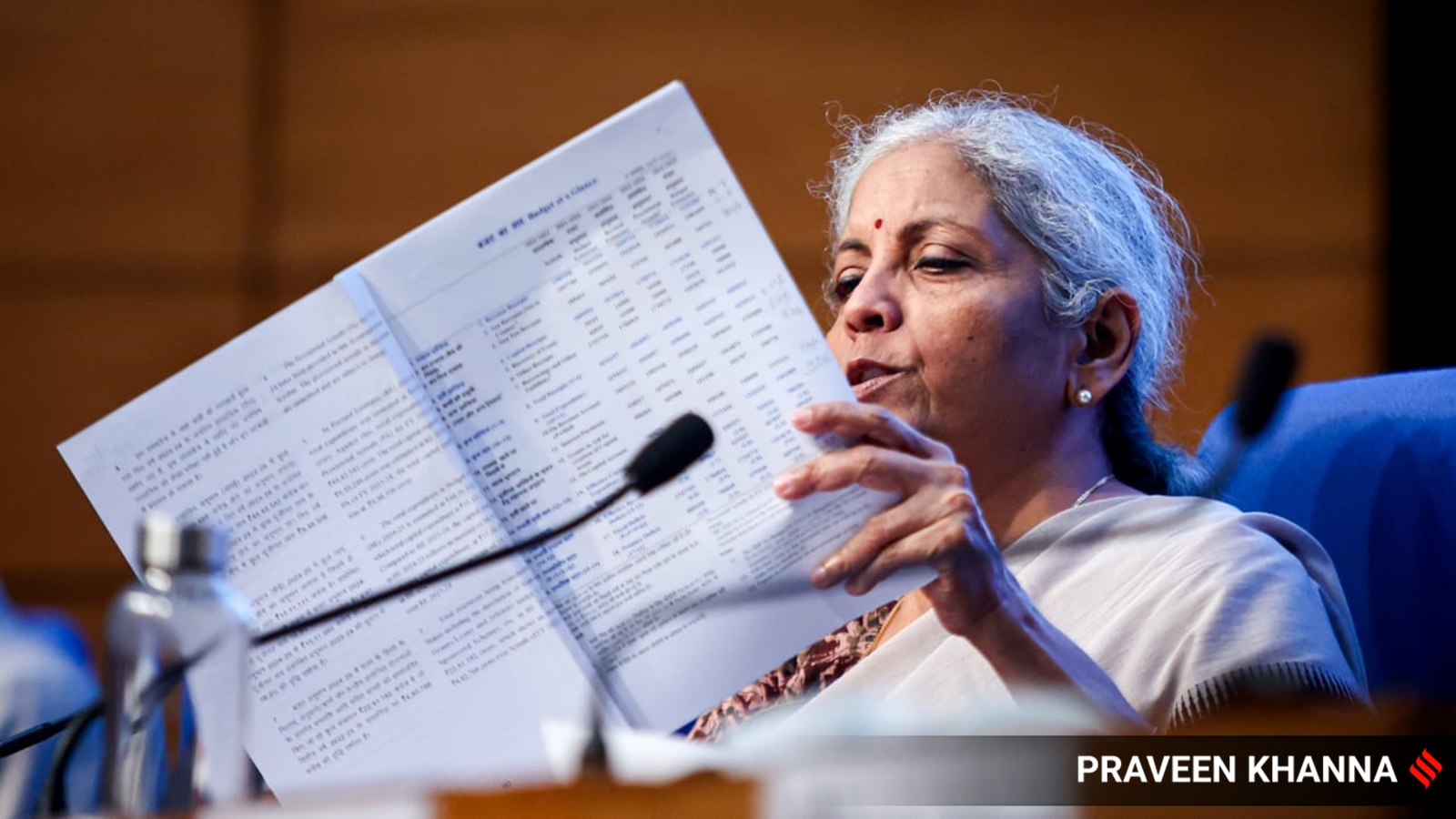

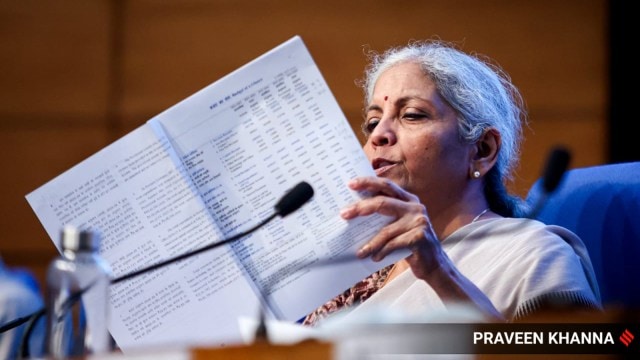

There were two clear expectations for the economy from the first budget of the NDA government’s third term, which was presented on July 23: First, a roadmap on fiscal consolidation and second, a roadmap for medium-term interventions, in terms of the challenges facing the economy. The budget speech paid attention to both of these fronts.

