“Massive Farms Loan Waiver” proclaimed the frontpage headlines of The Hindu’s edition dated March 1, 2008. Debts worth Rs. 60,000 crore were to be written off, with 40 million farmers expected to benefit.

In what was described by the paper as a “politically crafted budgetary exercise ahead of the general election,” Finance Minister P. Chidambaram introduced the final full Union Budget of the first United Progressive Alliance government on February 29, 2008. The UPA’s tenure was set to end on May 21, 2009.

This leap-year budget was the seventh budget for P. Chidambaram, who had started with the so-called “dream budget” of 1996. It was the country’s ninth budget and the UPA’s fifth; Mr. Chidambaram had also announced the previous four.

The budget, deemed a “populist” budget, also provided “higher-than-expected” respite for income tax payers belonging to the middle class, with increased basic exemption limits and new taxation slabs.

Prevailing conditions

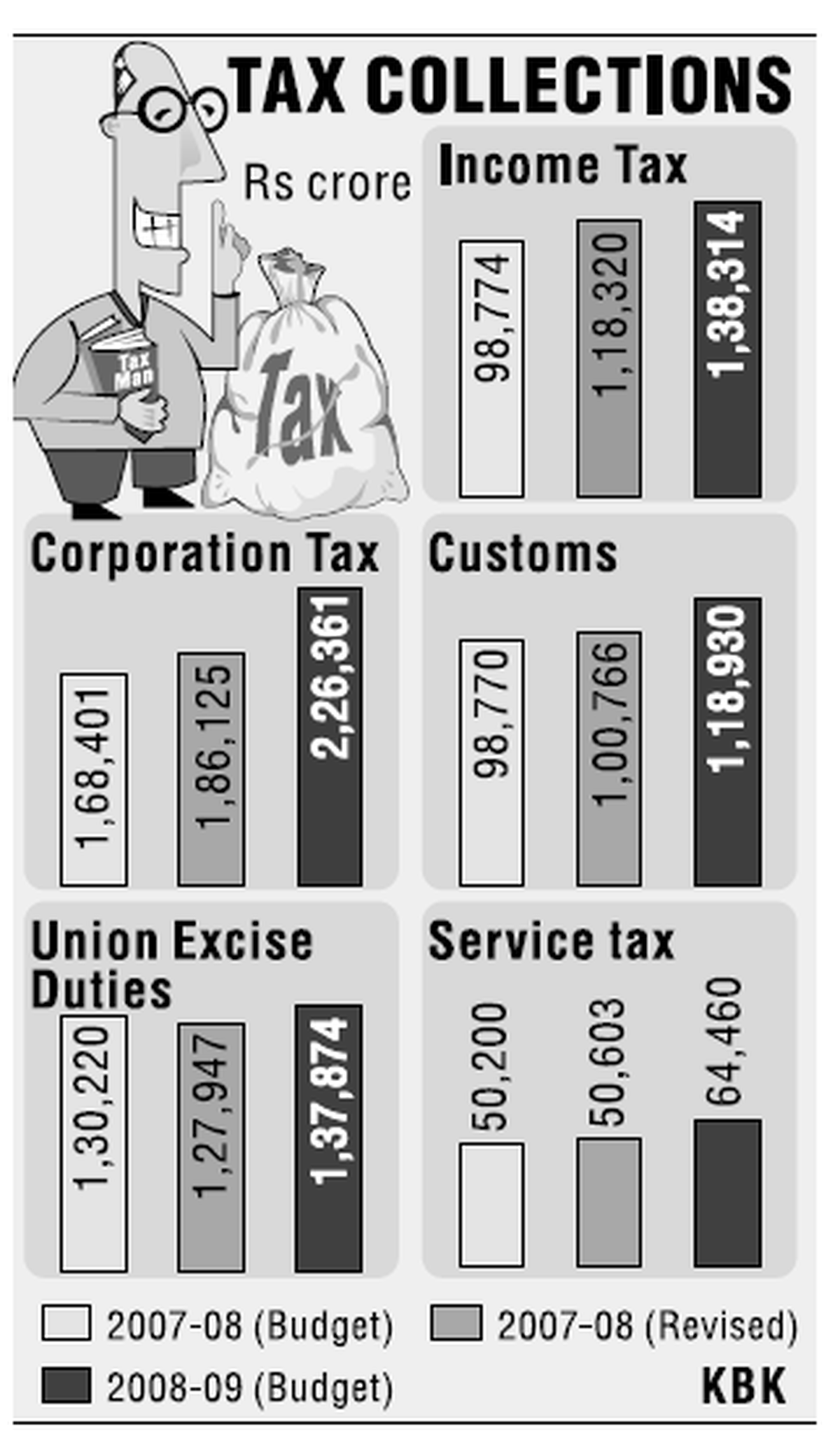

Growth had purportedly been on an upward trajectory in India. The tax to GDP ratio rose to 12.5% at the end of 2007-08 after the UPA government inherited a 9.2% ratio in 2003-04. ‘‘High growth rates have helped. Changes in attitude have also helped. Above all, information systems and technology have helped most. And, if I may add in a lighter vein, having a lucky Finance Minister may have also helped!’’ Mr. Chidambaram reportedly said.

