MUMBAI:

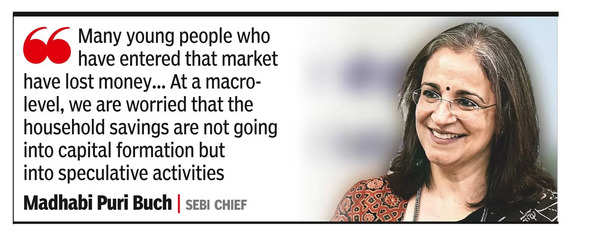

Sebi chief

Madhabi Puri Buch on Friday warned about the increasing speculation in the

derivatives space

again, saying it has morphed into a macro issue that is affecting the broader economy. She said

household savings

, rather than going into capital formation, are being diverted for speculative bets through the futures & options segment of the market.

“Many young people who have entered that market have lost money… nobody could have expected that,” she said. The markets regulator chief was speaking at an SBI Mutual Fund’s event to mark the milestone of crossing the Rs 10-lakh-crore AUM, the first fund house to do so. “At a macro-level, we are worried that the household savings are not going into capital formation but into

speculative activities

.”

Over the last few months several of the ministers and top govt officials, including Sebi chairperson herself, have been warning about this trend of excessive speculation in the F&O segment.

Data from Sebi’s latest monthly bulletin showed that in May this year, the total turnover in the equity derivatives segments of the two bourses together was Rs 9,504 lakh crore, a rise of 71% over May 2023 figure, which was at Rs 5,548 lakh crore. In comparison, the aggregate turnover in the cash segment in May 2024 was Rs 26.4 lakh crore. Last year, a research paper by the regulator showed that nearly nine out of 10 investors in the F&O space lost money.

To rein in excessive speculation that could affect the whole economy in any major way, Sebi is expected to propose a 5x increase in the minimum contract size in the F&O segment. Earlier this week, it also proposed a new product in that would allow wealthy investors to trade in the F&O space, but through the more regulated mutual fund route.

We also published the following articles recently

Sebi mulls hedge-fund like products for retail investors

Learn about India’s new investment opportunity for retail investors – hedge fund-like products! The capital market regulator is proposing a new asset class to meet the growing demand for higher-risk investments. Find out how this can benefit India’s middle class and stock market. Share your feedback by August 6!

Household savings are moving to mutual funds from banks impacting their liquidity: RBI governor

Discover the changing landscape of household investments as RBI governor Shaktikant Das discusses the shift from banks to capital markets and other financial intermediaries. Learn about the implications for the banking sector and the need for alternative strategies in credit-deposit management.

Min Hyo Rin’s agency refutes speculation about her and Taeyang’s second child

Get the latest update on Min Hyo Rin amid pregnancy rumors. Her agency debunked the speculation, citing clothing folds as the reason for the misunderstanding. Learn more about the actress and her relationship with Taeyang from BIGBANG.