China’s annual Central Economic Work Conference (CEWC), held on December 11-12, 2024, set economic policy directions for 2025. Amid sluggish demand, structural inefficiencies, and external pressures, the conference focussed on reviving growth through fiscal and monetary adjustments, high-quality predictive forces, and comprehensive reforms. CEWC’s resolutions aim to stabilise China’s economy and lay the groundwork for long-term transformation. The International Monetary Fund’s (IMF) August research forecasted a 3.3 per cent growth by 2029 due to an ageing population and slower productivity growth (around five per cent).

Demand, consumption and growth

Due to years of slowing consumption and overcapacity, China’s weak domestic demand challenges its economic recovery. To address this, the government prioritises boosting household consumption in 2025. This strategic move aims to increase spending as China’s population ages, and households save for medical emergencies. To achieve this, the government plans targeted fiscal policies, including subsidies for low-income households, enhanced pension benefits, and support for sectors like cultural tourism and the silver economy. These measures aim to reignite consumption and sustain short-term economic recovery. The fiscal deficit ceiling will also rise to approximately 4 per cent from 3 per cent of the GDP, enabling more infrastructure and public services investment.

The government is implementing fiscal measures to increase wages, demands and consumption to revive the struggling local economy, particularly in China’s Central-Western and South-Western provinces. Local government special bonds are projected to surpass RMB 3.9 trillion (US$536 billion) by 2025, while ultra-long-term government bonds will double to RMB 2 trillion (US$275 billion). These measures aim to stimulate economic growth while ensuring stability amid global uncertainties. The government’s balanced approach prioritises short-term growth while simultaneously addressing structural issues.

Monetary Policy

In addition to fiscal measures, the CEWC underscored substantial adjustments in China’s monetary policy. The People’s Bank of China (PBOC) has indicated its intention to adopt a “moderately loose” monetary policy. This entails anticipated reductions in the reserve requirement ratio (RRR) and loan prime rates to facilitate credit expansion and enhance financing conditions for businesses and consumers. By reducing the RRR by 50-100 basis points and lowering loan prime rates by 30, the PBOC aims to ensure that the money supply and social financing align with the country’s economic and price-level objectives. The yield on 10-year government bonds slid below 1.8 per cent for the first time after officials vowed to cut policy rates and banks’ reserve ratios to boost a flagging economy.

On the fiscal front, the government has pledged to increase the fiscal deficit ratio to support pro-growth initiatives, such as enhanced government spending on infrastructure development, green energy, and innovation. These investments are expected to stimulate demand and contribute to China’s long-term objectives of technological self-sufficiency.

Nevertheless, the challenge lies in implementing these policies without incurring long-term fiscal risks. While China’s relatively low debt-to-GDP ratio offers some policy flexibility, vigilant monitoring is still necessary to prevent excessive debt accumulation or inflationary pressures.

