GDP Growth 2024 Live: Slowdown in economic activity reflecting in data

According to Kunal Kundu, India Economist at Societe Generale, “The slowdown in India’s economic activity is eventually getting reflected in the GDP data despite clear evidence of it in various high frequency data led by persistently weakening domestic consumption. That said, rising deflator is equally responsible markedly slower growth now, unlike last year when the real GDP growth was artificially propped up by unusually low deflator.”

GDP Growth 2024 Live: Growth to remain subdued in coming quarters?

“We expect growth to remain subdued over the next few quarters as household consumption moderates and investment growth eases in an environment of still-high interest rates. But the economy is not going to crater,” said Harry Chambers, Assistant Economist, Capital Economics.

“In terms of the policy implications, we don’t think the (Sept quarter) data will convince the RBI to lower interest rates at its December meeting given that headline inflation has surged over the past few months. But if we are right in thinking that inflation has now peaked and will gradually retreat towards the 4% target, that should open the door for policy easing to begin in April.”

India GDP Growth 2024 Live: Urban consumption has taken a hit

India GDP Growth 2024 Live: “Needless to say, the fall in income capacity of the urban sector has hit their consumption profile, albeit with a lag. The last 3-6 months have seen a pronounced fall in urban consumption demand across durables and non-durable items, as also seen in various consumption-based companies’ results and commentaries. Public sector has been a missing agent in India’s growth profile for the first five months of this fiscal year. However, sharp pick-up in public spending since September should increase the contribution of public sector spending in GDP growth ahead in H2 FY25,” says Madhavi Arora, Lead Economist, Emkay Global.

Amid sluggish consumption growth owing to moderating real income growth and effect of concentrated and heavy rains, demand drivers remained weak in Q2 FY25. The rise in commodity prices amid sluggish top-line growth led to drop in gross value added growth in manufacturing sector

Garima Kapoor, Economist, Institutional Equities, Elara Securities

India GDP Growth 2024 Live: Why did the GDP growth slow?

“India’s GDP growth in Q2 stood at 5.4%, falling below our projection of 6.7% and the street’s estimate of 6.5%. This weakness in the numbers was largely due to discrepancies; net of these, GDP growth remained at a healthy 7.5%. On the production side, weaker growth was observed in the industrial segment, while the services sector, where we had expected 8% growth, recorded a healthy but slightly lower expansion of 7.1%. Agriculture, on the other hand, expanded at a strong pace, as reflected in the advanced estimates for Kharif output. While we are not revising our full-year growth projection of 7% thus implying a 7.9% growth in H2, we will closely monitor the momentum going forward. We believe that growth in the second half (H2) will be driven by continued strength in agriculture, which is expected to boost rural demand further and increase in capital expenditure (capex) from both central and state governments . Additionally, moderation in the industrial sector’s base should support stronger growth, especially with the complete monsoon season. However, certain headwinds could impact our outlook. Risks include the potential impact of Chinese imports (“China dumping”) and policy uncertainties following the US elections, both of which could dampen a revival in private sector investment,” says Sujan Hajra, Chief Economist & Executive Director, Anand Rathi Shares and Stock Brokers.

The GDP data for Q2 this year is a reflection of the vagaries of monsoons, as well as slower than expected consumption growth in urban areas. The impact was felt across industries, such as retail, mining to automobiles. With a pickup expected in capital expenditure by the government, growth in demand during the festive season, and stable rural demand, we are likely to see better numbers for the coming quarters and FY 2025

Vineet Agarwal, Managing Director, Transport Corporation of India Ltd

GDP Growth 2024 Live: Why GDP growth slowed down?

India GDP Growth 2024 Live: According to Sakshi Gupta, Principal Economist at HDFC Bank, “The softer economic growth stemmed from lower manufacturing, electricity and mining growth in the second quarter. On the demand side, consumption growth slowed probably due to a moderation in urban demand. While we expect the RBI to keep the policy rate unchanged at its meeting next week, the possibility of a move in February for a rate cut has increased.”