However, the country was also facing high inflation, slowing growth and dealing with a global recessionary environment. The financial crisis that ultimately resulted in the Great Recession of 2008 had already made its effect felt around the world. Beginning in late 2007 after the bursting of the US housing market bubble, the recessive environment continued till mid-2009, with a severe contraction of liquidity in global financial markets. India took measures to bolster its economy in September 2008, but its impacts on this budget were not as pronounced.

India’s growth story also did not see equal benefit for all. Farmers in India, characterised by small or marginal holdings, dependent on rainfall and irrigation, and caught in debt traps, had been seeking respite for years. While the share of agriculture in GDP was around 40%, it accounted for more than 70% of the workforce.

A committee instituted under the chairmanship of R Radhakrishna in 2007 noted that though there were “a number of factors behind the present agrarian crisis, it is the growing indebtedness that compels attention.” However, it stopped short of recommending a loan waiver.

The National Commission on Farmers, chaired by Prof. M. S. Swaminathan, was constituted in November 2004. In its fifth report in October 2006 the final report focused on the causes of farmer distress and the rise in farmer suicides, and proposed addressing it through a balanced national policy. Among its suggestions, along with land reforms, irrigation and productivity issues, credit and insurance, the committee mooted a mratorium on debt recovery, including loans from non-institutional sources, and waiver of interest on loans in distress hotspots and during calamities, till capability is restored.