The Finance Minister needs to be commended for sticking to the path of fiscal consolidation with a further reduction in the fiscal deficit target, compared to the interim budget. The estimated fiscal deficit for 2024-25 is 4.9 per cent of the GDP, bringing it closer to the target of 4.5 per cent in the next fiscal. Debt to GDP for the central government too has been forecast to reduce from 58.2 per cent to 56.8 per cent. While the budget speech does not provide a clear roadmap beyond 2025-26 in terms of target fiscal deficit, it does propose “to keep the fiscal deficit each year such that the central government debt will be on a declining path as percentage of GDP.” The flexibility provided by the lack of firm announcements would allow for nimble policymaking but limits predictability for the wider economy.

While fiscal consolidation is one primary concern of the government, augmenting expenditures is often seen as the other priority. In the last three years, additional fiscal space, made available through more buoyant tax revenues, has been utilised to raise the allocations for various spending programmes. Unlike in previous years, some of the additional resources available have been used for fiscal consolidation as well — the resources to undertake fiscal consolidation in this budget can be traced to the surplus to be received from the Reserve Bank of India. Some additions to expenditure and marginal compression in tax revenues too are observed when compared to the interim budget.

Working on the challenges flagged by the Economic Survey 2023-24, the budget speech presents an overview of the initiatives proposed for the current year as well as the next five years. Concerns regarding employability and employment for the youth and improved infrastructure in the country emerge as key points for motivating policy initiatives. A number of initiatives are proposed to create better employability through skilling and higher employment through financial support for provident fund contributions. While these initiatives are welcome and flag the concerns of citizens and the government, an overall framework would help identify the synergies among potential initiatives. The government’s proposal to present an economic policy framework is a welcome announcement in this regard — it can help establish consistent medium-term expectations on likely reforms to be undertaken.

On the tax front, the budget communicates a season of changes. Within indirect taxes, it signals the possibility of rationalisation of the GST rates and expansion in the base and continued recalibration of customs duties. Apart from the initial years which witnessed a slew of rate changes, the GST regime has been remarkably stable in terms of structure and design of the tax. However, some rationalisation of the structure is called for. The likely changes in the GST regime are widely anticipated and discussed, and would constitute an important step in completing the reform of the regime before it can settle into a stable and predictable regime for taxpayers as well as governments.

Unlike the GST regime, the customs duty regime is now used to address varying concerns in the economy — to reduce competition in some cases and to increase competition in others. The need for regular recalibration in customs duties too could benefit from an overall framework. The proposed economic policy framework could provide a basis for this, suggesting stability and predictability in the regime.

The medium-term approach is evident in the section pertaining to direct taxes as well: It begins with a proposal to undertake a review of the Income Tax Act with the objective to “make the Act concise, lucid, easy to read and understand”. A recurring theme in this section is the intent to reduce disputes and litigation. The budget proposes to introduce a “Vivad se Vishwas, 2024” scheme to reduce the amount of revenue locked in litigation. Manpower allocated to address the backlog of cases of first appeals too is proposed to be augmented. Further, the budget proposes to limit the cases of appeal by the departments in case of income tax, excise and service tax cases — cases involving small liabilities are not to be contested. The focus on dispute resolution is commendable; the source of large numbers of disputes too perhaps could use some attention.

Emerging discussions on direct taxes across the globe flag concerns of increasing inequality and the need to bring in higher levels of tax on “the rich”. The Economic Survey articulates the concern in terms of differential taxation of labour income and capital income. The budget seeks to address this concern by raising the taxes on capital gains, both short-term and long-term, while providing some relief to retail investors by raising the exemption to Rs 1.25 lakh. This initiative, along with the enhanced securities transaction tax on futures and options transactions, could cool some of the fervour in the capital markets in the short term and reduce some of the irrational exuberance, bringing in stability for the medium term.

While the budget provides some elements of a medium-term framework, adding more elements to it would be helpful for stability and predictability in the economy.

The writer is Director, NIPFP