MUMBAI: With

discretionary spending

still subdued, retailers are pinning hopes on festivities and

weddings

in the second half of the year to give a leg up to demand. Prediction of a

good monsoon

– which often translates into availability of cash for people employed with the farming sector or adjacent industries – is also expected to help

consumption

.

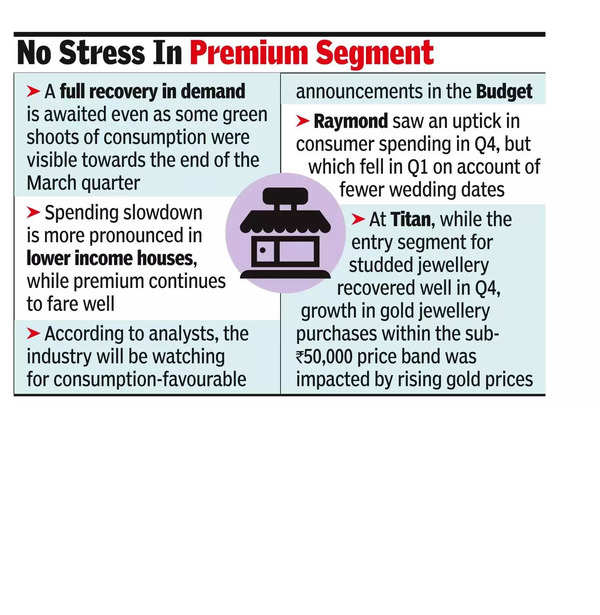

To be sure, some green shoots of consumption were visible towards the end of the March quarter, as indicated by companies, but a full recovery in demand is awaited. The slowdown in spending is more pronounced in lower (includes lower middle class) income households, impacting the mass segment, while premium continues to fare well.

The mass segment, weighed down by

economic pressures

, is displaying “cautious spending behaviours” and is recovering at a slower pace, Joy Alukkas, chairman and managing director of Joyalukkas Group told TOI. “The biggest requirement in the market is for the bottom of the pyramid to come in and spend,” said Kumar Rajagopalan, CEO at Retailers Association of India (RAI). Demand has remained flat in the current quarter and most retailers are worried because they had planned for a much bigger growth, he added.

The industry, analysts said, will also be closely watching for consumption-favourable announcements in the upcoming Budget. Within middle-income households, those earning between Rs 5-8 lakh annually seem to be more strained financially, industry executives indicated.

“FY25… things may improve but it is good if we plan that the uptick is gradual. Maybe we are also looking at a good monsoon, good industrial output, agricultural output… so, these are all good things which should help us to boost demand in the later part of the year,” V S Ganesh, managing director at Page Industries (exclusive licensee of the Jockey brand in India), said in the company’s Q4 earnings call.

A recent study by Deloitte India showed that about 32% of the 660 respondents surveyed intended to reduce their spending on apparel and footwear in the next 12 months. Accessories like watches and jewellery saw the lowest percentage of respondents intending to increase their purchase frequency. While adequate wardrobes, financial constraints and minimalist lifestyle choices all dictate the cohort’s spending preferences, 30% of respondents cited financial constraints to be the key reason for a lesser likelihood of spending on consumer durables.

“The big risk is that the mass segment does not revive as quickly as expected in the near term and we have continued pressure on volume growth, while the premium segment also remains sluggish with consumers feeling that their needs have already been met by past purchases,” Anand Ramanathan, partner and consumer products & retail sector leader at Deloitte India, said about the near-term challenges to consumption.

Paritosh Tiwari, head of retail at Raymond Lifestyle Business, said that the company saw an uptick in consumer spending in Q4, but which dwindled significantly in Q1 largely on account of fewer wedding dates. “The heatwave and national elections restricted consumer movement, adding to the low customer walk-insand pushing retailers to initiate an early EOSS (end of season sale) and mid-season sales,” Tiwari added.