Budget proposals

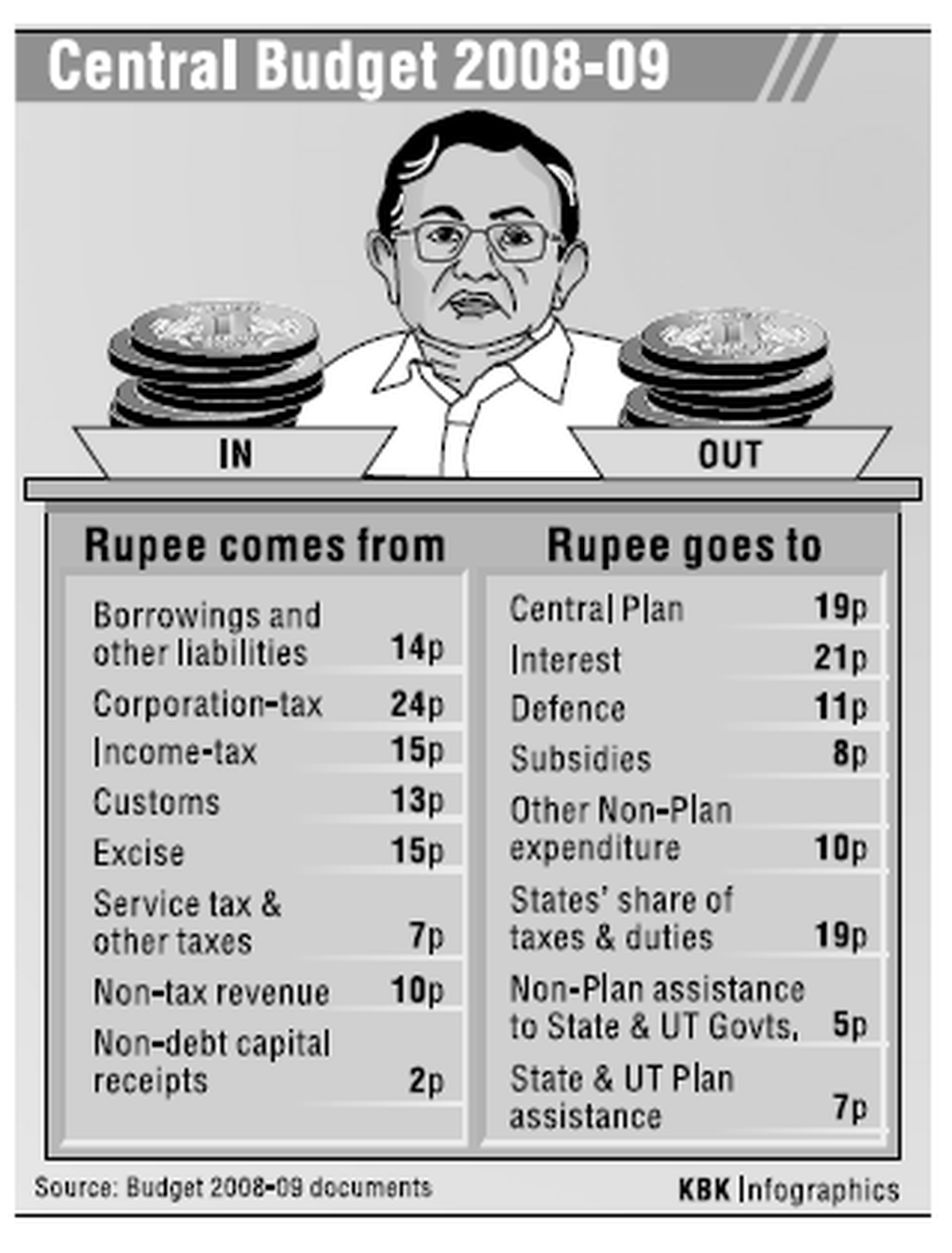

Clipping from the Hindu edition dated March 1, 2008

The budget proposed the annual plan outlay for the next fiscal at Rs. 3.75 lakh crore, with the social sector getting over Rs. onw lakh crore of the outlay. Energy and transport were the next highest sectors, while among ministries, it was the rural development ministry which was allocated the maximum.

Finance Minister P. Chidambaram went on to state that the revenue deficit for the current fiscal year would be 1.4% against the estimated 1.5%, with fiscal deficit also coming in lower at 3.1% against the estimated 3.3%. With further progress during 2008-09, the revenue deficit was estimated at one per cent of the GDP, while the fiscal deficit was pegged at 2.5% of the GDP. The Hindu’s report on the budget noted the conscious shift in expenditure in favour of health, education and the social sector, indicating that this would entail another more year to eliminate the revenue deficit.

Farm loan waiver

The standout feature of the budget was the unprecedented loan waiver for farmers. The Agricultural Debt Waiver and Debt Relief Scheme (ADWDRS), 2008, proposed a complete waiver of all loans overdue on December 31, 2007 which remained unpaid until February 9, 2008 for three crore small and marginal farmers. An one time settlement (OTS) scheme was also proposed for all farmer’s loans that were overdue for the same period, with a rebate of 25% against payment of the balance of 75%. While the OTS relief was estimated to cost ₹10,000 crore for the Centre, the debt waiver was estimated to cost the exchequer ₹52,000 crores.

A subsequent report by the Comptroller and Auditor General (CAG) concluded that the scheme had favoured several ineligible farmers and a large number of deserving small and marginal farmers were left out during its implementation. The CAG report found that no records were maintained of farmers’ applications accepted or rejected by lending institutions, or how many fresh loans were issued due to debt waiver/relief.

The process also took long: a study by Credit Suisse found that the waiver took 2.5 years from announcement to completion, and was 27% smaller than announced. “The reason is not just lack of fiscal space, but also complexity of execution,” it noted.