Structural Reforms

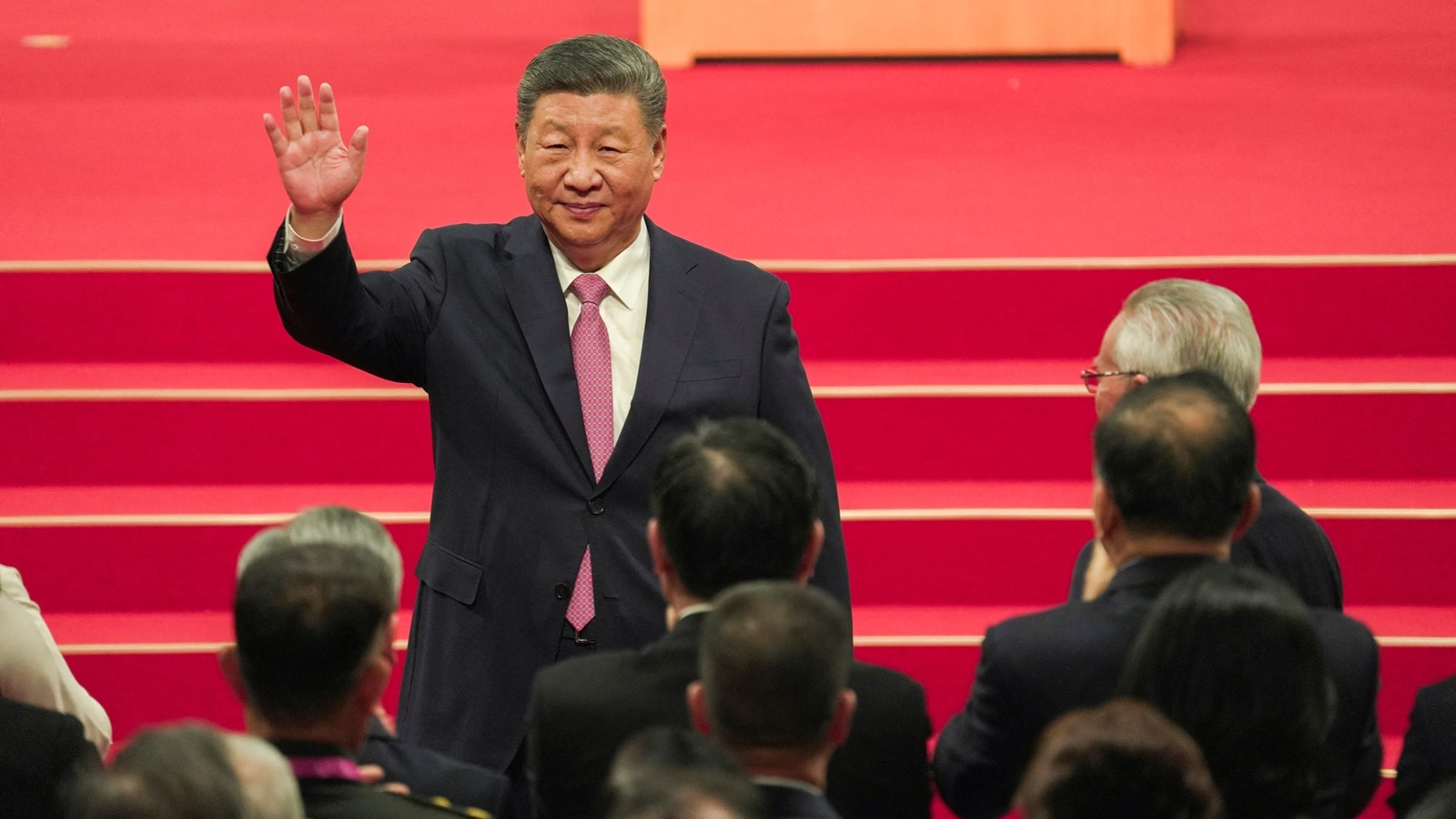

The CEWC highlighted the significance of technological innovation as a cornerstone of China’s long-term economic strategy. President Xi Jinping emphasised the need for China to lead in emerging industries like artificial intelligence (AI), quantum computing, and green technologies. These sectors are crucial for driving future economic growth and ensuring technological self-reliance. For instance, AI, projected to grow from RMB 213.7 billion (US$30 billion) in 2023 to RMB 811 billion (US$114 billion) by 2028, is already making substantial progress in healthcare, finance, and manufacturing. This aligns with Xi’s vision for high-quality development, outlined in his 20th Party Congress report, which emphasises a “new development concept” that prioritises innovation, coordination, sustainability, openness, and equity. It advocates for a “new development paradigm” focused on boosting domestic demand, advancing indigenous technology, and reducing foreign dependencies on China.

Similarly, quantum computing is another strategic focus area. China’s advancements, such as the JiuZhang 3 quantum computer and 504-qubit chips, position the country at the forefront of global technological competition in critical areas. These innovations align with China’s long-term goal of achieving carbon neutrality by 2060. Investments in renewable energy projects, zero-carbon industrial parks, and biodiversity initiatives will support this objective. However, China must address challenges like intellectual property protection, technological dependencies, and supply chain disruptions to scale these industries effectively.

Focus on social stability

The party-state’s top priority has always been social stability — especially amid economic stagnation, rising unemployment, and increasing public discontent since the Covid pandemic. The conference’s emphasis on social welfare measures aims to boost public confidence. The government plans to improve the pension system, healthcare, and social security benefits, stimulating domestic consumption and enhancing citizens’ quality of life, particularly in lower-income regions.

most read

Furthermore, it ensures social stability by addressing risks in key areas, such as the property market, local government debt, and financial stability. The property sector has been a source of instability, exacerbated by policies like the Three Red Line’ policy, which have led to a struggling housing market. The government plans to revitalise unused land and restructure commercial housing to address these issues. Additionally, efforts will be made to improve fiscal management at the local government level, reducing the risks posed by excessive debt.

To sum up, China unveiled a roadmap for economic policies in 2025. The party-state aims to stabilise the economy by boosting demand, implementing stimulus, advancing innovation, and reforming structures. However, success depends on effective execution, especially considering overcapacity, a struggling property market, and weak consumer sentiment. Managing these risks while adapting to a changing global landscape will be crucial for China’s economic trajectory.

The writer is a researcher at Centre for East Asian Studies, School of International Studies, Jawaharlal Nehru University

Why should you buy our Subscription?

You want to be the smartest in the room.

You want access to our award-winning journalism.

You don’t want to be misled and misinformed.

Choose your subscription package