India GDP Growth 2024 Live: Disappointing GDP data

India GDP Growth 2024 Live: “The sharply lower-than-expected GDP figures reflect the highly disappointing corporate earnings data. The manufacturing sector appears to have taken the maximum beating. The high-frequency data suggests festive-linked revival in activity may provide a marginally better second-half growth but overall GDP growth for the full year is going to be around 100bps lower than RBI’s estimate of 7.2%. Despite the sharp slowdown in GDP growth, we maintain our view of a pause by the RBI next week, given elevated inflation and uncertain global environment, says Upasna Bhardwaj, Chief Economist at Kotak Mahindra Bank.

GDP Growth 2024 Live: Real GVA growth for H1 of FY25

India GDP Growth 2024 Live: The Real GVA for H1 of 2024-25 stood at ₹81.30 lakh crore, exhibiting a 6.2% growth from ₹76.54 lakh crore in H1, 2023-24. Similarly, the Nominal GVA in H1 of 2024-25 amounted to ₹139.78 lakh crore, showing an 8.9% increase from ₹128.31 lakh crore in H1, 2023-24.

India GDP Growth 2024 Live: GDP Growth for H1 of FY25

During April-September of 2024-25 (H1 2024-25), the Real GDP or GDP at Constant Prices reached ₹87.74 lakh crore, demonstrating a 6.0% growth compared to ₹82.77 lakh crore in H1 of 2023-24. The Nominal GDP or GDP at Current Prices for H1, 2024-25 reached ₹153.91 lakh crore, indicating an 8.9% increase from ₹141.40 lakh crore in H1 of 2023-24.

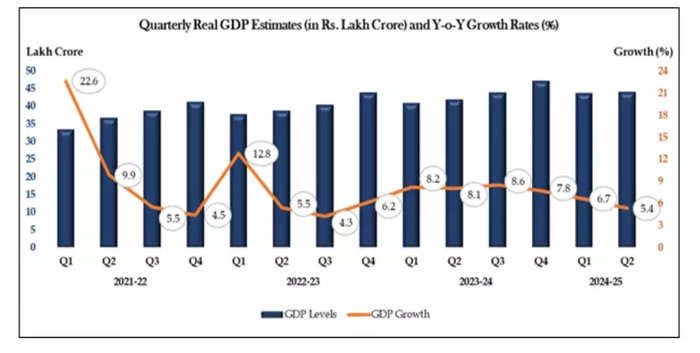

India GDP Growth 2024 Live: Trendline of Quarterly GDP Growth Data

India GDP Growth 2024 Live: Real GVA calculations

GDP Growth 2024 Live: The Real GVA calculations for Q2 2024-25 amounted to ₹40.58 lakh crore, whilst the previous year’s Q2 figure was ₹38.42 lakh crore, reflecting a 5.6% growth. Similarly, the Nominal GVA in Q2 2024-25 reached ₹69.54 lakh crore, increasing from ₹64.35 lakh crore in Q2 2023-24, showing an 8.1% rise.

GDP Growth 2024 Live: GDP at Constant Prices

India GDP Growth 2024 Live: In the second quarter of 2024-25, the Real GDP or GDP at Constant Prices reached ₹44.10 lakh crore, compared to ₹41.86 lakh crore in the corresponding quarter of 2023-24, indicating a growth of 5.4%. The Nominal GDP or GDP at Current Prices for Q2 2024-25 stood at ₹76.60 lakh crore, up from ₹70.90 lakh crore in Q2 2023-24, demonstrating an 8.0% increase.

India GDP Growth 2024 Live: Quarterly GDP Data Trajectory

India GDP Growth 2024 Live: Breaking down the numbers

* The Construction industry sustained domestic steel consumption, showing growth of 7.7% in Q2 and 9.1% in H1 of FY 2024-25.

* The Tertiary sector registered 7.1% growth in Q2 of FY 2024-25, improving from 6.0% in Q2 of the previous year. The segment comprising Trade, Hotels, Transport, Communication & Services related to Broadcasting achieved 6.0% growth in Q2 of FY 2024-25, up from 4.5% in Q2, 2023-24.