Direct Taxation

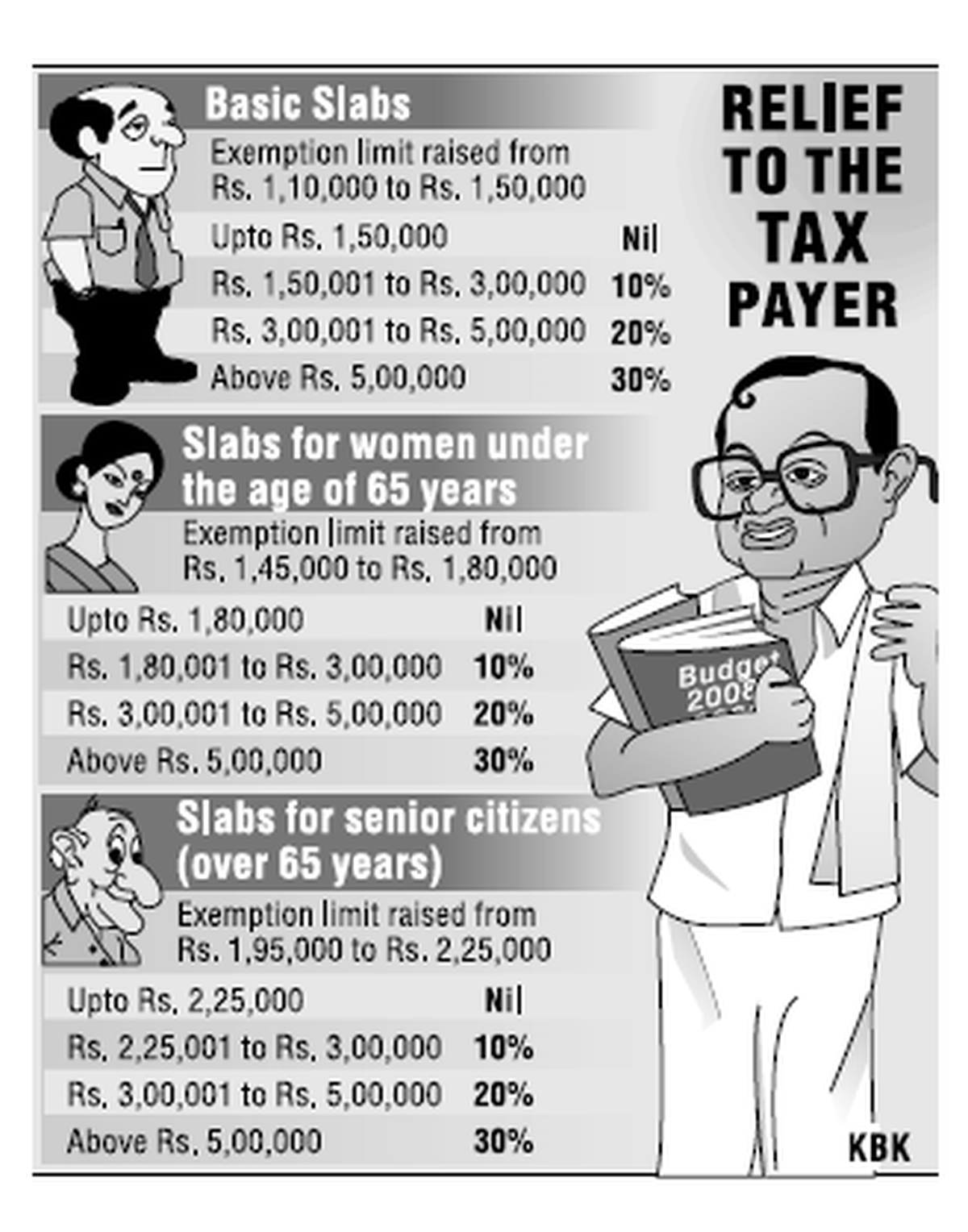

Clipping from the Hindu edition dated March 1, 2008

The Finance Minister announced new income tax exemption limits, raising the limit for general taxpayers from Rs. 1.1 lakhs to Rs. 1.5 lakhs. The lower limit for women taxpayers was increased from Rs. 1.45 lakhs to Rs. 1.8 lakhs, while that for senior citizens above the age of 65 was increased from Rs. 1.95 lakhs to Rs. 2.25 lakhs. Two schemes popular among the elderly were exempted from income tax: the Senior Citizen Saving Scheme 2004 and Post Office Time Deposit Accounts.

New tax slabs were introduced as follows: Rs. 1,50,001 – Rs. 3,00,000 : 10% tax Rs. 3,00,001 – Rs. 5,00,000 : 20% tax Rs. 5,00,001 and above : 30% tax

Further, mediclaim policies for the parents of tax-payers were made deductible from the taxable income.

The Banking cash transaction tax, which had been controversial when it was introduced, was withdrawn. A new commodities transaction tax on commodity dealings along the lines of the securities transaction tax was levied on stock market deals.

The tax on short-term capital gains was increase to 15%, from 10%. There was no change in corporate tax and surcharge, but creche facilities, sports sponsorship and guest houses were exempted from Fringe Benefit Tax (FBT).

