MUMBAI: The Reserve Bank of India (

RBI

) on Wednesday declared a

record

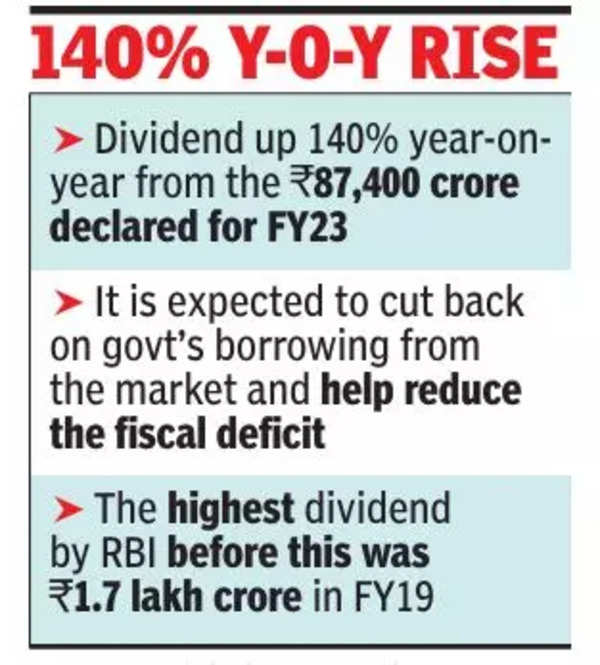

dividend of Rs 2.1 lakh crore to govt, more than double what was expected by the money markets.

The

dividend

is more than the Rs 1.02 lakh crore that govt had budgeted as dividends from all financial institutions and will reduce its need to borrow from the market.

This is the second year in a row that the central bank has paid a dividend which is sharply higher than the amount that govt had budgeted.

The likelihood of a lower govt borrowing pushed down yields on the 10-year govt

bonds

to below 7%. Experts said the surplus transfer to govt will help it reduce the fiscal deficit and make funds available for capital spending.

Bonds rally as RBI pays record dividend to govt

RBI’s decision to pay govt reord Rs 2.1 lakh crore dividend – which will infuse substantial

liquidity

in to the banking system – led to a smart rally in the bond market on Wednesday. As a result, the benchmark yield on the 10-year paper fell below the psychologically important 7% mark after about a year.

At close of trade, the 10-year bonds maturing in 2034 closed at a yield of 6.99% while the one maturing in 2033 (the outgoing 10-year benchmark bonds) closed at 7.04%. Both the bonds saw yields fall by 6 basis points (100 basis points = 1 percentage point), RBI data showed.

Bond dealers, however, said for further rally in sovereign bonds they would want to know how and where the govt will use the huge pay-in from the central bank. In case the govt cuts its total market borrowing for the current fiscal which could lead to a rally in gilts.

Currently, the banking system is facing Rs 1-lakh-crore deficit, which is keeping yields at an elevated level. After the election, if govt starts spending, which will infuse liquidity into the system that could help soften yields in the market, said a bond dealer. A fresh rally in bonds could also start if the ruling BJP-led govt comes back to power with a comfortable majority. Any unusual election result could lead to some selloff in the bond market, the dealer said.

A section of the market players feels that govt should continue to cut its short-term borrowings (which are bonds of less than 5-year maturity). Such a policy could soften rates at the shorter end of the curve. And since corporates mostly borrow at the shorter end of the yield curve, a softer rate could also help corporates through lower interest outgo.