* Private Final Consumption Expenditure (PFCE) demonstrated significant improvement with 6.0% growth in Q2 and 6.7% in H1 of FY 2024-25, compared to lower rates of 2.6% and 4.0% respectively in the previous financial year’s corresponding periods.

* Government Final Consumption Expenditure (GFCE) showed recovery with 4.4% growth, following three consecutive quarters of minimal or negative growth rates.

India GDP Growth 2024 Live: Agriculture sector sees strong recovery

India GDP Growth 2024 Live: The Agriculture and Allied sector demonstrated a notable recovery, achieving a 3.5% growth rate during the second quarter of fiscal year 2024-25. This marks a significant improvement compared to the previous four quarters, which witnessed modest growth figures between 0.4% and 2.0%.

GDP Growth 2024 Live: Real GVA growth at 5.6%

In the second quarter of fiscal year 2024-25, Real GVA demonstrated a 5.6% increase, compared to the 7.7% growth observed in the corresponding quarter of the preceding fiscal year. During the same period, Nominal GVA exhibited an 8.1% growth rate, which was lower than the 9.3% growth recorded in the second quarter of fiscal year 2023-24.

India GDP Growth 2024 Live: GDP growth slows drastically to 5.4%

Real GDP has been estimated to grow by 5.4% in Q2 of FY 2024-25 over the growth rate of 8.1% in Q2 of FY 2023-24. Despite sluggish growth observed in Manufacturing (2.2%) and Mining & Quarrying (-0.1%) sectors in Q2 of FY 2024-25, real GVA in H1 (April-September) has recorded a growth rate of 6.2%.

India GDP Growth 2024 Live: What do high frequency indicators show?

GDP Growth 2024 Live: “Available high frequency data for September and October 2024 point to a recovery in growth momentum of the Indian economy. Headline manufacturing PMI (seasonally adjusted (sa)) increased to 57.5 in October 2024 from 56.5 in September 2024 due to a faster growth in new orders and international sales. Similarly, owing to sharper expansion in output, new business and recovery in the growth of new export sales, services PMI recovered to 58.5 in October 2024 from a 10-month low of 57.7 in September 2024. As per the data released by Federation of Automobile Dealers Association, retail sales of motor vehicles showed a strong growth of 32.1% in October 2024, led by festive demand. In September 2024, retail sales of vehicles had contracted by (-)9.3%. Within the vehicle segments, growth in two-wheeler sales was the highest at 36.3% followed by retail sales of passenger vehicles at 32.4% in October 2024. GST revenues in October 2024 grew by 8.9% reaching a level of INR1,87,346 crores, its second highest monthly gross collections since its introduction in July 2017. Following a contraction of (-)0.1% in August 2024, IIP posted a growth of 3.1% in September 2024, led by a broad-based recovery in the growth of all the major sub-industries,” says EY’s November Economy Watch edition.

India GDP Growth 2024 Live: Sensex ends 759 points higher

Ahead of the Q2 GDP data for FY25, BSE Sensex ended at 79,802.79, up 759 points or 0.96%. The almost 1% rally in the stock market today comes a day after the stock market crash which wiped several lakh crore from investors’ wealth.

India GDP Growth 2024 Live: Why 7% plus GDP growth is important for India

GDP Growth 2024 Live: “As India aims to become a Viksit, that is, developed economy by FY2048, achieving a minimum of 7%+ potential real GDP growth on a sustained basis and ensuring that actual growth remains close to this potential is critical,” says D.K. Srivastava Chief Policy Advisor, EY India.

In India we see GDP growth easing to 6.8 per cent this fiscal year as high interest rates and a lower fiscal impulse temper urban demand. While purchasing manager indices (PMIs) remain convincingly in the expansion zone, other high-frequency indicators indicate some transitory softening of growth momentum due to the hit to the construction sector in the September quarter

S&P Global Ratings

GDP Growth 2024 Live: What’s challenging growth momentum?

Between September and November 2024, multiple analysts projected India’s fiscal year 2025 growth estimates, ranging from 6.5% to 7.2%. Whilst institutions such as the RBI and IMF maintain an optimistic outlook, forecasting growth rates of 7.0% or higher for FY25, potential challenges to these projections arise from the slow pace of infrastructure development through the Government of India’s investment spending.

