Akasa Air

, one of India’s newest airlines, is in discussions with a consortium comprising

Premji Invest

and

Claypond Capital

, the family offices of Wipro’s

Azim Premji

and the Manipal Group’s

Ranjan Pai

, respectively, for a significant minority stake investment of approximately $125 million. The consortium has engaged Alvarez & Marsal, a consultancy firm, to conduct due diligence for the process, according to people familiar with the matter.

Premji Invest and Claypond are keen on investing in well-managed, consumer-oriented startups that are close to profitability and have a sizable addressable market, according to an individual familiar with the agreement.

According to an ET report, the raised funds will be utilized for further expansion and making pre-delivery payments for aircraft. The investment will also result in the dilution of the shareholding of the

Jhunjhunwala family

and that of co-founder and chief executive

Vinay Dube

, who together own over 65% stake in the company. However, the Jhunjhunwala family, currently holding around 40% stake, will remain the largest shareholder, a person familiar with the details told the financial daily.

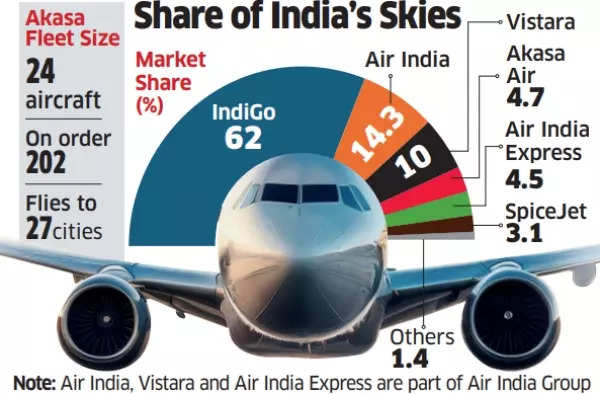

India’s Skies

A person close to the process said, “The diligence is underway while talks are moving steadily though it may still take some time to finalise and freeze the investment.”

CEO Dube declined to comment on the potential investment but emphasized the company’s commitment to remaining well-capitalized, stating, “The amount of cash that we have is more than the initial investment that was made. We have committed to being well capitalised–we are today and will continue to be as we are building Akasa Air for the long run.”

The prospects of the airline are also encouraging investors, as the industry is increasingly becoming a two-player race led by IndiGo and Air India, considering Go First’s bankruptcy and SpiceJet’s financial difficulties, which have reduced its operational fleet from 98 to 22 aircraft.

Also Read | Modi government sets ball rolling for schemes, labour reforms with aim to create 29 million formal jobs

Akasa Air, which commenced operations in August 2021, capitalized on the pandemic-induced decrease in aircraft leasing costs and the ready availability of pilots and cabin crew to expand its fleet by a record 24 aircraft, the quickest by any airline since India liberalized aviation in the early 1990s.

The airline initially ordered 76 Boeing 737 Boeing Max planes and subsequently placed an order for an additional 150 aircraft of the same model in January.

However, growth has been hindered as Boeing’s aircraft production has significantly slowed due to increased regulatory scrutiny following several safety incidents.

Akasa incurred losses of Rs 744 crore in its first year of operations, and industry projections estimate losses exceeding Rs 1,600 crore for FY24. Nonetheless, Dube stated that this is because Akasa is establishing a robust foundation.