MUMBAI: Corporate India’s profits shrunk by 3.1% in the first quarter of FY25 compared to a 31% growth in the corresponding quarter last year. In terms of earnings growth, this is the worst first-quarter performance after the pandemic (since Q1FY21).

In Q1FY25, net sales of 2,539 companies totalled Rs 22.9 lakh crore, a 5.2% increase from Rs 21.7 lakh crore in Q1FY24.

Total expenditure rose by 6.4%, reaching Rs 19.6 lakh crore compared to Rs 18.5 lakh crore in the previous year.

Net profit

shrunk by 3.1%, with companies reporting Rs 1.9 lakh crore net profit in Q1FY25, down from Rs 1.97 lakh crore in Q1FY24, a report by Bank of Baroda‘s economics department showed.

The corporate scorecard excludes the performance of companies in the BFSI segment. Meanwhile, an analysis of the country’s top 50 companies represented in the Nifty by Motilal Oswal shows that their profit after tax rose 4%, with the aggregate performance being dragged down by public sector oil marketing companies. Excluding the oil marketing companies, Nifty 50 posted 9% growth in earnings.

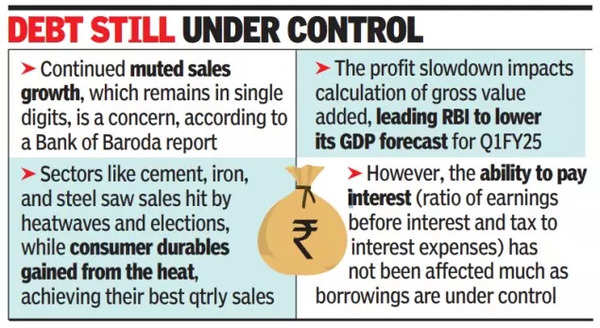

In Q1FY25, India Inc experienced a slowdown in profit growth despite stable interest rates and lower input costs. This underwhelming performance can partly be attributed to an unfavourable base effect. However, the more concerning factor according to Bank of Baroda is the continued muted

sales growth

, which remains in single digits. Sectors like cement, iron, and steel saw sales impacted by heatwaves and general elections, while consumer durables benefited from the heat, achieving their best quarterly sales.

FMCG companies reported a sequential sales pickup and are optimistic due to the satisfactory monsoon progress. The overall profit slowdown is significant, as it impacts the calculation of gross value added, leading RBI to lower its GDP forecast for Q1FY25, reflecting moderation in

corporate profitability

.

The good news is that despite the drop in profits, the ability to pay interest (ratio of earnings before interest and tax to interest expenses) has not been affected much because borrowings are under control.

“Going ahead, an unfavourable base and increased input costs will weigh on corporate profitability. However, support will come from a pickup in demand due to the festive season, moderation in inflation and a pickup in rural demand. Interest costs too are expected to decline once the RBI cuts rate,” Bank of Baroda economist Aditi Gupta said in the report.

According to the Bank of Baroda report, Of the 33 sectors, 18 saw sales growth above the 7.7% average, with 22 industries showing improved sales compared to last year, partly due to the base effect from

Q1

FY24. Key sectors with strong sales included consumer durables, electricals, and retailing, driven by seasonal demand. For net profits, 20 sectors exceeded the 3.5% average growth, but only 15 surpassed last year’s profit growth, including consumer durables and healthcare.