NEW DELHI:

Foreign investors

have poured Rs 57,359 crore into

Indian equities

in Sept, making it the highest inflow in nine months, mainly driven by a rate cut by the

US Federal Reserve

.

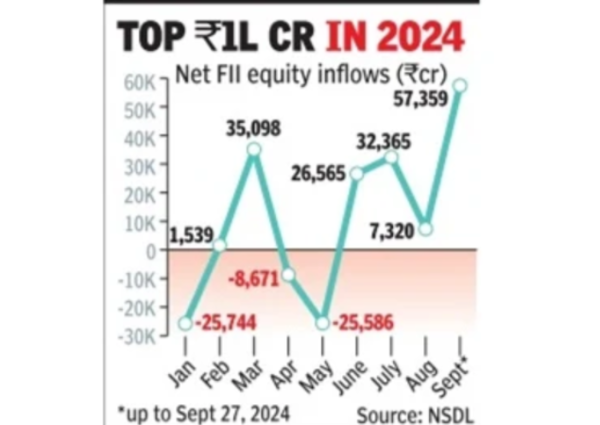

With this infusion, foreign portfolio investors’ (FPIs) investment in equities has surpassed the Rs 1 lakh crore mark in 2024, data with the depositories showed. FPI inflows are likely to remain robust, driven by global interest rate easing and India’s strong fundamentals.

However, the RBI’s decisions, particularly regarding inflation management and liquidity, will be key in sustaining this momentum, Robin Arya, smallcase manager and founder & CEO of research analyst firm GoalFi, said.

According to the data, FPIs made a net investment of Rs 57,359 crore in equities until Sept 27, with one trading session still left this month. This was the highest net inflow since Dec 2023, when FPIs had invested Rs 66,135 crore in equities.

Since June, FPIs have consistently bought equities after withdrawing Rs 34,252 crore in April-May. Overall, FPIs have been net buyers in 2024, except for Jan, April, and May.

Several factors have contributed to the recent surge in

FPI inflow

into Indian equity markets, such as the start of the interest rate cut cycle initiated by the US Fed, increased India weightage in global indices, better growth prospects, and a series of large IPOs, Himanshu Srivastava, associate director — manager research,

Morningstar Investment Research

India, said.