In a bid to garner resources to fund the loan waiver and social sector schemes, four more services were brought under the tax net: asset management services provided under the ULIP was brought on par with similar service providers for mutual funds, while customised software was brought on par with packaged software and other IT services. Services provided by stock and commodity exchanges and clearing houses were also included, as was the right to use goods in cases where VAT was not payable.

“55% of the GDP is contributed by the services sector, which is a growing sector that must contribute its legitimate share to the exchequer,” Mr. Chidambaram reasoned.

Clipping from the Hindu edition dated March 1, 2008

Indirect taxes

With the objective of bolstering demand and kick-starting the manufacturing sector to its earlier high growth momentum, Mr. Chidambaram proposed that the Cenvat rate be reduced from 16% to 14%, while keeping the peak rate of customs duty unchanged.

The Finance Minister slashed excise duties on a number of items, aiming to “stimulate demand, production and economic growth.” The excise duty on two and three-wheelers, small cars, buses and chasis was cut to 12%. The excise duty was removed on coconut water, tea and coffee mixes and puffed rice, while breakfast cereals were expected to cost less. The duty on pharmaceutical products, and some writing and printing paper was cut. While the import duty on steel and aluminium scrap was removed, the custom duty on project imports cut.

The only consumers affected were smokers of non-filter cigarette, for which the was duty brought on par with the filter variety. Further, to prop up petroleum sector in view of the spiralling world oil prices, special rates of duty were imposed on unbranded petroleum products, replacing the prevalent ad valorem rates.

Minority schemes: The Budget doubled the allocation for the Minority Affairs ministry from Rs. 500 crore to Rs. 1000 crore. Part of this was to facilitate the implementation of recommendations of the Justice Rajinder Sachar Committee report on the social, economic and educational status of the Muslim community.

rs. 45.45 crore was allotted towards modernising madrasa education. Other initiatives included a Rs. 3780 crore multi sectoral development plan for 90 minority concentration districts, a pre-matric scholarship, and an allotment of Rs. 60 crore to enhance the corpus of the Maulana Azad Education Foundation for promotion of education among educationally backward communities. All five communities notified as minorities were eligible for these programmes.

Further the Minister announced a provision of Rs. 3966 crore for schemes benefiting SCs and STs, with a further Rs. 18,983 crore for schemes of which 20% of benefits went to SC/STs.

There was a 24% increase in the allocation to the Ministry of Women and Child development.

Defence: The defence sector saw an outlay at Rs. 1,05,600 crore, up 10% from Rs. 96,000 crore the previous year, thus crossing the 1 lakh crore mark for the first time. The highest outlay among the forces was for buying major equipment for the Indian Air Force.

Education: The education outlay was at Rs 34,400 crore, marking a 20% increase from the previous budget. The Budget included some other provisions for schools, extending the mid-day meal scheme to all upper primary classes in all blocks and proposing that 6000 high quality model schools be opened. Additionally, provision was made to establish 16 new central universities, and three new IITs in Andhra Pradesh, Bihar and Rajasthan.

Health: The health sector saw a 15% increase in its allocation, rising to Rs. 16,534 crore. A substantial sum of Rs. 12,050 crore was allotted to the government’s flagship programme, the National Rural Health Mission, which aimed to establish a fully functional community owned, decentralised health delivery system.

Along with an allocation of Rs. 993 crore to the National AIDS Control organisation, the Finance Minister also removed the excise duty on anti-AIDS drug Atazanavir. Further, the customs duty on some life saving drugs was slashed from 10% to 5%, while bulk drugs used to manufacture other drugs were exempted completely from customs duty.

The Centre also proposed the Rashtriya Swasthya Bima Yojana,, under which every worker in the unorganised sector and their family would be entitled to a health cover of Rs. 30,000, if they fell below the poverty line.

Environment: The dwindling tiger population received a special mention, with the government announcing a special package for the conservation of tigers. An allocation of Rs. 50 crore was made for the National Tiger Conservation AUthority, bulk of grant to be used to establish a special armed Tiger Protection force

Reactions

Provisions for farmers in the 2008 Budget met the approval of M.S Swaminathan, who said that it was “likely to stimulate agricultural renewal and would mark the beginning of the era of farmers’ suicides.” BJP veteran L.K Advani was less impressed, saying that he was “surprised at the heavy communal overtones of the budget,” and calling it a “throwback to the Liaqat Ali days.” Meanwhile, senior communist leader Sitaram Yechury echoed sentiments that this was a populist budget, saying that “the content, tone and tenor of the last budget of the UPA shows its preparedness for the general election.”

