NEW DELHI: India’s gross

foreign direct investment

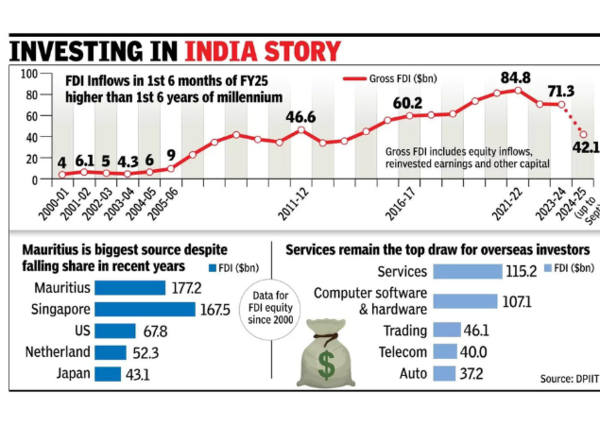

(FDI) inflows rose nearly 29% to $42.3 billon during the first half of the current fiscal year, taking the overall overseas investment to $1 trillion since April 2000.

The rise during the current fiscal year comes after two consecutive years of fall, indicating that investors globally are more upbeat on India. While gross FDI includes reinvested earnings by foreign investors and other capital, the rise is more impressive if just the equity component is looked at – 45% jump to just under $21 billion. The equity inflows since April 2000 are pegged at $708 billion, latest data available with the department for promotion of industry and internal trade showed.

According to OECD data, during Jan-June 2024, the US was the top destination for FDI ($153 billion), followed by Brazil ($32 billion), Mexico ($31 billion), with India placed eighth. During this period,

FDI inflows

in China were down 29% to $70 billion, with the numbers for Jan-Aug 2024 pegging investments at $82 billion, 31% lower than last year.

Since the Covid crisis, the global FDI landscape has become more competitive with countries courting investors with sops to woo them away from China as companies seek to diversify their production bases to de-risk their operations. Industrial policy is back in focus with countries – from the US to Australia – lining up incentives to attract investment. India too has rolled out the

production-linked incentive scheme

and other measures to attract global investors.

Mexico is seen as one of the beneficiaries of the China Plus One strategy along with Vietnam but with the Trump administration due to take charge next month, there could be some change in trends.

The latest World Investment Report by Unctad showed that Asia is the main battleground for FDI with the continent attracting $678 billion in 2023, more than half the global flows of $1.3 trillion and 50% higher than the $426 billion going to developed markets.