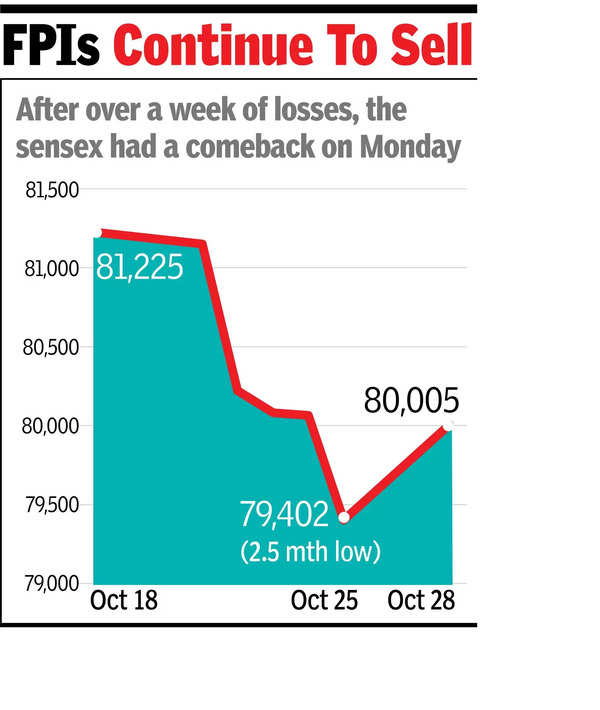

MUMBAI: Bargain hunting on Dalal Street after the sensex slid for five days lifted it by 603 points or 0.8% to 80,005 points on Monday. While ICICI Bank led the rally on the back of a strong set of quarterly numbers, foreign fund selling late in the session limited gains after the index was up more than 1,100 points during mid-session.

Restricted air strikes by Israel over the weekend on select military installations in Iran also prompted global investors to speculate about non-escalation of hostilities between the two West Asian nations. This, in turn, led to a slide in the prices of crude oil – the biggest import item for India – which helped the rupee strengthen a bit. Crude price on the NYMEX tanked nearly 6% in early trades on Monday, while the rupee ended 5 paise up at 84.05 against the dollar.

On the NSE, too, Nifty rallied strongly and closed 158 points or 0.7% up at 24,339 points. In Monday’s session, both Nifty and the sensex reversed their five-session losing streaks.

The market’s Monday gains were “supported by a fall in crude oil prices… after Israel’s retaliatory strike on Iran over the weekend bypassed Iranian oil and nuclear facilities, and did not disrupt energy supplies,” Siddhartha Khemka, head of research (wealth management) at Motilal Oswal Financial Services, said.

Continuing with Oct’s trend of selling in secondary market,

foreign funds

were net sellers at Rs 3,228 crore on Monday too. On the other hand, domestic funds were net buyers at Rs 1,401 crore. The day’s session added about Rs 3.7 lakh crore to investors’ wealth.