Then Prime Minister Manmohan Singh called the agricultural loan waiver was “a very unorthodox response” to raise the “depressed animal spirits” of farmers, who he called the biggest businessmen of the country. He asserted that given the prevailing depression in the agriculture sector, this was a fully justified response mechanism, also nothing that there was a general feeling that farmers were not becoming active partners in the process of accelerated economic growth.

India Inc. welcomed the budget, calling it growth-oriented, although the lack of any change in the corporate tax disappointed some industry leaders. Exporters also indicated their dissatisfaction with the Budget since there were no measures to address issues caused due to the appreciating rupee and stagnating traditional markets. The IT industry was also concerned by the increase in the excise duty on packaged software, worried that it would affect IT usage in the country.

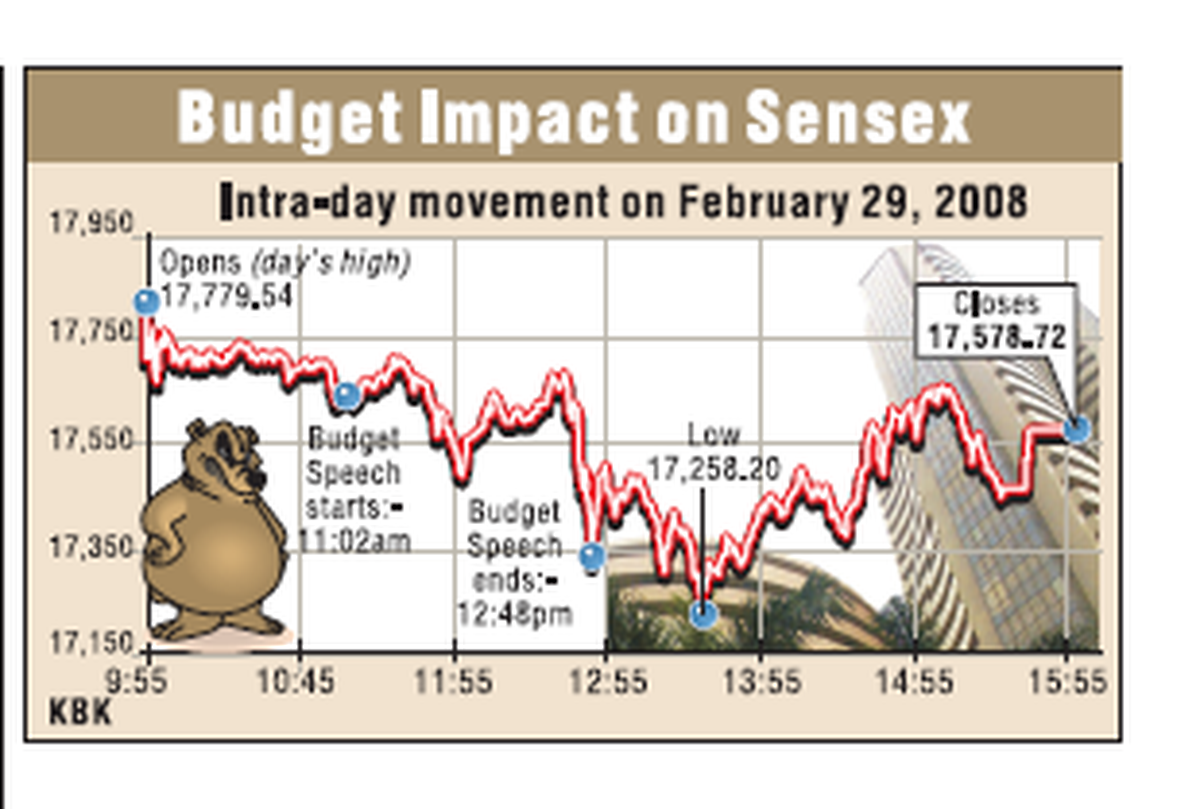

Clipping from the Hindu edition dated March 1, 2008

The markets were not very enthused post the Budget, with a slight dip seen in the Sensex. However people’s purchasing power was expected to go up due to what was called a “people’s budget.”

Published – February 01, 2025 10:07 am IST