Is it better to stay on rent or get your own place? It’s complicated, to borrow a phrase from romantic conundrums. So, should one spend a big sum on a house property – especially with the help of a home loan – given that prices are higher and the capital appreciation in many towns is not as significant as it once was? Isn’t living on rent, perhaps closer to the office, easier? On the other hand, an investment in a house property is a secured and tangible investment.

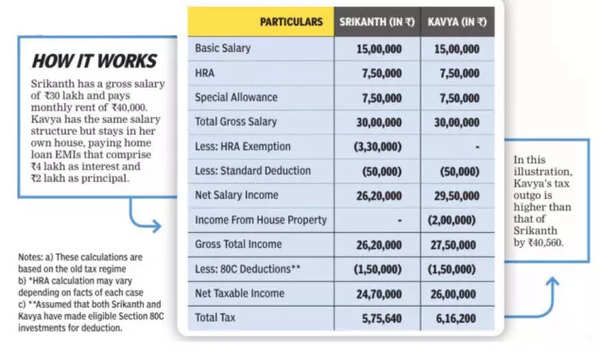

Plus, a house is not just four walls; there is a lot of emotion attached to it. Let’s look at it from the tax perspective…

Renting a house

One of the biggest advantages of renting a house from a tax perspective is the exemption for

house rent allowance

(HRA), a tax-efficient salary component. If HRA is not a part of your salary package — for example if you are self-employed or a consultant— you can avail deduction of up to 5,000 a month from gross taxable

income, under the old tax regime. The HRA exemption is not available to taxpayers who opt for the new tax regime. The exemption is on the lowest of the following:

● Rent paid less 10% of salary (basic salary and dearness allowance)

● 50% of salary if the house is in Delhi, Mumbai, Kolkata or Chennai, or 40% of salary in other cities

● Actual HRA received

Other pros

● Rent may be lower than a home loan EMI

● More choice of location and type

● Easy to relocate to another area of city

● Tax benefits are available (under old tax regime)

Cons

● Rent, however high, does not go towards creating an asset

● Rents usually increase every year, leading to higher cash outflow

● No or limited scope of making structural changes

● One may have to vacate on short notice

Buying a property

Tax benefits are only available under the old tax regime. If you take a home loan to buy a house property, the EMI is typically made up of two parts: one part goes towards the principal (the amount you took as loan) and the other towards the interest (the cost of servicing the loan).

On principal repayment: Deduction is available under the overall 1.5 lakh limit under Section 80C under the old tax regime. Principal repayment, stamp duty, registration fee and other expenses related to transfer of the house property qualify for the deduction, under this limit.

On interest paid: Three situations apply: the house is self-occupied, vacant or rented out. For a self-occupied house property, there is deduction available on the interest paid on home loan up to 2 lakh per annum under the old tax regime. This can be set off against any other income. The same rules apply even if the house is vacant. If you have rented out the house, you can claim deduction for not only the interest paid on the home loan, but also municipal taxes paid and a standard deduction of 30% of the rental income.

Set-off and carry forward of loss: If your house is a self-occupied property bought using a home loan, it means you do not earn any rental income from it. Therefore, interest paid on the home loan will result in a loss. Total loss up to 2 lakh from house property (either self-occupied or letout) can be adjusted in a financial year against any other head of income (such as salary or income from other sources). Loss exceeding 2 lakh can be carried forward for eight subsequent assessment years but can be setoff only against ‘Income from house property’.

Notional rent: The concept of notional rent applies when an individual owns three houses or more. In such cases, two house properties are considered self-occupied (without any conditions as per the 2025 Budget proposals) and the remaining are treated as ‘deemed let-out’, thus attracting notional rent. This is based on the expected market rent and becomes a taxable income.

Pros:

● A house is an asset and EMIs go towards creating this asset

● Substantial tax benefits on home loans

Cons:

● Heavy upfront costs such as down payment and registration, followed by property taxes and repairs

● House properties are illiquid as they cannot be sold quickly

● Property prices see fluctuations and may not fetch expected returns

● EMIs have to be paid regularly, mostly irrespective of situations like loss of income