India GDP Growth 2024 Live: Fiscal deficit target to be achieved?

The government is expected to achieve a fiscal deficit of 4.75 per cent in FY25, which is 0.19 per cent below the budgetary target, through effective expenditure management, according to India Ratings and Research’s statement. The agency further indicated that revenue expenditure, excluding subsidies, would be 0.12 per cent of GDP lower than the budget estimate.

Devendra Kumar Pant, the agency’s chief economist and head of public finance, indicated that the government’s capital expenditure would fall short by Rs 62,000 crore from the projected Rs 11.11 lakh crore.

GDP Growth 2024 Live: S&P Global Ratings revises down growth forecasts

S&P Global Ratings has adjusted its growth projections for the Indian economy downwards for the upcoming fiscal years, citing elevated interest rates and reduced fiscal stimulus as factors affecting urban consumption.

Following the US election outcome, the rating agency’s revised Asia-Pacific economic forecast indicates India’s GDP growth will reach 6.7 per cent in FY 2025-26 and 6.8 per cent in FY 2026-27, lower than its earlier estimates of 6.9 per cent and 7 per cent, respectively.

The agency has maintained its growth forecast for FY 2024-25 at 6.8 per cent.

India GDP Growth 2024 Live: What’s slowing GDP growth?

Private consumption, constituting approximately 60% of India’s gross domestic product (GDP), has experienced a decline in urban areas, according to economists. This downturn stems from elevated food inflation, increased borrowing expenses and stagnant real wage progression, despite indications of improvement in rural consumer spending.

The retail food component, which represents about half of the consumer spending basket, registered a 10.87% increase year-on-year in October, significantly diminishing household purchasing capacity.

We expect recovery in growth in the second half

Axis Capital Economic Research note

GDP Growth 2024 Live: Q2 GDP growth expected between 6.3-6.5%

Economist Toshi Jain from J.P. Morgan has observed that recent months have witnessed a deceleration in key economic indicators, including industrial production, fuel usage and bank lending expansion, coupled with subdued corporate financial results, which has impacted the growth trajectory.

“(Though) government spending has re-accelerated in the July-September quarter that has not prevented a slowing in high frequency data, suggesting underlying private sector momentum has softened,” she said in note earlier this week.

According to Jain’s analysis, the GDP expansion is projected to range between 6.3% and 6.5% for the September quarter.

India GDP Growth 2024 Live: Cause for worry?

Leading corporations in India recorded their poorest quarterly results in more than four years during July-September, indicating that the developing economic deceleration has started impacting business profits and investment strategies.

According to economists surveyed by Reuters, the RBI is likely to maintain current policy interest rates in the upcoming week, considering the elevated retail inflation levels. The RBI’s Monetary Policy Committee retained its primary repo rate at 6.50% in its previous meeting, whilst adjusting its policy position to “neutral”.

State officials and various economists anticipate that the economy might recover its vigour in the latter half of the fiscal year, supported by increased government expenditure following recent elections and strengthened rural consumption after an improved harvest.

India GDP Growth 2024 Live: GDP growth to drop to 6.5%?

India’s real GDP growth is expected to drop to 6.5 per cent in the September quarter, according to domestic rating agency Icra, citing adverse impacts from heavy rainfall and subdued corporate performance. Despite this decline, the agency has retained its FY25 growth forecast at 7 per cent, anticipating improved economic activity in the latter half of the fiscal year.

The assessment comes amid growing concerns about economic deceleration, particularly regarding the slowdown in urban consumption patterns. Whilst the Reserve Bank of India maintains its growth projection at 7.2 per cent for the fiscal year, most analysts anticipate it to fall below 7 per cent, with numerous institutions revising their forecasts downward in recent weeks.

India’s economic growth decelerated significantly in July-September, reaching 5.4% year-on-year, considerably below the analysts of 6.5% and the central bank’s 7% estimate, as revealed in Friday’s data. Urban consumption weakened due to increased food prices.