MUMBAI: Mumbai: A resilient economy in the face of global volatility, which lifted the equity markets to new highs in July, prompted

retail investors

to repose their faith in

mutual funds

and continue their investments through this

asset class

.

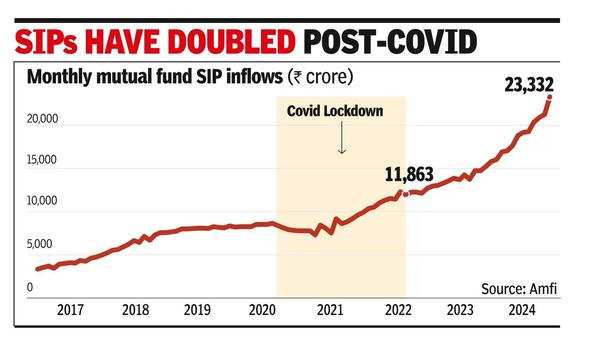

As a result, the

monthly flows

through the SIP route jumped to an all-time high of Rs 23,332 crore while the total assets under management of the MF industry was almost at Rs 65 lakh crore, also a new record high, data released by AMFI, the fund

industry trade body

showed.

“SIP contributions reaching an all-time high…in July 2024 reflects the growing

financial discipline

among retail investors, helping them build wealth systematically over time,” said Venkat Chalasani, chief executive, Amfi.Although equity funds recorded a lower net inflow in July at Rs 37,113 crore compared to Rs 40,608 crore in June, it was 41st consecutive month of

net inflows

for these schemes.

Debt funds

too recorded robust net inflows, at nearly Rs 1.2 lakh crore.